1/ Impact of Impact Investing (Berk, van Binsbergen)

"Current ESG divesture strategies have little impact on on the cost of capital of affected firms. Instead of divesting, socially-conscious investors should invest and exercise their rights of control."

papers.ssrn.com/sol3/papers.cf…

"Current ESG divesture strategies have little impact on on the cost of capital of affected firms. Instead of divesting, socially-conscious investors should invest and exercise their rights of control."

papers.ssrn.com/sol3/papers.cf…

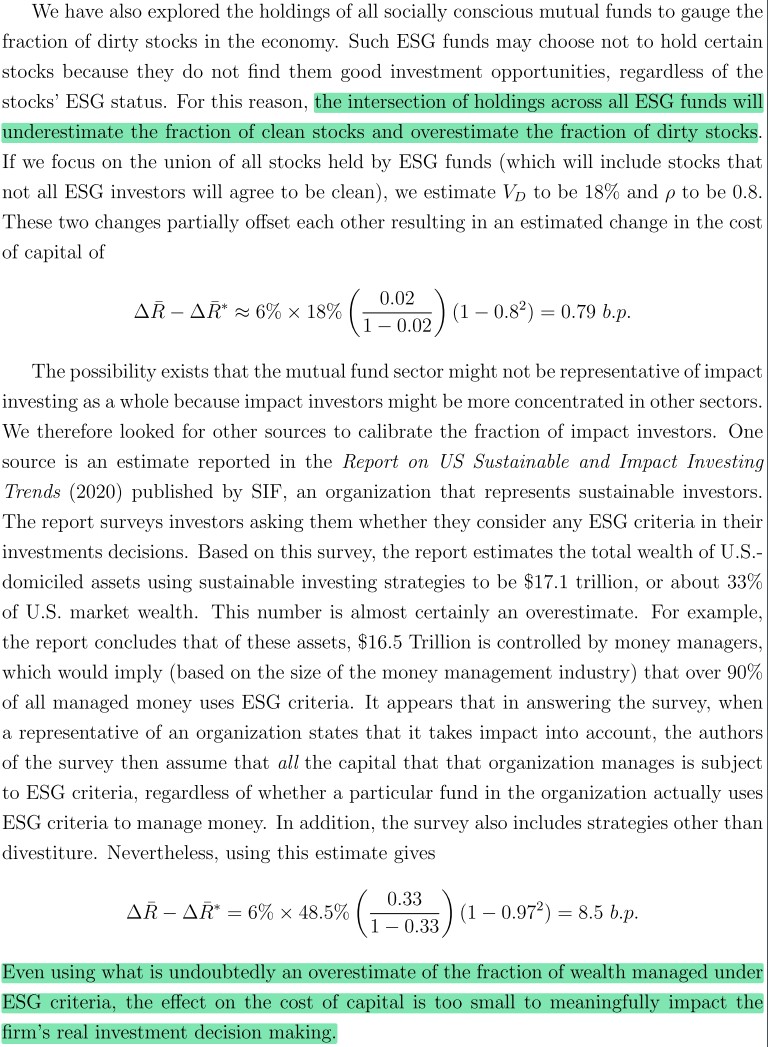

2/ "Using the most optimistic estimates, we show that to effect a more than 1% change in the cost of capital, impact investors would need to make up more than 80% of all investable wealth. Given the low likelihood of this, our results question the effectiveness of disinvestment.

3/ "Given that the set of companies targeted comprise only 18% of the market, socially conscious investors could purchase stock & effect change through the proxy process or by gaining a majority stake and replacing upper management. This would require less than 50% participation.

4/ "The reason divestiture has so little impact is that stocks are highly substitutable, & socially costly stocks make up less than half of the economy. It does not take much of a price change to induce an investor who does not care about the social costs to hold more of a stock.

5/ "When investors divest, they must induce other investors to move away from their fully diversified portfolio. But because the fraction of stocks subject to divestment is small relative to the supply of investable capital and stocks are highly correlated with each other,

6/ "the new portfolio is only slightly less diversified than the old one. So the new investors do not demand much of an increase in their expected return. Thus, the effect on the cost of capital is small."

7/ "Firms have other sources of financing, such as public debt, banks, and internally-generated funds. We assume ESG investors only hold 'clean' stocks. ESG funds may also choose not to hold certain stocks (regardless of ESG status) b/c they do not consider them good investments.

8/ "Thus, our results represent an upper bound on the effect of ESG investors."

"With 2% of mutual fund wealth invested in ESG funds, the effect on the cost of capital is 0.35 bps, which cannot meaningfully affect real capital budgeting decisions.

"With 2% of mutual fund wealth invested in ESG funds, the effect on the cost of capital is 0.35 bps, which cannot meaningfully affect real capital budgeting decisions.

9/ "If Blackrock were to shift all its capital into clean U.S. stocks (and none of Blackrock's investors reacted by withdrawing funds), the fraction of clean shareholders would rise from 2% to, at most, 19%. At 19%, the impact on the cost of capital is just 3.7 bps."

10/ "There is no consensus on the effect of ESG on cost of capital. One possible explanation is that those studies rely on risk models. B/c dirty stocks are concentrated in particular industries, results might reflect uncontrolled factors."

For example:

For example:

https://twitter.com/ReformedTrader/status/1443277462364844037

11/ "We focus on changes in ESG classifications.

"If inclusion in has a measurable effect on cost of capital, we would expect instantaneous price appreciation (depreciation) upon inclusion (exclusion), with lower average returns following the instantaneous price appreciation."

"If inclusion in has a measurable effect on cost of capital, we would expect instantaneous price appreciation (depreciation) upon inclusion (exclusion), with lower average returns following the instantaneous price appreciation."

12/ "There seems little to no evidence that inclusion in the FTSE USA 4 Good index has any meaningful price or return effects.

"The effect on cost of capital is so small (if it exists at all) that it cannot meaningfully influence a firm's investment decisions."

"The effect on cost of capital is so small (if it exists at all) that it cannot meaningfully influence a firm's investment decisions."

• • •

Missing some Tweet in this thread? You can try to

force a refresh