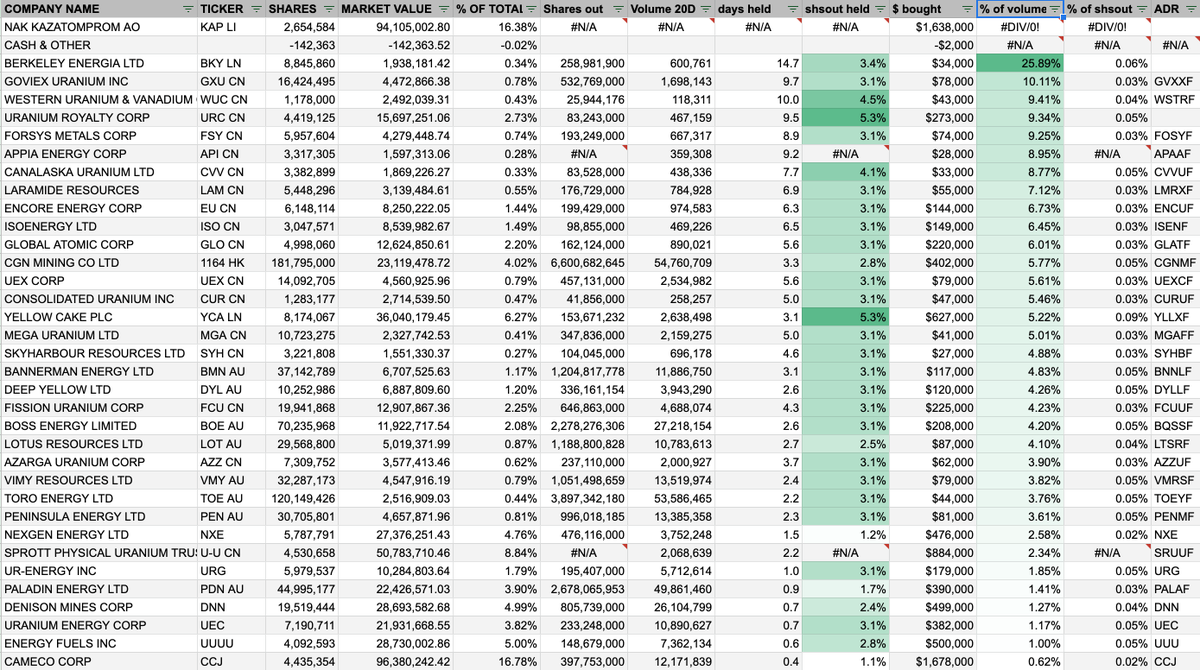

Started analyzing the $URNM holdings. Data as of 09/30. Wanted to look at the potential impact of URNM flows if (when?) that ETF starts getting massive inflows.

#uranium

#uranium

Question I was trying to answer: If $URNM sees $10 million of inflow in a day (<2% assets), how much of volume will the passive flows make up for each of its holdings?

Holdings from $URNM website, rest of the data from Google Finance.

Holdings from $URNM website, rest of the data from Google Finance.

Using recent 20-day volume, top names are:

1. Berkeley Energia $BKY.LN (26% median volume)

2. Goviex Uranium $GXU.CN $GVXXF (10%)

3. Western Uranium & Vanadanium $WUC.CN $WSTRF (9%)

1. Berkeley Energia $BKY.LN (26% median volume)

2. Goviex Uranium $GXU.CN $GVXXF (10%)

3. Western Uranium & Vanadanium $WUC.CN $WSTRF (9%)

Why $10 million? No reason, just an analysis. When $URNM and #uranium starts flying, the flows could easily peak much higher. This is just to get a sense of how inelastic some names could be.

While the miners should benefit from #uranium prices due to operating leverage, the passive flows can really torque the rally. $URNM is one vehicle for that. $URA is another, I need to do the same exercise for that as well.

From my past life as a portfolio manager, I have seen some stocks go berserk just from the ETF flows. Xinyi Solar (968-HK) comes to mind when $TAN was going nuts last year. May $URNM do the same

I'm heavily invested in #uranium and most of my exposure is through $SRUUF ( $U.UN). But I put a tiny bit of money towards some of these illiquid names last week.

Not investment advice

Not investment advice

I haven't done fundamental research on these. This is just an alternate take. For fundamentals or to keep up with these stocks and other industry news, follow people like @quakes99 @BambroughKevin @adequateryan.

Let's do it #uranium $URNM $SRUUF $U.UN

LFG 🚀🚀🚀🚀🚀

LFG 🚀🚀🚀🚀🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh