Many economies have begun prioritizing liquified natural gas within their energy mix in the push for more sustainable alternatives.

Here are highlights from this week’s #MarketsinMotion report on #LNG: ow.ly/FR2950GrD2Y

Here are highlights from this week’s #MarketsinMotion report on #LNG: ow.ly/FR2950GrD2Y

From @SPGlobalPlatts: Seizing on higher U.S. natural gas prices expected this winter, a group of industrial manufacturers is making a pitch for the Department of Energy to limit LNG exports: ow.ly/N0eS50GqeGU

From @SPGlobalPlatts: Soaring Asian spot LNG prices should push buyers that rely heavily on the prompt market to consider long-term contracts that can lock in more favorable terms: ow.ly/dx0950GqeK9

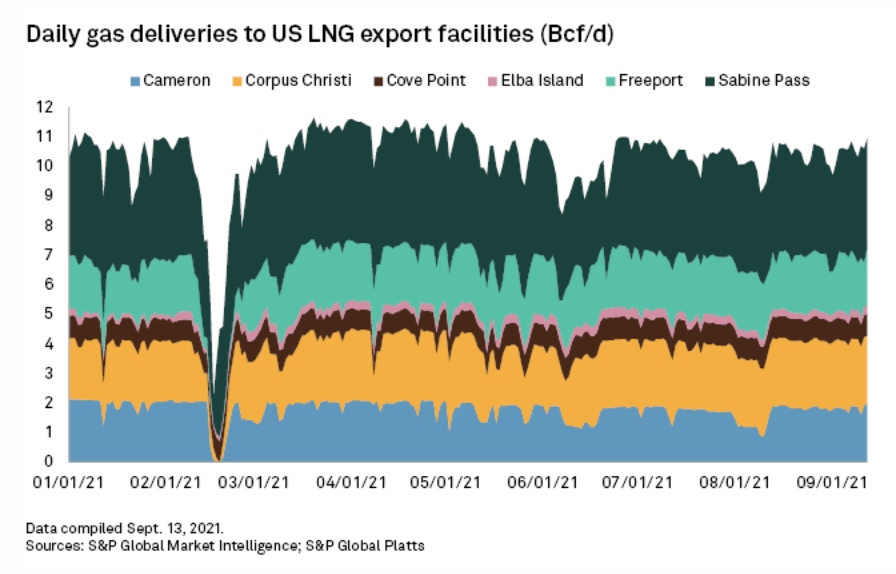

From @SPGMarketIntel: LNG export facilities and their demand for supplies will drive a large portion of U.S. natural gas pipeline construction through 2026: ow.ly/fGYo50GqeMY

From @SPGlobalPlatts: As of early afternoon Sept. 30, Brazil had received 32 U.S. LNG cargoes during the third quarter, matching its total for all of 2020: ow.ly/zNSn50GqeUi

From @SPGlobalPlatts: Pakistan is likely to import fuel oil after a gap of three years as the country looks to cushion the shock from surging LNG prices at a time domestic appetite for fuels from the industrial sector is growing fast: ow.ly/B8Co50GqeXk

From @SPGlobalPlatts: As the LNG market matures, the commodity's spot price has emerged as the driving force behind prices of all contract types, including long-term contracts: ow.ly/tYtu50Gqf6l

From @SPGMarketIntel: Future contracts for the coming winter months through February 2022 were all above $5/MMBtu at midday Sept. 14: ow.ly/U4d650GqfbU

From @SPGlobalPlatts: New outbreaks of COVID-19 in some Chinese cities and provinces recently have raised concerns over the country's mobility restrictions: ow.ly/87Qo50GqffC

From @SPGMarketIntel: Chinese imports of U.S. LNG have surged in recent months, helping to keep U.S. export facilities running close to full bore: ow.ly/iH3d50GqfiS

From @SPGlobalPlatts: Asia's LNG importers expect high spot prices this winter on the back of tight demand-supply fundamentals, which could derail procurement plans and increase power prices: ow.ly/RRdb50Gqfnl

From @SPGlobalPlatts: Surging Asia spot LNG prices point to sustained market volatility in the coming months despite a slim chance of cold weather this winter: ow.ly/R4nS50GqfpL

From @SPGlobalPlatts: The current spot LNG price volatility is a key focus for the industry as uncertainty over supply and demand continues to drive market fundamentals: ow.ly/sdfg50Gqfs1

From @SPGlobalPlatts: Short-term supply needs versus long-term demand uncertainty set the stage as the largest in-person gathering of gas market participants since the pandemic got underway in Dubai: ow.ly/oZ7O50GqfxY

From @SPGlobalPlatts: Bangladesh is increasingly concerned about the surge in LNG spot prices as its domestic demand is set to double from the current level of 4 million mt/year within two years: ow.ly/gWvq50GqfMr

From @SPGlobalPlatts: Bangladesh has reversed its decision to skirt the expensive spot LNG market following a surge in demand for natural gas in industries and power plants: ow.ly/E1jX50GqfP1

From @SPGlobalPlatts: Spot Asia-Pacific LNG prices hit a record high on Sept. 30. on persistent supply constraints in global gas markets and strong winter restocking demand among Asian end-users: ow.ly/xJPs50GqfS0

From @SPGMarketIntel: The biggest U.S. LNG exporter, Cheniere Energy Inc., discussed commercially sanctioning an LNG growth project in 2022: ow.ly/8jcj50Gqgiy

From @SPGlobalPlatts: Malaysia's national oil company Petronas has sounded out customers on the possibility of more LNG cargoes being deferred for the winter months from its nine-train LNG complex at Bintulu, Sarawak: ow.ly/oKqn50Gqgkw

From @SPGlobalPlatts: State-owned Qatar Petroleum has ordered four new LNG carriers from Hudong-Zhonghua Shipbuilding Group Co.: ow.ly/C0Tt50GqgmG

From @SPGlobalPlatts: Venture Global LNG's Calcasieu Pass export terminal in Louisiana is nearing completion and will begin production within months: ow.ly/I49Y50GqgoF

From @SPGlobalPlatts: Singapore-based Pavilion Energy is building an emission business that taps carbon offsets initially to drive decarbonization across the LNG value chain: ow.ly/HhxQ50Gqgq0

From @SPGlobalPlatts: Clean Energy Fuels is making its first foray into the liquified natural gas bunker market with its contract to supply World Fuel Services with LNG to fuel two Jones Act Hawaiian container ships: ow.ly/qTMC50GqgrT

From @SPGlobalPlatts: Global resources company BHP is tapping LNG's and biodiesel's potential as a marine fuel choice to advance sustainable shipping: ow.ly/9XFA50Gqgz3

From @SPGlobalPlatts: Vietnam aims to start importing LNG in 2022 and sees LNG among its solutions for lowering carbon emissions and ensuring the country's energy security: ow.ly/5JXd50GqgCJ

From @SPGlobalPlatts: LNG as a marine fuel presents a viable and immediate solution to expedite decarbonization as shipping explores other options like biofuels, ammonia and methanol to meet stricter environmental regulations: ow.ly/8ksZ50GqgFK

From @SPGMarketIntel: The concept of carbon-neutral LNG involves accounting for emissions of greenhouse gases throughout the natural gas supply chain that are associated with a cargo: ow.ly/PaFP50GqgJt

From @SPGlobalPlatts: Lack of investments and supply disruptions are helping drive LNG and natural gas prices to record highs but LNG is still expected to play a significant role in the energy transition: ow.ly/uBUG50GqgMx

• • •

Missing some Tweet in this thread? You can try to

force a refresh