1/22 🧵 A beginners guide to Liquidity Pools (LPs) on @terra_money & some of the higher return options currently available.

Note: LP provision is a high risk play & the following thread should not be considered advice - always DYOR.

$LUNA $UST $PSI $VKR $APOLLO $SPEC $MINE $STT

Note: LP provision is a high risk play & the following thread should not be considered advice - always DYOR.

$LUNA $UST $PSI $VKR $APOLLO $SPEC $MINE $STT

What is an LP?

A liquidity pool facilitates decentralised trading between 2 assets. The assets on either side of the pool are weighted based on the demand for each asset.

On Terra most LPs are typically a token e.g. $LUNA, $ANC & $MIR on one side & $UST on the other side.

A liquidity pool facilitates decentralised trading between 2 assets. The assets on either side of the pool are weighted based on the demand for each asset.

On Terra most LPs are typically a token e.g. $LUNA, $ANC & $MIR on one side & $UST on the other side.

When you are providing liquidity to an LP you provide an equal amount of each token to the pool based on the relative value of each asset at the time you are providing liquidity.

e.g. if $MIR=$3 & you’re adding to $MIR/$UST LP for every 100 $MIR you need to add $300 of $UST.

e.g. if $MIR=$3 & you’re adding to $MIR/$UST LP for every 100 $MIR you need to add $300 of $UST.

If the price of the $MIR token goes up you will have less $MIR in your LP & more $UST & if the price of $MIR reduces you will hold more $MIR & less $UST.

You are not protected from price fluctuations in an LP.

Price goes up = LP value up

Price goes down = LP value down

You are not protected from price fluctuations in an LP.

Price goes up = LP value up

Price goes down = LP value down

You will often see high APRs offered for providing liquidity to an LP - this is because it’s relatively high risk to provide liquidity, but liquidity is needed to help stabilise a token’s price, therefore LP providers are highly incentivised through swap fees & token emissions.

Why is LPing risky?

Impermanent loss:

- impermanent loss means that if the price of the volatile asset goes up or down you make slightly less profit, or lose slightly more value than if you had just held the equivalent amount of each asset in your wallet.

Example:

Impermanent loss:

- impermanent loss means that if the price of the volatile asset goes up or down you make slightly less profit, or lose slightly more value than if you had just held the equivalent amount of each asset in your wallet.

Example:

If I deposit $500 of $MIR & $500 $UST into an LP & the price of $MIR drops from $3 to $2 - my LP would be worth $816 vs. $833 had I held in my wallet.

If $MIR increased from $3 to $4 the LP value would be $1,154 vs. $1,166 had I held in my wallet.

If $MIR increased from $3 to $4 the LP value would be $1,154 vs. $1,166 had I held in my wallet.

Personally I think impermanent loss is a negligible risk on a small scale, with small value increases/decreases. But at large $ scale or where a token increases in price by 100%+ it can become significant.

Typically where a token price is stable the APR will outweigh IL risk.

Typically where a token price is stable the APR will outweigh IL risk.

Low liquidity risk:

Where an LP has low liquidity the price of the fluctuating token can go significantly up or down with relatively low $ buy or sell orders.

e.g. today someone bought $300K of $MIAW with only $550K of liquidity in the LP, spiking the price from $0.2 to $0.9

Where an LP has low liquidity the price of the fluctuating token can go significantly up or down with relatively low $ buy or sell orders.

e.g. today someone bought $300K of $MIAW with only $550K of liquidity in the LP, spiking the price from $0.2 to $0.9

Had you provided liquidity at the peak of the price & then token holders subsequently sell their tokens, the value of your LP provision would significantly reduce, very quickly.

Always be careful LPing low liquidity coins & on price spikes 🤝

Always be careful LPing low liquidity coins & on price spikes 🤝

To combat low liquidity - new tokens often heavily incentivise people to provide liquidity to help stabilise the token price.

2 examples recently are the launches of the $VKR & $PSI tokens - both of which have provided significant incentives to provide liquidity.

2 examples recently are the launches of the $VKR & $PSI tokens - both of which have provided significant incentives to provide liquidity.

By allocating large amounts of their token supply to incentivising liquidity, both in the short term & longer term - both @valkyrie_money & @NexusProtocol have been able to attract large initial liquidity ($31m & $29m respectively) which helps stabilise the token price.

By offering these incentives the $VKR/ $UST LP (Currently 1,200% APR) & the $PSI/ $UST LP (Currently 209% APR) are the 2 most lucrative LPs available in the Terra ecosystem and I have personally been providing liquidity to both of these pairs.

