One of the things that should be considered by rural legislators debating Leandro is that their counties are by and large pretty tapped out locally. Property taxes in rural counties are at a post-2003 high since 2014. The help their schools need has to come from the state. #ncpol

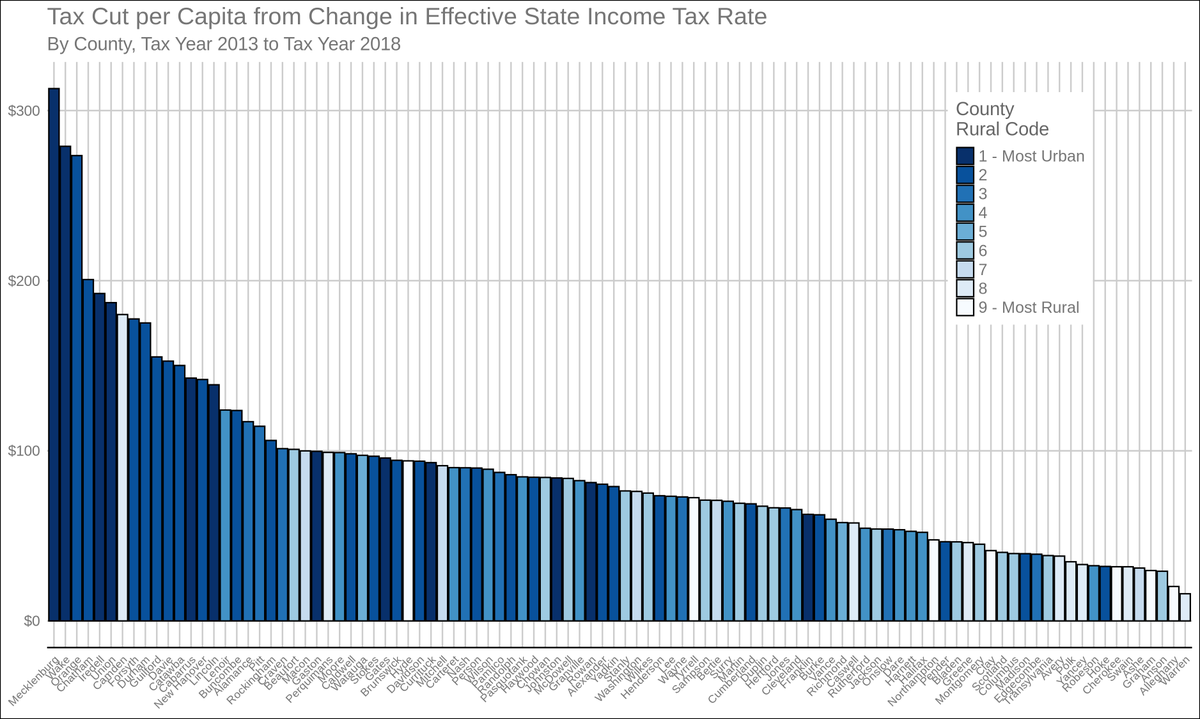

In 25 counties (18 rural), the 2013-2018 income tax cut was actually completely offset by increases in local taxes. That's *without* including statewide base-broadening sales tax hikes, which at $50-$70 per household would add another 2-7 counties . #ncpol

Meanwhile Leandro compliance (and greater public health/edu investments in general, but particularly Leandro) would address specific, long-standing needs and directly benefit rural counties specifically in a way that recent tax cuts demonstrably haven't. #ncpol #LeadWithLeandro

(Data shoutout to the indispensable @EveryChildNC Leandro impact analysis: everychildnc.org/leandro-impact…)

When we talk about rural counties, here's what's meant. This dataset categorizes "ruralness" on a scale from 1-9, and is available for every county nationwide, which standardizes definitions and allows apples-to-apples analysis.

For example, this chart is pretty stark...but it shouldn't be a surprise. K-12 and Medicaid funds are spent where there's need, while tax cuts land where there was already income. #ncpol

Of course there's been a rural/metro economic disparity within NC for a very long time, but our rural areas nearly kept pace with rest of the country during the 2002-2007 expansion. In contrast, the gap increased dramatically during the more recent expansion. #ncpol

This pattern can be found all over America, but some of it is specific to NC. Compared to rural counties of our (similarly culturally conservative) neighbors, NC's have long held a prosperity advantage, especially in good economic times...but it's been dwindling. #ncpol

NC's ranking in the Tax Foundation's Business Tax Climate was 44th in 2013, 10th today. SC went from 36th to 33rd; GA 34th to 31st; TN 15th to 18th. If the change in the chart above is driven by changes in "competitiveness" based in policy, it's NC's changes doing the driving.

See in these charts both a lack of improved "competitiveness" and also the significant rural/metro gap in poverty and median household income. Equity initiatives are, to a great degree, rural initiatives. Here's more on that from (again) @EveryChildNC: everychildnc.org/rural-students/

Nor has the relative economic performance of NC as a whole become some great positive outlier. This chart, from the North Carolina's 2020 Comprehensive Annual Financial Report, speaks volumes.

Leandro compliance would be a sustained (and sustainable!) investment in our most in-need children, one that is demanded by our state constitution. We need not choose between that investment and future prosperity; it is an investment IN our future prosperity. #LeadWithLeandro

• • •

Missing some Tweet in this thread? You can try to

force a refresh