1/ My new essay "The Quest for Digital Cash" follows the evolution of eCash to Bitcoin, the career of @adam3us, and the ongoing Cypherpunk struggle to fight for freedom and privacy via open-source code instead of asking the state for permission.

🧵 ☕

bitcoinmagazine.com/culture/bitcoi…

🧵 ☕

bitcoinmagazine.com/culture/bitcoi…

2/ One summer day in August 2008, Adam Back got an email from Satoshi Nakamoto.

It was the first time Nakamoto had reached out to anyone about a new project called Bitcoin.

The cryptocurrency seemed like it could finally be the Cypherpunk holy grail: decentralized digital cash.

It was the first time Nakamoto had reached out to anyone about a new project called Bitcoin.

The cryptocurrency seemed like it could finally be the Cypherpunk holy grail: decentralized digital cash.

3/ Two months later, on October 31, 2008, Nakamoto sent an email to the Cryptography Mailing List with the subject line: "Bitcoin P2P e-cash paper"

The author wrote: "I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party."

The author wrote: "I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party."

4/ On January 9, 2009, in the wake of the Great Financial Crisis, Nakamoto launched the Bitcoin software.

Today each BTC is worth > $50k and the currency has a marketcap of > $1 trillion.

But back then, Nakamoto needed help, and the first person they reached out to was @adam3us

Today each BTC is worth > $50k and the currency has a marketcap of > $1 trillion.

But back then, Nakamoto needed help, and the first person they reached out to was @adam3us

5/ Back is a Cypherpunk: a student of computer science defending human rights and privacy in the digital realm.

As far back as the 80s, these activists knew the digitization of society would make states ultra-powerful.

They thought cryptography was the best way to fight back.

As far back as the 80s, these activists knew the digitization of society would make states ultra-powerful.

They thought cryptography was the best way to fight back.

6/ In the 80s and 90s governments began to erect surveillance states and collect treasure troves of citizen data.

Many could see this happening and called for governments to stop.

The Cypherpunks thought this wasn't very effective, and instead wrote code to enforce privacy.

Many could see this happening and called for governments to stop.

The Cypherpunks thought this wasn't very effective, and instead wrote code to enforce privacy.

7/ Once the domain of militaries and spy agencies, cryptography was brought to the public in the 70s through academics like Merkle, Diffie, and Hellman.

At Stanford, this trio figured out how two people could trade private digital messages without needing to trust a third party.

At Stanford, this trio figured out how two people could trade private digital messages without needing to trust a third party.

8/ This pioneering work was published in 1976, forever changing the information power balance between individuals and governments.

In 1977, Merkle, Diffie, and Hellman filed U.S. patent #4200770 for "public key cryptography"

It was the beginning of the Cypherpunk revolution.

In 1977, Merkle, Diffie, and Hellman filed U.S. patent #4200770 for "public key cryptography"

It was the beginning of the Cypherpunk revolution.

9/ In the early 90s, Cypherpunks united to battle with their biggest enemy: the US government.

In 1992, a year after the release of the world wide web, John Gilmore, Eric Hughes, and Timothy May began to meet in San Francisco to discuss how cryptography could preserve freedom.

In 1992, a year after the release of the world wide web, John Gilmore, Eric Hughes, and Timothy May began to meet in San Francisco to discuss how cryptography could preserve freedom.

10/ Later that year they launched The Cypherpunks Mailing List (or "The List"), a place where activists debated how the creation of the open internet and cryptography could democratize privacy tech and disrupt the surveillance state.

11/ Adam Back had a background in computer science, distributed systems, and economics.

He became an avid participant on The List and by the mid-1990s was fascinated with how citizens could create "ecash" outside the control of governments and corporations.

He became an avid participant on The List and by the mid-1990s was fascinated with how citizens could create "ecash" outside the control of governments and corporations.

12/ He read A Cypherpunk's Manifesto by Eric Hughes:

"Cypherpunks write code. Our code is free for all to use, worldwide. We don’t much care if you don’t approve of the software we write.

We know that software can’t be destroyed and a widely dispersed system can’t be shut down"

"Cypherpunks write code. Our code is free for all to use, worldwide. We don’t much care if you don’t approve of the software we write.

We know that software can’t be destroyed and a widely dispersed system can’t be shut down"

13/ This kind of thinking, Back thought, was what actually changes society.

Sure, one could lobby or vote, but then society changes slowly, lagging behind govt policy.

The other way was bold, permissionless change through inventing new technology:

activism.net/cypherpunk/man…

Sure, one could lobby or vote, but then society changes slowly, lagging behind govt policy.

The other way was bold, permissionless change through inventing new technology:

activism.net/cypherpunk/man…

14/ At the time, the US government classified cryptography alongside fighter jets and aircraft carriers as munitions, and tried to ban the export of encryption software to kill its use globally.

They wanted to scare people away from using privacy technology.

They wanted to scare people away from using privacy technology.

15/ The conflict became known as the "Crypto Wars," and Back was a frontline soldier.

The USG's biggest target was a computer scientist named Phil Zimmerman, who in 1991 released the first consumer-level secret messaging system, called Pretty Good Privacy (or PGP)

The USG's biggest target was a computer scientist named Phil Zimmerman, who in 1991 released the first consumer-level secret messaging system, called Pretty Good Privacy (or PGP)

16/ PGP was an easy way for two individuals to communicate privately using PCs and the new world wide web.

It promised to democratize encryption to millions of people and end the state’s decades-long control over private messaging.

It promised to democratize encryption to millions of people and end the state’s decades-long control over private messaging.

17/ But PGP fell under attack from corporations and governments.

Zimmerman asked MIT patent-holders for a free license, but was denied.

In defiance he released PGP as "guerilla freeware," sharing it through floppy disks and message boards.

Zimmerman asked MIT patent-holders for a free license, but was denied.

In defiance he released PGP as "guerilla freeware," sharing it through floppy disks and message boards.

18/ A 1994 WIRED feature hailed Zimmerman's brazen release of PGP as a "pre-emptive strike against an Orwellian future."

It's no coincidence that Hal Finney -- who would later play a key role in the Bitcoin story -- was an early contributor to PGP.

wired.com/1994/11/cypher…

It's no coincidence that Hal Finney -- who would later play a key role in the Bitcoin story -- was an early contributor to PGP.

wired.com/1994/11/cypher…

19/ Zimmerman was investigated by the US government for "exporting munitions" -- he defended himself by arguing that he was enacting his First Amendment rights.

The Clinton Administration was trying to crack down on encryption, and was promoting the use of "clipper chips"

The Clinton Administration was trying to crack down on encryption, and was promoting the use of "clipper chips"

20/ The Cypherpunks rallied to support Zimmerman.

They printed the PGP source code in books, and mailed them overseas.

Recipients would scan the code, reconstitute it, and run it, to prove the point: you cannot stop us.

They printed the PGP source code in books, and mailed them overseas.

Recipients would scan the code, reconstitute it, and run it, to prove the point: you cannot stop us.

21/ Adam Back famously sold and distributed t-shirts with the code on the front and a piece of the U.S. Bill of Rights with "VOID" stamped over it on the back:

22/ In 1996, the DOJ dropped charges against Zimmerman. The threat of clipper chips faded.

Federal judges argued encryption was protected by the First Amendment-it became central to the open web/e-commerce.

PGP became the most widely used email encryption software in the world.

Federal judges argued encryption was protected by the First Amendment-it became central to the open web/e-commerce.

PGP became the most widely used email encryption software in the world.

23/ Today, companies and apps ranging from Amazon to WhatsApp and Facebook rely on encryption to secure payments and messages.

Billions of people benefit.

Code changed the world.

Billions of people benefit.

Code changed the world.

24/ Back is self-deprecating and said that it is hard to say if his activism in particular made a difference.

But certainly, the fight that the Cypherpunks mounted was one of the main reasons that the USG lost the Crypto Wars.

The authorities tried to stop the code and failed.

But certainly, the fight that the Cypherpunks mounted was one of the main reasons that the USG lost the Crypto Wars.

The authorities tried to stop the code and failed.

25/ As the computing historian Stephen Levy said in 1993, the ultimate crypto tool would be “anonymous digital money.”

Indeed, after winning the fight for private communications, the next challenge for the Cypherpunks was to create digital cash.

wired.com/1994/12/emoney/

Indeed, after winning the fight for private communications, the next challenge for the Cypherpunks was to create digital cash.

wired.com/1994/12/emoney/

26/ Some Cypherpunks were crypto-anarchists, deeply skeptical of modern democracy.