However by way of warning:

However by way of warning:

As liquidity increases, and price stabilises, the APR returns will reduce & this may mean that whales pull their liquidity, look to realise their gains & reallocate capital.

Also high APR % LPs mean more tokens are entering circulation which increases market cap & sell pressure.

Also high APR % LPs mean more tokens are entering circulation which increases market cap & sell pressure.

Other options for high returns on LPs are auto-compounding LPs that are offered by @ApolloDAO & @SpecProtocol - rather than having to claim LP rewards, these protocols automatically claim & re-invest your rewards creating a higher APY than the native LP.

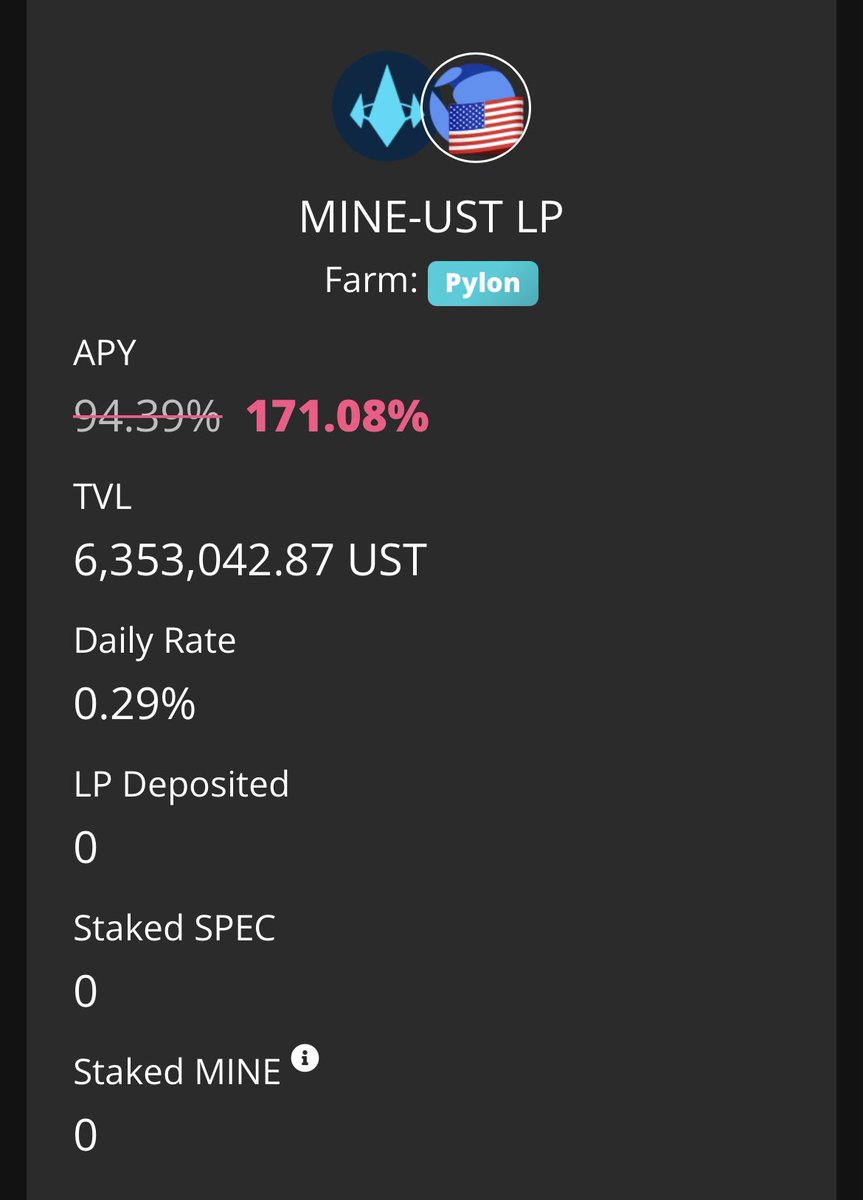

For example on @SpecProtocol if you deposit to the $MINE/ $UST pool - instead of receiving 95% APR on the basic LP, you will receive 171% APY as your rewards are auto-compounded into your existing LP position + you gain extra returns through $SPEC rewards.

@ApolloDAO offer a similar boosting service with slightly reduced APYs as a % of yield goes to farming $APOLLO tokens for their launch event. This is a fantastic LP option as the APR is based on $APOLLO @ $0.25 when in reality the token will trade at a higher price post launch.

