1/ The @anchor_protocol whitepaper describes its goal of disrupting central banks by providing a decentralized central bank target rate which will become a reference rate for the broader DeFi ecosystem.

The protocol aims to do this by building itself around the Anchor Rate.

The protocol aims to do this by building itself around the Anchor Rate.

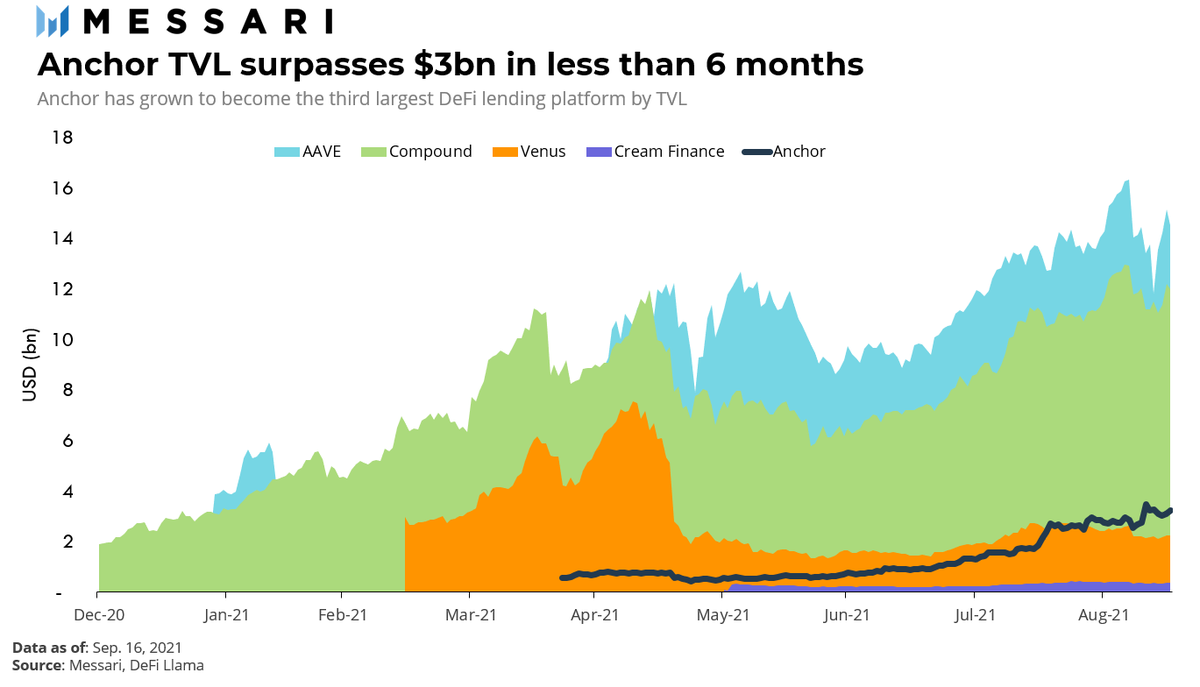

2/ Driven by @anchor_protocol's high headline fixed deposit rate, @terra_money's comparatively low costs versus @ethereum mainnet, as well as the strong run up in $LUNA's price, TVL has continued to increase since launch and in August it become the 3rd largest lending platform.

3/ The $ANC token is designed to capture a proportion of the yield available and to scale with the assets under management in the protocol.

ANC is also used as borrower incentives (100m per year) as well as rewards within ANC liquidity pools.

ANC token supply is capped at 1B.

ANC is also used as borrower incentives (100m per year) as well as rewards within ANC liquidity pools.

ANC token supply is capped at 1B.

4/ Learn more about @anchor_protocol in the full article from @Ainsley_To messari.io/article/return…

• • •

Missing some Tweet in this thread? You can try to

force a refresh