Others believed it was possible to reform democracies to preserve individual rights.

No matter what side they took, many considered digital cash to be the Holy Grail of the Cypherpunk movement.

Others believed it was possible to reform democracies to preserve individual rights.

No matter what side they took, many considered digital cash to be the Holy Grail of the Cypherpunk movement.

27/ In the 80s and 90s major steps were taken both culturally and technically toward digital cash.

Sci-fi authors like @nealstephenson captured the imagination of computer scientists around the world with depictions of future societies where paper money was replaced by e-bucks.

Sci-fi authors like @nealstephenson captured the imagination of computer scientists around the world with depictions of future societies where paper money was replaced by e-bucks.

28/ On the technical front, a cryptography scholar at the University of California, Berkeley named David Chaum (@chaumdotcom) took the powerful idea of public-key encryption and started to apply it to money through the invention of blind signatures.

29/ In 1985 Chaum published “Security Without Identification: Transaction Systems To Make Big Brother Obsolete,” a prescient paper that explored how the growth of the surveillance state could be slowed through private digital payments:

cs.ru.nl/~jhh/pub/secse…

cs.ru.nl/~jhh/pub/secse…

30/ In 1989 Chaum moved to Amsterdam, applied theory to practice, and launched DigiCash.

The company aimed to allow users to convert fiat money into digital eCash.

The company aimed to allow users to convert fiat money into digital eCash.

31/ Chaum's goal was to "catapult currency into the 21st century… in the process, shattering the Orwellian predictions of a Big Brother dystopia, replacing them with a world in which the ease of electronic transactions is combined with the elegant anonymity of paying in cash"

32/ DigiCash, however, failed to get the right funding, and later that decade went bankrupt.

For Adam Back and others, this was a big lesson: to survive, digital cash needed to be decentralized, without a single point of failure.

For Adam Back and others, this was a big lesson: to survive, digital cash needed to be decentralized, without a single point of failure.

33/ Centralized digital money could fail operationally, come under regulatory capture, or go bankrupt, à la DigiCash.

But its biggest vulnerability is that monetary issuance is dictated by a trusted third party.

But its biggest vulnerability is that monetary issuance is dictated by a trusted third party.

34/ States historically have abused monopolies on the issuance of money.

Examples include ancient Rome, Weimar Germany, Soviet Hungary, Mugabe’s Zimbabwe, and the 1.3 billion today living under double, triple, or quadruple-digit inflation everywhere from Sudan to Venezuela.

Examples include ancient Rome, Weimar Germany, Soviet Hungary, Mugabe’s Zimbabwe, and the 1.3 billion today living under double, triple, or quadruple-digit inflation everywhere from Sudan to Venezuela.

35/ In 1997 Back announced Hashcash, an anti-spam concept later cited in Nakamoto’s white paper that would prove foundational for Bitcoin mining.

It enabled financial “proof of work”: a currency that required energy to produce new monetary units, making money harder and fairer.

It enabled financial “proof of work”: a currency that required energy to produce new monetary units, making money harder and fairer.

36/ In 1998, the computer engineer Wei Dai released his b-money concept: "an anonymous, distributed electronic cash system"

Dai was inspired by Back’s work with Hashcash, incorporating proof of work into b-money:

Dai was inspired by Back’s work with Hashcash, incorporating proof of work into b-money:

37/ Dai had previously written to The List, echoing the spirit of the Cypherpunks in arguing that open-source technology -- not regulation -- would be the savior of our future digital rights:

38/ That same year the cryptographer and DigiCash alum @NickSzabo4 proposed bit gold: a digital currency with its own value proposition, separate from the dollar or the euro.

Bit gold was important because it linked the idea of hard money to the cypherpunk movement:

Bit gold was important because it linked the idea of hard money to the cypherpunk movement:

39/ Bit gold tried to make gold's “provable costliness” digital.

A gold necklace proves the owner either expended significant time and energy to dig that gold out of the ground and make it into jewelry, or paid a lot to buy it.

Szabo wanted to bring provable costliness online.

A gold necklace proves the owner either expended significant time and energy to dig that gold out of the ground and make it into jewelry, or paid a lot to buy it.

Szabo wanted to bring provable costliness online.

40/ In 2004, former PGP contributor Hal Finney (@halfin) finally announced reusable proof of work, or “RPOW” for short, expanding the bit gold concept.

This was the final major innovation in the path toward Bitcoin.

This was the final major innovation in the path toward Bitcoin.

41/ When the email from Satoshi Nakamoto arrived in Back's inbox in August 2008, he was intrigued.

He read it carefully and responded, suggesting that Nakamoto look into a few other digital money systems, including Dai’s b-money.

He read it carefully and responded, suggesting that Nakamoto look into a few other digital money systems, including Dai’s b-money.

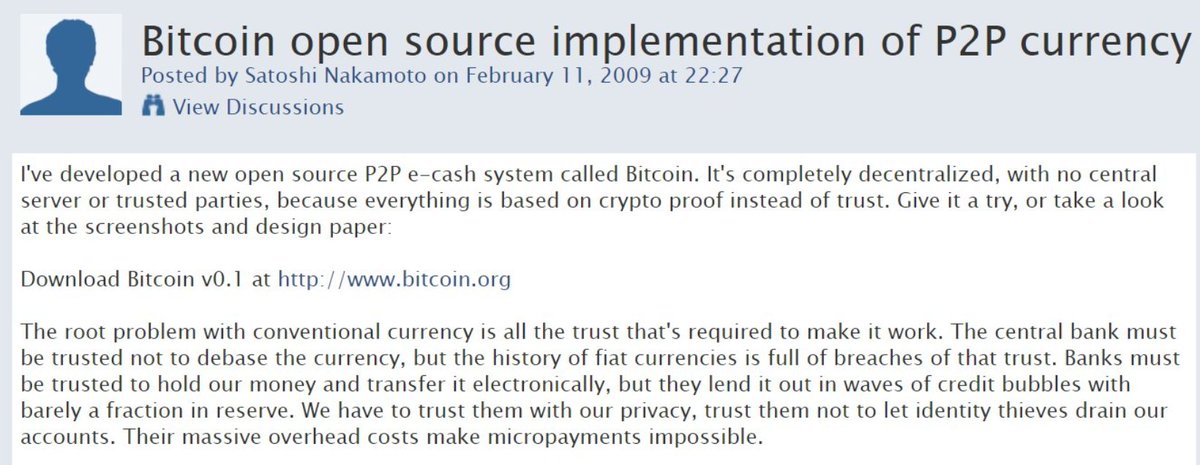

42/ On 10/31/08 Nakamoto published the Bitcoin white paper, promising the dream many had chased:

“a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”

“a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”

43/ On 1/9/09 Nakamoto launched the Bitcoin software.

Finney was one of the first to download the program, as he was excited that someone had continued his work from RPOW.

On January 10, Finney posted his famous tweet: “Running bitcoin.”

The peaceful revolution had begun.

Finney was one of the first to download the program, as he was excited that someone had continued his work from RPOW.

On January 10, Finney posted his famous tweet: “Running bitcoin.”

The peaceful revolution had begun.

44/ Hashcash was one of the 8 citations in the Bitcoin white paper.

As @AaronvanW writes "Hashcash killed two birds with one stone. It solved the double-spending problem in a decentralized way, while providing a trick to get new coins into circulation with no centralized issuer"

As @AaronvanW writes "Hashcash killed two birds with one stone. It solved the double-spending problem in a decentralized way, while providing a trick to get new coins into circulation with no centralized issuer"

45/ Back’s Hashcash was not the first ecash system, but @AaronvanW argues that a *decentralized* electronic cash system “might have been impossible without it"

bitcoinmagazine.com/technical/gene…

bitcoinmagazine.com/technical/gene…

46/ Nakamoto stood on the shoulders of Diffie, Chaum, Back, Dai, Szabo, and Finney and forged decentralized digital cash.

The key was to combine the ability to make private transactions outside of the banking system *with* the ability to hold an asset that could not be debased.

The key was to combine the ability to make private transactions outside of the banking system *with* the ability to hold an asset that could not be debased.

47/ This last feature was not top of mind for the cypherpunks before the late 1990s.

Szabo had certainly aimed for it with bit gold, and others inspired by Austrian economists like Hayek and Rothbard had long discussed getting the creation of money out of government hands.

Szabo had certainly aimed for it with bit gold, and others inspired by Austrian economists like Hayek and Rothbard had long discussed getting the creation of money out of government hands.

48/ Still, generally, cypherpunks prioritized privacy over monetary policy in early visions of digital cash.

The ambivalence towards monetary policy shown by privacy advocates is still evident today, with many civil liberties groups ignoring or being outright hostile to Bitcoin.

The ambivalence towards monetary policy shown by privacy advocates is still evident today, with many civil liberties groups ignoring or being outright hostile to Bitcoin.

49/ The 21M limit and “hard money” qualities proved foundational to achieving privacy through digital cash.

Yet digital rights advocacy groups have largely not recognized the role that proof of work and an unchanging monetary policy can play in protecting human rights.

Yet digital rights advocacy groups have largely not recognized the role that proof of work and an unchanging monetary policy can play in protecting human rights.

50/ To underline the primary importance of scarcity and predictable monetary issuance in the making of digital cash, Nakamoto released Bitcoin not after a government surveillance scandal, but in the wake of the Global Financial Crisis and money printing experiments of 07/08.

51/ The first record in Bitcoin’s blockchain is known as the Genesis Block, and it is a political rallying cry.

Right there in the code is a message worth pondering: “The Times / 03 Jan / 2009 Chancellor on brink of second bailout of banks.”

Right there in the code is a message worth pondering: “The Times / 03 Jan / 2009 Chancellor on brink of second bailout of banks.”

52/ Nakamoto’s Genesis statement was a challenge to the moral hazard created by the Bank of England, which was functioning as a lender of last resort for British companies that had followed reckless policies and were now in danger of going bankrupt.

53/ The average Londoner would pay the price during a recession, whereas the Canary Wharf elite would find ways to protect their wealth.

No British bankers would go to prison during the Great Financial Crisis, but millions of lower- and middle-class British citizens suffered.

No British bankers would go to prison during the Great Financial Crisis, but millions of lower- and middle-class British citizens suffered.

54/ Bitcoin was more than just digital cash, it was an alternative to central banking.

Nakamoto did not think highly of the model of bureaucrats increasing debt to save ever-more financialized economies, accusing them of breaching the public's trust:

Nakamoto did not think highly of the model of bureaucrats increasing debt to save ever-more financialized economies, accusing them of breaching the public's trust:

55/ Ultimately, Nakamoto launched the Bitcoin network as not just e-cash but as a competitor to central banks, offering the automation of monetary policy and eliminating the smoky back rooms where small handfuls of elites would make decisions about public money for everyone else.

56/ Back was struck by Bitcoin's algorithmic issuance, Nakamoto's disappearance, and the currency's predictable monetary policy -- all factors which in retrospect may be sine qua non for decentralized digital cash:

57/ Back also thought Nakamoto's so-called “difficulty algorithm” was a significant scientific breakthrough.

This trick addressed a concern Back had originally had for Hashcash, where users with faster computers could eventually overwhelm the system.

This trick addressed a concern Back had originally had for Hashcash, where users with faster computers could eventually overwhelm the system.

58/ In Bitcoin, Nakamoto prevented this from happening by programming the network to reset the difficulty required to successfully mine a block every two weeks.

If the market crashed, or some catastrophic event happened...

If the market crashed, or some catastrophic event happened...

59/ ...for example, when the Chinese Communist Party kicked half the world’s Bitcoin miners offline in May 2021 -- then the total global amount of energy spent mining Bitcoin would go down, and it would take longer than normal to mine blocks.

60/ But with the difficulty algorithm the network would compensate and make mining easier.

Conversely if the global hash rate went up and miners found blocks too quickly, the difficulty algorithm would compensate upwards.

Here you can see the latest network recovery:

Conversely if the global hash rate went up and miners found blocks too quickly, the difficulty algorithm would compensate upwards.

Here you can see the latest network recovery:

61/ These innovations combined made Back think that Bitcoin could potentially succeed where other digital currency attempts had failed.

However, one glaring problem remained: Bitcoin was not very private.

However, one glaring problem remained: Bitcoin was not very private.

62/ For the cypherpunks, privacy was a key goal.

E-cash prototypes had made the tradeoff of achieving privacy by sacrificing decentralization.

There could be immense privacy in these systems, but users had to trust the mint and were at risk of censorship and devaluation.

E-cash prototypes had made the tradeoff of achieving privacy by sacrificing decentralization.

There could be immense privacy in these systems, but users had to trust the mint and were at risk of censorship and devaluation.

63/ To make a decentralized mint, Nakamoto was forced to rely on an open ledger system, where anyone could publicly view all transactions.

It was the only way to ensure auditability, but it sacrificed privacy.

Back says he still thinks this was the right engineering decision.

It was the only way to ensure auditability, but it sacrificed privacy.

Back says he still thinks this was the right engineering decision.

64/ There had been more work done in the area of private digital currencies since DigiCash.

In 1999, security researchers published a paper called “Auditable Anonymous Electronic Cash,” around the idea of using zero-knowledge proofs:

cs.tau.ac.il/~amnon/Papers/…

In 1999, security researchers published a paper called “Auditable Anonymous Electronic Cash,” around the idea of using zero-knowledge proofs:

cs.tau.ac.il/~amnon/Papers/…

65/ More than a decade later, the “Zerocoin” paper was published as an optimization of this concept.

But the math required for these anonymous transactions was so complicated that it made each transaction very large and each spend time-consuming:

ieeexplore.ieee.org/document/65471…

But the math required for these anonymous transactions was so complicated that it made each transaction very large and each spend time-consuming:

ieeexplore.ieee.org/document/65471…

66/ One reason Bitcoin works so well today is that the average transaction is just a couple of hundred bytes.

Anyone can cheaply run a full node at home and keep track of Bitcoin’s history and incoming transactions, keeping power over the system in the hands of users.

Anyone can cheaply run a full node at home and keep track of Bitcoin’s history and incoming transactions, keeping power over the system in the hands of users.

67/ If Nakamato had used a Zerocoin-type model, each transaction would have been > 100kb, the ledger would have grown huge, and only a handful of people with specialized datacenter equipment could have run a full node, introducing collusion, censorship, or even a betrayal of 21M.

68/ Back said that he is, in retrospect, glad that he did not mention the 1999 paper to Nakamoto in his emails.

Creating decentralized digital cash was the most crucial part: privacy, he thought, could be programmed in later.

Creating decentralized digital cash was the most crucial part: privacy, he thought, could be programmed in later.

69/ By 2013, Back decided Bitcoin had demonstrated enough stability to be the foundation for decentralized digital cash.

He realized he could take some of his applied cryptography experience and help make the system more private.

He realized he could take some of his applied cryptography experience and help make the system more private.

70/ Back’s biggest vision for Bitcoin was something called Confidential Transactions.

Currently, a user exposes the amount of bitcoin they send with each transaction.

Currently, a user exposes the amount of bitcoin they send with each transaction.

71/ This enables auditability of the system — everyone at home running the Bitcoin software can ensure that there are only a certain number of coins — but it also enables surveillance to happen on the blockchain.

72/ If a govt can pair a Bitcoin address with a real-world identity, they can follow the funds.

Confidential Transactions (CT) would hide the transaction amount, making surveillance much more difficult or perhaps even impossible when used in conjunction with CoinJoin techniques.

Confidential Transactions (CT) would hide the transaction amount, making surveillance much more difficult or perhaps even impossible when used in conjunction with CoinJoin techniques.

73/ Back realized it would be extremely difficult to implement CT as the community prioritized security and audibility over privacy.

So he helped create an experimental testbed for Bitcoin technology, so that he could test out ideas like CT without harming the network.

So he helped create an experimental testbed for Bitcoin technology, so that he could test out ideas like CT without harming the network.

74/ Back raised money and teamed up with noted Bitcoin Core developer Greg Maxwell and investor Austin Hill and launched @Blockstream, which is today one of the world’s biggest Bitcoin companies:

blockstream.com

blockstream.com

75/ In 2015, Back and Maxwell released a version of the Bitcoin “testnet” they had envisioned and called it Elements.

They proceeded to enable CT on this sidechain — now called Liquid — where today hundreds of millions of dollars are settled privately:

bitcoin.clarkmoody.com/dashboard/

They proceeded to enable CT on this sidechain — now called Liquid — where today hundreds of millions of dollars are settled privately:

bitcoin.clarkmoody.com/dashboard/

76/ Back still thinks it's possible to get CT transactions small enough to implement in Bitcoin. It's still several years away, at best, from being added, but he continues on his quest.

