Popularity of sale and leaseback transactions.

Equities Properties and the Eskom Pension & Provident Fund have agreed to form a joint venture that will buy the DSV Campus from DSV Real Estate for R2 050 000 000 and lease it back to DSV for an initial annual rent of R157 515 084.

Equities Properties and the Eskom Pension & Provident Fund have agreed to form a joint venture that will buy the DSV Campus from DSV Real Estate for R2 050 000 000 and lease it back to DSV for an initial annual rent of R157 515 084.

What is a sale and leaseback?

It is a transaction where one entity (the seller-lessee) transfers an asset to another party (the buyer-lessor) and leases back that same asset.

This is becoming a popular way for entities to secure long-term financing from its assets.

It is a transaction where one entity (the seller-lessee) transfers an asset to another party (the buyer-lessor) and leases back that same asset.

This is becoming a popular way for entities to secure long-term financing from its assets.

Accounting treatment varies on whether transfer qualifies as a sale.

If transfer of asset is not a sale (no control), it is considered to be a financing transaction.

Legally, sale has occurred, economically, asset remains with the seller and no P/L on sale should be recognised.

If transfer of asset is not a sale (no control), it is considered to be a financing transaction.

Legally, sale has occurred, economically, asset remains with the seller and no P/L on sale should be recognised.

How will the structure of the joint venture look like?

A joint venture (JVCO) will be formed.

Equites Properties will own 51% and Eskom Pension and Provident Fund will own 49%.

Equities Properties' total equity contribution to the joint venture will be R732 million.

A joint venture (JVCO) will be formed.

Equites Properties will own 51% and Eskom Pension and Provident Fund will own 49%.

Equities Properties' total equity contribution to the joint venture will be R732 million.

Equites states that it has the ability to dispose of a stake in its South African properties to the JV in the future, which ensures that

EPPF will obtain exposure to the logistics sector whilst providing Equites with an alternative source of equity for its development pipeline.

EPPF will obtain exposure to the logistics sector whilst providing Equites with an alternative source of equity for its development pipeline.

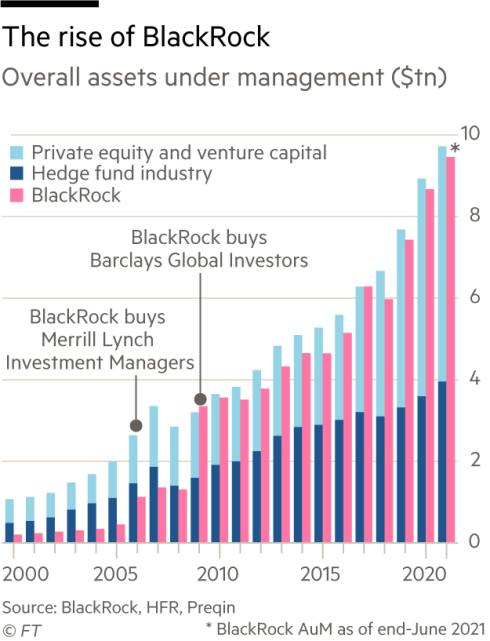

Eskom Pension and Provident Fund is one of the largest asset managers in SA, with R145 billion assets under management.

EPPF aims to earn an annual return of at least 4.5% after inflation, applicable taxes, and investment fees and costs, over a rolling

three-year period.

EPPF aims to earn an annual return of at least 4.5% after inflation, applicable taxes, and investment fees and costs, over a rolling

three-year period.

The DSV Campus has 142 129m2 Gross Lettable Area.

The lease will endure for an initial period of 10 years.

The initial annual rental payable by DSV Solutions to the joint venture shall be R157 515 084 (incl VAT).

The lease will endure for an initial period of 10 years.

The initial annual rental payable by DSV Solutions to the joint venture shall be R157 515 084 (incl VAT).

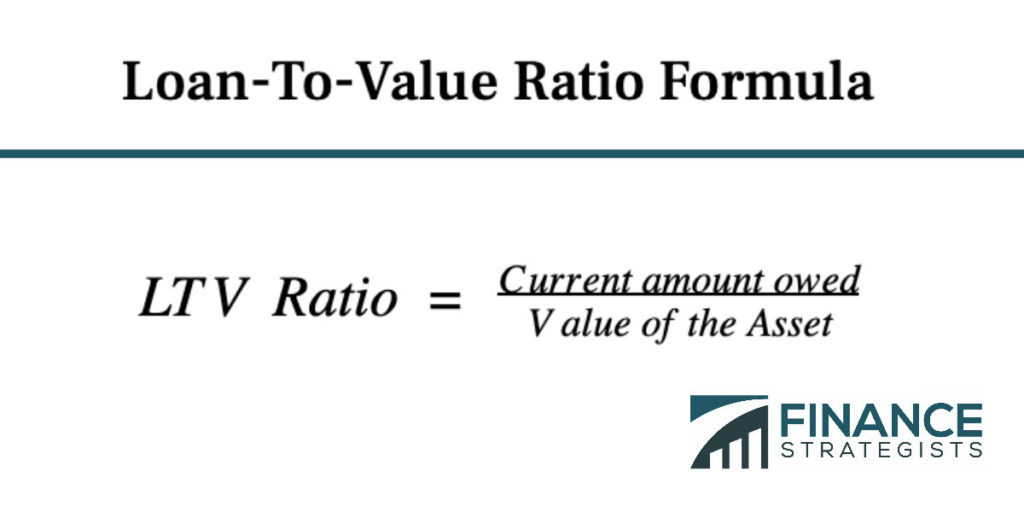

How will Equities fund the R732m and what is the effect on Equities' LTV?

Equites’ equity contribution to the JV will be funded from existing cash resources and undrawn debt facilities.

Transaction will increase Equites’ LTV ratio by 3.1% from 28.6% as at 31 Aug 2021 to 31.7%.

Equites’ equity contribution to the JV will be funded from existing cash resources and undrawn debt facilities.

Transaction will increase Equites’ LTV ratio by 3.1% from 28.6% as at 31 Aug 2021 to 31.7%.

SA fund managers 'prefer' property companies’ LTVs not to exceed 40%.

LTV ratio is a metric that assesses the lending risk that a lender carries by providing a loan to a borrower.

Rebosis Property has the highest LTV ratio of listed property funds with a LTV ratio ~72%.

LTV ratio is a metric that assesses the lending risk that a lender carries by providing a loan to a borrower.

Rebosis Property has the highest LTV ratio of listed property funds with a LTV ratio ~72%.

Banks also use the interest cover ratio (ICR).

This is a debt and profitability ratio used to determine the ease with which an entity can pay interest on its outstanding debt.

ICR = Earnings Before Interest and Taxes (EBIT) ÷ interest expense.

This is a debt and profitability ratio used to determine the ease with which an entity can pay interest on its outstanding debt.

ICR = Earnings Before Interest and Taxes (EBIT) ÷ interest expense.

Some factors that impacted Equities' LTV in FY21:

Shoprite transaction ⬆️ LTV by 1.8%.

Investment of R2.2bn in

development pipelines in SA and UK ⬆️ LTV by 7.9%

Disposal of 2 UK logistics facilities

to Blackstone for a purchase consideration of £43m ⬇️ LTV ratio

by 2.9%

Shoprite transaction ⬆️ LTV by 1.8%.

Investment of R2.2bn in

development pipelines in SA and UK ⬆️ LTV by 7.9%

Disposal of 2 UK logistics facilities

to Blackstone for a purchase consideration of £43m ⬇️ LTV ratio

by 2.9%

Equites Properties has maintained its debt levels below 60% of its gross asset value due to JSE

requirements for REITs.

It is also subjected to strict financial covenants such as;

a 50% LTV covenant on its bank borrowings and 2x ICR.

Group’s overall borrowings were ~R6.83bn.

requirements for REITs.

It is also subjected to strict financial covenants such as;

a 50% LTV covenant on its bank borrowings and 2x ICR.

Group’s overall borrowings were ~R6.83bn.

Equites Properties growth has been quick.

It has grown its investment property portfolio value from R6bn at Feb 2017 to a portfolio value of R19.3 n at Feb 2021.

Equities Gross Lettable Area under management has ⬆️ from 391,954 m² at Feb 2017 to 1,146,354m² at Feb 2021.

It has grown its investment property portfolio value from R6bn at Feb 2017 to a portfolio value of R19.3 n at Feb 2021.

Equities Gross Lettable Area under management has ⬆️ from 391,954 m² at Feb 2017 to 1,146,354m² at Feb 2021.

Equites Properties says that it has delivered total shareholder

returns of 46% as a result of strong distribution and Net Asset Value growth between 2017 and 2021.

SA REITs are required to distribute a minimum of 75% of their taxable earnings in the form of dividends.

returns of 46% as a result of strong distribution and Net Asset Value growth between 2017 and 2021.

SA REITs are required to distribute a minimum of 75% of their taxable earnings in the form of dividends.

Another sale and leaseback transactions by Equities Properties.

FY21, Equites Properties concluded a strategic venture with Shoprite for the acquisition of a 50.1% equity stake in 3 distribution centers with an initial portfolio value of R3.2bn and led to a 1.8% ⬆️ in LTV ratio

FY21, Equites Properties concluded a strategic venture with Shoprite for the acquisition of a 50.1% equity stake in 3 distribution centers with an initial portfolio value of R3.2bn and led to a 1.8% ⬆️ in LTV ratio

The 3 distribution centres located in Western Cape and Gauteng were then leased back to Shoprite on three 20 year fully repairing and insuring leases (with three 10-year renewal options) and an annual rental escalation rate of 5%.

So Shoprite disposed 3 of its distribution centres to Retail Logistics Fund (RLF).

Equites acquired a 50.1% stake in RLF, with Shoprite holding the remaining 49.9%.

Equites Properties exercises control over RLF and this was assessed using IFRS 10 considerations.

Equites acquired a 50.1% stake in RLF, with Shoprite holding the remaining 49.9%.

Equites Properties exercises control over RLF and this was assessed using IFRS 10 considerations.

Equites, as a holder of 50.1% of the equity in RLF, remains exposed to both downside risks and upside potential as a result of the broad

scope of the business that RLF can conduct and through its ability to direct the activities that are undertaken by RLF.

scope of the business that RLF can conduct and through its ability to direct the activities that are undertaken by RLF.

Equites’ power over RLF gives Equites the ability to affect the amount of returns generated by RLF.

RLF is consolidated by Equites in respect of its Group financial statements and Shoprite is reflected as a 49.9% non-controlling interest at a Group level.

RLF is consolidated by Equites in respect of its Group financial statements and Shoprite is reflected as a 49.9% non-controlling interest at a Group level.

MTN is close to concluding the sale and leaseback transaction of its ~13 000 SA towers.

MTN could raise ~R11bn from this, according to Bloomberg Intelligence.

MTN appointed Citigroup & Standard Bank to advise on the sale and leaseback.

MTN's fundraising

MTN could raise ~R11bn from this, according to Bloomberg Intelligence.

MTN appointed Citigroup & Standard Bank to advise on the sale and leaseback.

MTN's fundraising

https://twitter.com/MaanoMadima/status/1445072901674242050?t=05uKr7UchQR0h5jezqNn9Q&s=19

Do companies sometimes use sale and leaseback transactions to improve their BBBEE statuses?

What tends to happen is that some companies sell assets to a BBBEE consortium and then lease it back (sale and leaseback). This is deemed to be a transaction with a BEE-complaint entity.

What tends to happen is that some companies sell assets to a BBBEE consortium and then lease it back (sale and leaseback). This is deemed to be a transaction with a BEE-complaint entity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh