New CPI numbers are out. As usual, doesn't settle any arguments but broadly supportive of the view that: (1) inflation is slowing and (2) inflation remains high.

Notably inflation is slowing less than forecasters or the FOMC expected, could be due to supply chains or demand.

Notably inflation is slowing less than forecasters or the FOMC expected, could be due to supply chains or demand.

The unusually rapid inflation in autos and has ended (but prices have yet to fall, they probably will at least somewhat) and pandemic-services prices were down (e.g., travel). BUT, everything else maintained its pace of the previous six months. A pace ≈3% inflation.

We saw a sizable increase in shelter prices in September (can't blame supply chains for that), but still a lot of room to rise faster because: (1) below trend; (2) other measures show faster increases; and (3) it generally lags (for real and methodological reasons).

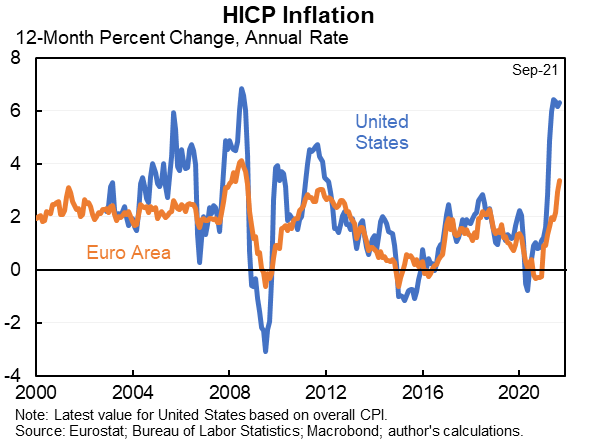

Your monthly reminder that: (1) inflation has risen everywhere and (2) inflation has risen much more in the United States than elsewhere. The 24-month graph shows that in Europe inflation is largely base effects, but we're well past that here.

The Fed targets a different measure of inflation that will be released later this month. But using today's measure to predict that one shows we'll need a large slowdown in inflation in the next three months to hit their median forecast.

I continue to believe there is massive uncertainty but if forced to pick a number for core PCE would say about 4% for this year and about 3% for next year. Most forecasters are slightly below me on the former and well below me on the later. But they've also been revising up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh