Should you rent or buy? [Thread]

"You're paying someone else's bond"

"A house is not an asset"

"Landlords get rich in their sleep"

We have R15k property seminars, overpriced "beaches" in JHB, adult res blocks next to highways & SMEG giveaways when you blow R1m on a jail cell in Midrand

It's fucking exhausting!

"A house is not an asset"

"Landlords get rich in their sleep"

We have R15k property seminars, overpriced "beaches" in JHB, adult res blocks next to highways & SMEG giveaways when you blow R1m on a jail cell in Midrand

It's fucking exhausting!

"House prices always go up!"

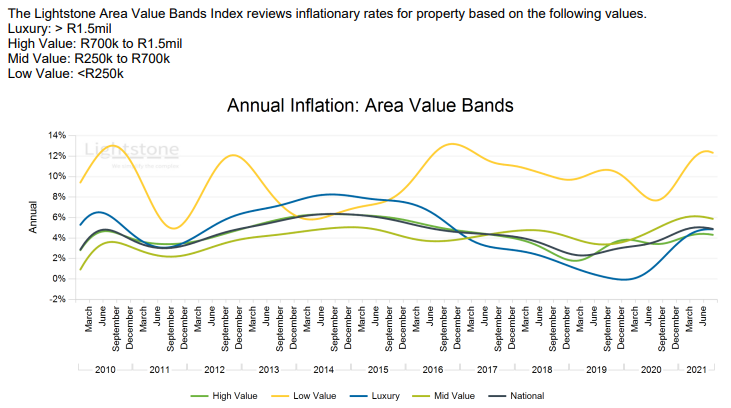

Mostly true except not all properties are equally attractive. That Clifton pad IG baddies love tends to underperform the Midrand prison. Must be the garden furniture.

price bands, location, inland/ coastal & freehold vs sectional title all matter!

Mostly true except not all properties are equally attractive. That Clifton pad IG baddies love tends to underperform the Midrand prison. Must be the garden furniture.

price bands, location, inland/ coastal & freehold vs sectional title all matter!

"It's becoming cheaper to rent"

True. If you thought Tinder was bad, try matching with a good tenant. Stable tenants are hard to find.

With interest rates being at historic lows, many people decided to buy houses - exiting the rental pool

Good news: rent escalations are <10%

True. If you thought Tinder was bad, try matching with a good tenant. Stable tenants are hard to find.

With interest rates being at historic lows, many people decided to buy houses - exiting the rental pool

Good news: rent escalations are <10%

"interest rates are low, it's a great time to buy a house!"

this narrative is pushed heavily by banks, estate agents & mortage brokers who all want to you take the plunge

being able to borrow cheaper for a house is good news... if interest rates never changed, except they do!

this narrative is pushed heavily by banks, estate agents & mortage brokers who all want to you take the plunge

being able to borrow cheaper for a house is good news... if interest rates never changed, except they do!

Lifesaving tip:

"Cheap to borrow" doesn't mean "Cheap house". It just means the financing costs you less.

Think about what happened in 2008. Cheap loans, huge property bubble.

Interest rates fluctuate... rather focus on the asset prices. Is the house itself much cheaper?

"Cheap to borrow" doesn't mean "Cheap house". It just means the financing costs you less.

Think about what happened in 2008. Cheap loans, huge property bubble.

Interest rates fluctuate... rather focus on the asset prices. Is the house itself much cheaper?

"But the bank said I can afford it!"

Qualifying & affordability are different. Being eligible for a loan is a great but once you overlay rates, levies, maintenance, insurance, utilities & security, costs rack up quickly!

Add 40% onto the bond & see if you're still comfortable

Qualifying & affordability are different. Being eligible for a loan is a great but once you overlay rates, levies, maintenance, insurance, utilities & security, costs rack up quickly!

Add 40% onto the bond & see if you're still comfortable

Buying a house requires cash - tons of upfront cash!

You won't pay transfer duties on a property less than R1m but you will still end up paying for everything from huge bond registration fees to even postage!!

Bond & transfer costs are actually fucking criminal.

You won't pay transfer duties on a property less than R1m but you will still end up paying for everything from huge bond registration fees to even postage!!

Bond & transfer costs are actually fucking criminal.

Renting a crib isn't without some upfront pain either!

You can expect to set aside 1-2 months of rent as a deposit. Make sure your deposit is placed in an interest bearing account!

... and if your new pad is unfurnished you will start to appreciate garden furniture a lot more

You can expect to set aside 1-2 months of rent as a deposit. Make sure your deposit is placed in an interest bearing account!

... and if your new pad is unfurnished you will start to appreciate garden furniture a lot more

Let's run some numbers on a R1m pad. Either you own the crib or you're a rentboi (don't judge my past, I wasn't always this flush)

The "savings" from maintenance, levies, rates leaves Brokebois who rent with a bit more cash at month end*

*But Brokebois won't ever own the crib

The "savings" from maintenance, levies, rates leaves Brokebois who rent with a bit more cash at month end*

*But Brokebois won't ever own the crib

Let's run it forward, if you bought a house for R1m... over 20 years you actually end up paying the bank R1.86m with monthly payments of R7,753

Then there's inflation... those levies, rates & maintenance escalate each year! At 5.5% annual inflation it gets very ugly...

Then there's inflation... those levies, rates & maintenance escalate each year! At 5.5% annual inflation it gets very ugly...

You might not think a few small changes in house price growth makes a big difference but over 20 years it's massive! It literally determines whether your crib will make you cash when you sell.

7% avg growth/ yr: +R120k

6% avg growth/ yr: -R500k

7% avg growth/ yr: +R120k

6% avg growth/ yr: -R500k

what makes home ownership so attractive? the structuring

when you buy a house using a debt, you're doing a leveraged buyout (LBO) - using a tiny fraction of your own equity (deposit) to secure an asset & over time, paying off the debt

ideally the house value goes increases

when you buy a house using a debt, you're doing a leveraged buyout (LBO) - using a tiny fraction of your own equity (deposit) to secure an asset & over time, paying off the debt

ideally the house value goes increases

when you overlay the "true cost" of home ownership it starts to soak up your gains

for instance, you may find yourself renovating your kitchen for R100k but the offer you receive is only R50k higher

house prices may go up - but there's no guarantee you will always make money

for instance, you may find yourself renovating your kitchen for R100k but the offer you receive is only R50k higher

house prices may go up - but there's no guarantee you will always make money

When you rent you don't have the benefit of using leverage & you don't get the asset price growth - if anything, you end up paying more rent

Let's run the numbers. Renting over time is usually more expensive than buying! Remember when you bought the house you were paying R1.86m

Let's run the numbers. Renting over time is usually more expensive than buying! Remember when you bought the house you were paying R1.86m

Didn't Brokeboi save R37k a year from renting? Yes

How you use the savings from renting is the main driver in the overall outcome. If Brokeboi religiously took that cash & invested it... he would be net positive

.... but investments are volatile (here 15% each year is a lot!)

How you use the savings from renting is the main driver in the overall outcome. If Brokeboi religiously took that cash & invested it... he would be net positive

.... but investments are volatile (here 15% each year is a lot!)

Here's how you hack the renting game:

- make sure what you're paying to rent is at least 30-40% CHEAPER than the all-in cost to buy

- never accept above market escalations, they add up

- minimize your utilities cost, "water included" makes a difference

- INVEST THE DIFFERENCE!!!

- make sure what you're paying to rent is at least 30-40% CHEAPER than the all-in cost to buy

- never accept above market escalations, they add up

- minimize your utilities cost, "water included" makes a difference

- INVEST THE DIFFERENCE!!!

Here's how you hack the buying game:

- pay a 10% deposit if you can

- negotiate the purchase price down (start with 25% lower) = means you take on less debt

- aim to really reduce your utilities bill

- always run a R/ square meter calculation

- look at high growth locations

- pay a 10% deposit if you can

- negotiate the purchase price down (start with 25% lower) = means you take on less debt

- aim to really reduce your utilities bill

- always run a R/ square meter calculation

- look at high growth locations

There's additional costs to selling a property (agent fees & capital gains tax) worth accounting for. For Brokebois, there's gains tax on your investments (& possibly dividend tax)

If you have a bond you're close to paying off, it's also a great facility to have for an emergency

If you have a bond you're close to paying off, it's also a great facility to have for an emergency

Expected higher interest rates, higher inflation, policy uncertainty, a very evident property bubble in many city areas, excess supply with residential developments, having liquidity & attractive opportunities to use that cash investing offshore can make renting in SA attractive

If you're keen to leave behind assets for your kids & give them a headstart, starting out with a home you don't have to pay does make a massive difference

Buying a house to rent it out is complex, it can end up costing you a ton more cash than you're comfortable spending

Buying a house to rent it out is complex, it can end up costing you a ton more cash than you're comfortable spending

Here's a thread of property threads (property inception)

https://twitter.com/iamkoshiek/status/1286328317042462724?s=20

Here's how to save a couple hundred grand on your next property

https://twitter.com/iamkoshiek/status/1358386573079945221?s=20

Shout-out for making it to the end!! Really love you guys 🙏❤️ For more dope personal finance, investing & entrepreneurship content please check out @Banker__X 🔥🔥

We're all going to make it!!✊✊

We're all going to make it!!✊✊

• • •

Missing some Tweet in this thread? You can try to

force a refresh