Does the latest data tell us the UK labour market has now fully recovered?

Not really.

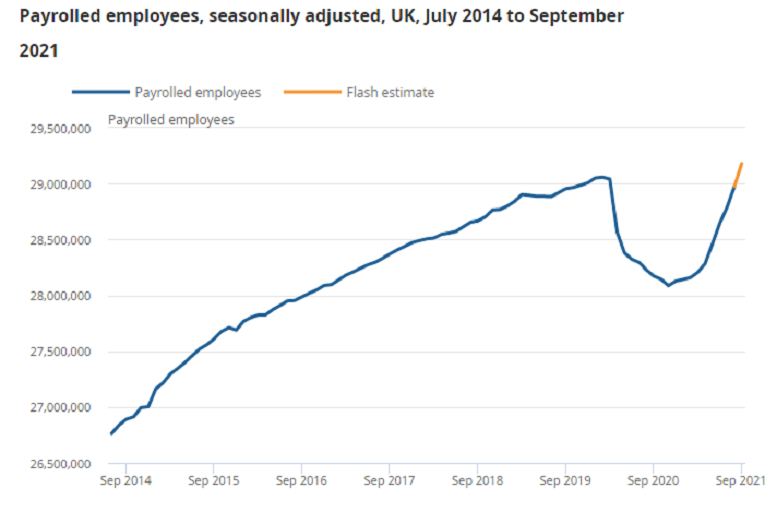

Experimental data from HMRC does suggests the numbers on company payrolls is now back *above* pre-crisis levels... ons.gov.uk/employmentandl…

Not really.

Experimental data from HMRC does suggests the numbers on company payrolls is now back *above* pre-crisis levels... ons.gov.uk/employmentandl…

...So it would seem that the labour market simultaneously has too much slack and also too little.

How to explain this?

Furlough is probably part of it. This data pre-dates the end of the scheme.

Yet the reality is that it's still hard to be certain what's going on...

How to explain this?

Furlough is probably part of it. This data pre-dates the end of the scheme.

Yet the reality is that it's still hard to be certain what's going on...

...@tonywilsonIES of the @EmploymtStudies argues here that the problem of supply not matching demand is that almost a million people have left the labour market (relative to where we would have been on pre-crisis trends)...

https://twitter.com/tonywilsonIES/status/1447819248185794561?s=20

....through a combination of emigration/lower migration and rising inactivity among older people...

https://twitter.com/tonywilsonIES/status/1447819253122482178?s=20

...But whatever the reason, it seems safe to say the UK labour market is not yet back to normal after the pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh