Would a rotation from growth to value benefit non-US equities? In principle, yes, but the earnings picture for MSCI EAFE (Europe, Australasia and Far East) and EM (and especially China) suggests some caution. (THREAD)

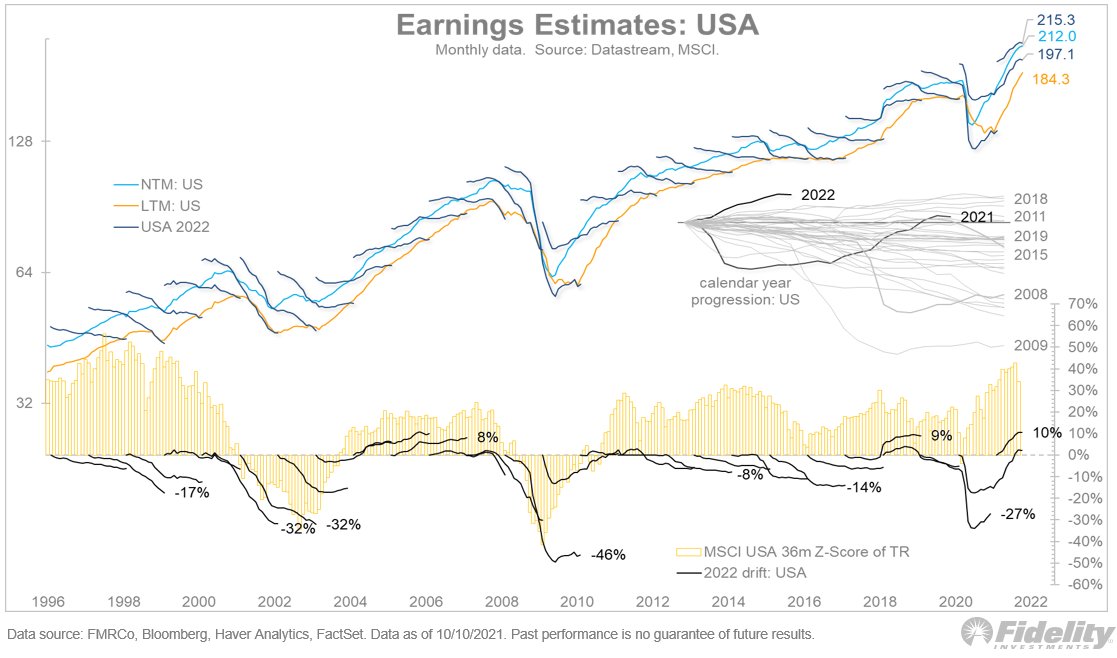

The chart above, and the ones below, use the Datastream “squiggles” series for consensus earnings estimate progression by calendar year. The estimates run from the February before the calendar year to the February after. /2

The top panel above shows the dollar estimates and the bottom panel shows the progression from the start of each squiggle. The yellow bars show the 36-month Z-score of the MSCI USA total return. /3

In the US chart above, you can see that estimates typically start too high and then progress down from there. The market is generally unfazed by this, except at cyclical inflection points. /4

Now look at EAFE. The bottom panel shows earnings estimate drift relative to the US, overlaid against the Z-score of relative return. Note the correlation between relative earnings and relative performance. Get the earnings right, and the performance will likely follow. /5

And here is the same chart but for Emerging Markets (EM). Again, we see a very clear relationship between relative earnings revisions and relative performance. /6

Note that the dollar EPS estimates above are still at or below the peak levels from 2010. The same is true for EAFE. It shows just what an earnings machine the US has been over the years. /7

And finally, here is China. The relative earnings progression has imploded relative to the US. The inset shows that 2021 and 2022 are among the worst years ever for relative revisions. /8

We often focus on valuation discounts when choosing non-US equities over the US, but these charts show that it’s the earnings that we must solve for. Price follows earnings, period. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh