I cant help obsessing over @fonbnk1 The FIRST

DeFi App that converts prepaid mobile airtime credits into money for mobile users in Africa and Latin America #unlockyourpotential

DeFi App that converts prepaid mobile airtime credits into money for mobile users in Africa and Latin America #unlockyourpotential

https://twitter.com/pesa_africa/status/1444693952330862601

I learnt about @fonbnk1 from my time at the just ended Stellar DFS lab African blockchain bootcamp. I was paired up with @cduffus as his coach and mentor

Close to 8 billion registered prepaid airtime SIM cards w/ more adoption that mobile phones, smartphones, crypto wallets, mobile money wallets and bank accounts

Prepaid airtime SIM cards are more universal than any other technology and digital currency

Prepaid airtime SIM cards are more universal than any other technology and digital currency

Fonbnk turns every prepaid SIM card into a virtual debit card to enable anyone with prepaid airtime to participate in the global digital economy - payments, banking, DeFi, earning, savings, yield!

This video by Visa Crypto breaks is a great primer

This video by Visa Crypto breaks is a great primer

https://twitter.com/pesa_africa/status/1444693952330862601

Fonbnk resonated w/ me b/c of my experience with Airtime currency traders from research documented here

How Africa’s Airtime Currency Traders Birthed A Fintech Innovation Playbook kioneki.com/2018/09/10/how…

How Africa’s Airtime Currency Traders Birthed A Fintech Innovation Playbook kioneki.com/2018/09/10/how…

Fonbnk also resonated w/ me b/c of its peer to peer style global market place for trading mobile airtime (just like the popular p2p crypto marketplaces of Africa) both create earning opportunitiee

How Bitcoin is Solving One of Africa’s Biggest Problem kioneki.com/2020/05/11/how…

How Bitcoin is Solving One of Africa’s Biggest Problem kioneki.com/2020/05/11/how…

Fonbnk is also proof of how we can productize DeFi to address gaps in Africa’s mobile consumer market. Fonbnk is a backend DeFi engine running on a crypto blockchain but plugged w/ real world problems like earning opportunities for airtime resellers

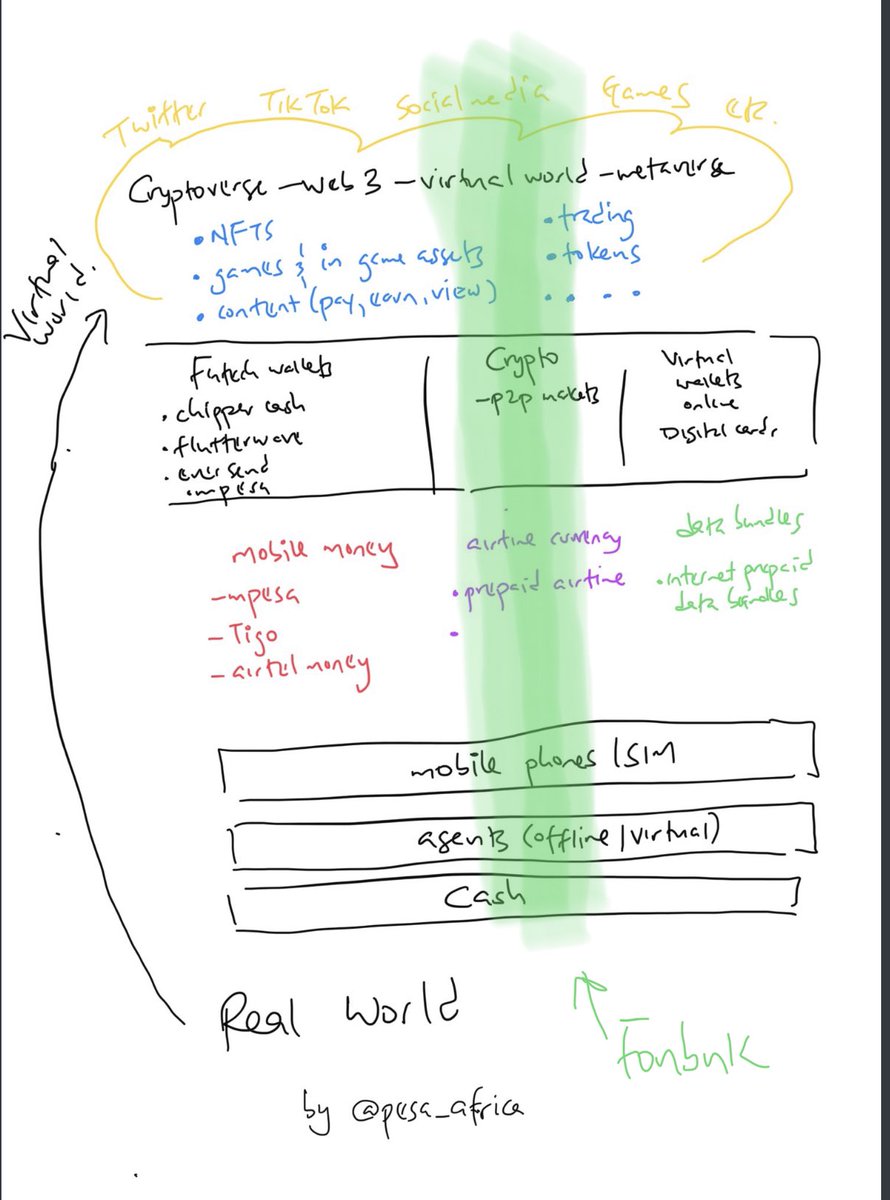

Fonbnk is a manifestation of web3 in context of Africa

https://twitter.com/pesa_africa/status/1444268905443254275?s=20

🏆🥇Fonbnk is a winner in my books

https://twitter.com/fonbnk1/status/1444983182084894725

Fonbnk is a critical piece of the African metaverse/web3 stack depicted here

https://twitter.com/pesa_africa/status/1443284162950086665

Now that this is public information, I imagine other blockchains interested in Africa and Latin America wld massively benefit from such bridges to the crypto realm from the real world - EOS, Ethereum, Stellar, Celo

Fonbnk is teaching us the gaps and playbook so take notes

Fonbnk is teaching us the gaps and playbook so take notes

The losers are legacy African Fintech companies b/c Apps like Fonbnkcan be NeoBanks and do everything legacy Fintech do. Its a pity, new startups built on DeFi rails are coming for your lunch.

Raise money now while you can, the tide has changed

Raise money now while you can, the tide has changed

• • •

Missing some Tweet in this thread? You can try to

force a refresh