Providing liquidity using @ApolloDAO is a great option for beginners as you can provide $UST and they will convert it to 50% of each asset for the LP. You can also choose to withdraw in $UST or 50% of each asset.

Apollo offer LPs on $MIR assets which are lower volatility & risk.

Apollo offer LPs on $MIR assets which are lower volatility & risk.

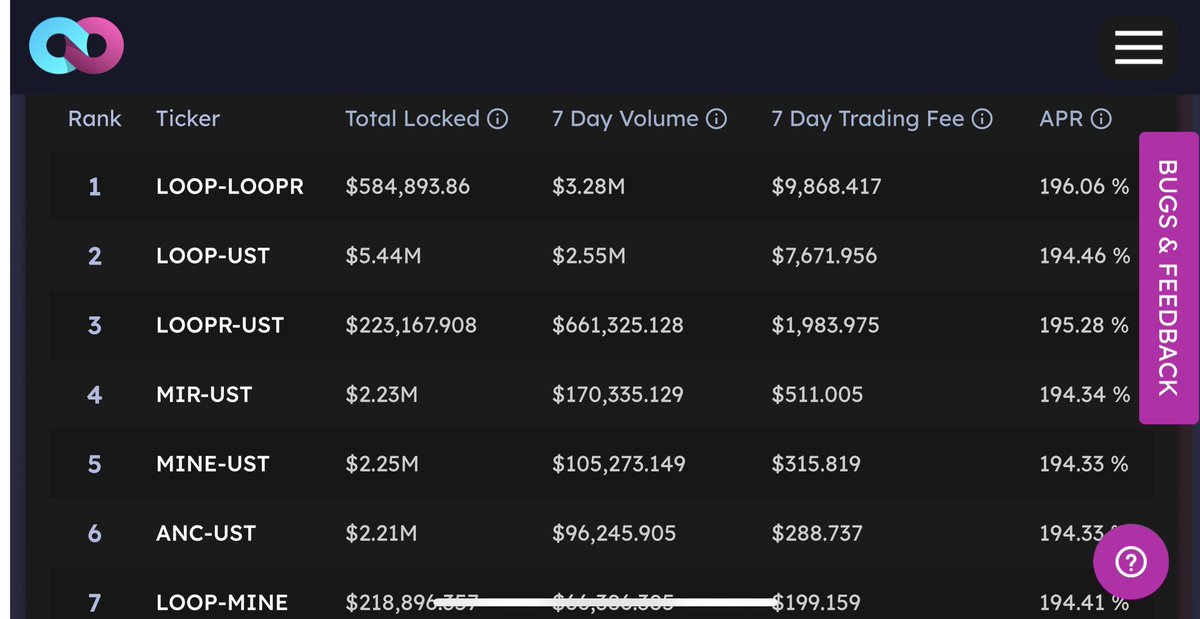

Another high APR % LP option is utilising @loop_finance - a new DEX launched on Terra which is offering increased rewards for liquidity provision through emissions of their $LOOP token. I have not yet used these LPs so not 100% sure on the reward mechanisms.

Another option worth considering is providing liquidity to one of the @StarTerra_io faction LPs. Not only are these offering >100% APR, but if you are providing between 200-2,400+ LP tokens, you also qualify for IDO allocations on starterra. Details here:

medium.com/@StarTerra/sta…

medium.com/@StarTerra/sta…

Whilst IDOs could present significant rewards, the $STT/$UST LP is unusual in that your LP tokens are locked for 5 days should you wish to withdraw liquidity (or you can pay a 5% instant unbonding fee) - unlike most LPs where you can pull your liquidity instantly without penalty

Finally a safe play is to provide liquidity to the $LUNA/ $bLUNA pair on @terraswap_io - here there are no incentivised rewards, only swap fees paid to liquidity providers, but as you are providing the same asset on both sides of the LP, impermanent loss is negated. APR is <5%.

I hope you have found this thread informative. Keen to hear in the comments if you are providing liquidity anywhere within the Terra ecosystem & what your favourite plays are? Also hit me up with any questions.

As always DYOR before taking any risk with your capital. 🤝🌝🚀

As always DYOR before taking any risk with your capital. 🤝🌝🚀

Here’s an impermanent loss calculator for anyone who worries about IL (always keep token B at 1 if you’re doing a $UST pair):

dailydefi.org/tools/imperman…

dailydefi.org/tools/imperman…

To clarify following feedback for dog coin lovers - I would never recommend providing liquidity to memecoins that have done 100-300x within an extremely short period of time. Was using this as an example of what not to provide liquidity to.

• • •

Missing some Tweet in this thread? You can try to

force a refresh