For now, users can improve privacy through CoinJoin, CoinSwap, Lightning, Mercury, or Liquid.

For now, users can improve privacy through CoinJoin, CoinSwap, Lightning, Mercury, or Liquid.

77/ In particular, the Lightning Network — another area where Back’s team at Blockstream invests heavily through work on c-lightning — helps users spend bitcoin more cheaply, quickly, and privately.

78/ Through innovations like these, Bitcoin already serves as censorship-resistant and debasement-proof savings tech for tens of millions of people around the world, and is becoming more friendly for daily transactions.

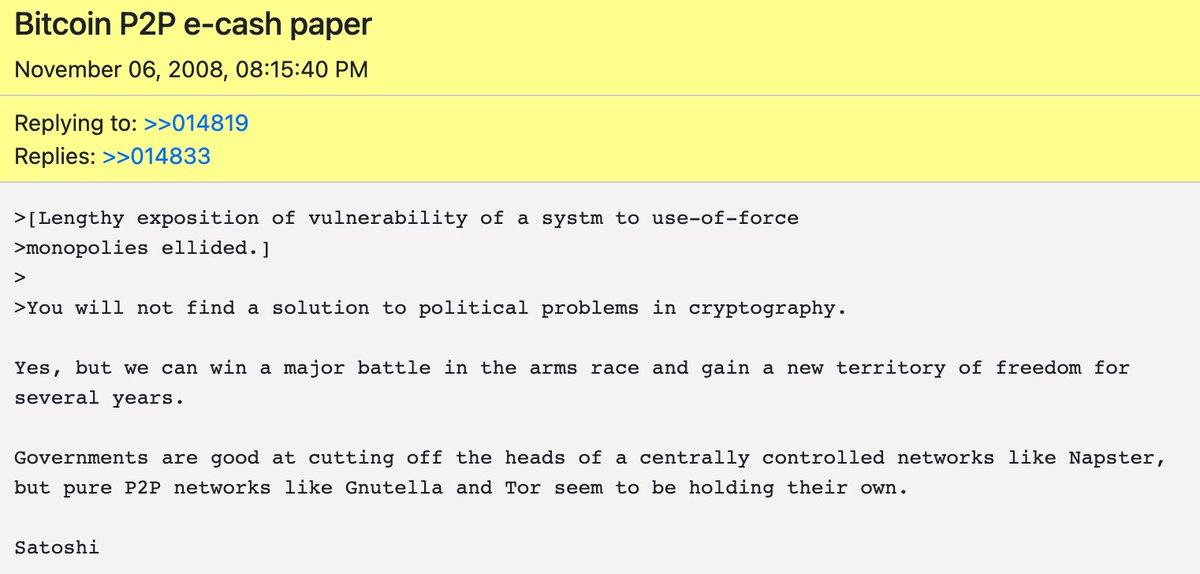

79/ In the near future, Bitcoin could very well fulfill the cypherpunk vision of teleportable digital cash, with all of the privacy aspects of cash and all of the store-of-value abilities of gold.

80/ This could prove one of the most important missions of the coming century, as governments experiment with and begin to introduce central bank digital currencies (CBDCs).

81/ CBDCs aim to replace paper money with electronic credits that can be easily surveilled, confiscated, auto-taxed, and debased via negative interest rates.

They pave the way for social engineering, pinpoint censorship and deplatforming, and expiration dates on money.

They pave the way for social engineering, pinpoint censorship and deplatforming, and expiration dates on money.

82/ But if the vision for Bitcoin’s digital cash can be fully achieved, then in Nakamoto’s words, “we can win a major battle in the arms race and gain a new territory of freedom for several years.”

This is the cypherpunk dream, and Adam Back is focused on making it happen.

This is the cypherpunk dream, and Adam Back is focused on making it happen.

83/ I am grateful for Adam Back and all of the other Cypherpunks who had the vision and persistence to help create Bitcoin.

In the coming years, we will need it.

Read my full essay at @BitcoinMagazine here:

bitcoinmagazine.com/culture/bitcoi…

In the coming years, we will need it.

Read my full essay at @BitcoinMagazine here:

bitcoinmagazine.com/culture/bitcoi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh