There's a lot of buzz about "DeFi 2.0" and what it actually means. There's a misunderstandings since everyone wants to brand themselves as the new trendy thing in town.

A 🧵 on what DeFi 2.0 actually is and the protocols that qualify as DeFi 2.0

A 🧵 on what DeFi 2.0 actually is and the protocols that qualify as DeFi 2.0

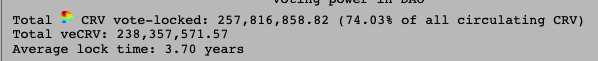

DeFi 2.0 protocols/designs bring more capital efficiency in holding assets on their balance sheet and deploy liquidity/stablecoins/assets/incentives through the hivemind of their token holders. Critics might say this is just "treasury management." I disagree.

To understand why, we have to understand the "Theory of the Firm" by Coase. Why do companies emerge? Why doesn't a company have market pricing internally? If Zuck tells his dev to code up a new feature, "why doesn't he say that'll be $500."

Why don't employees rent/buy office space/ from the company? Why are all these transcations internalized, packaged, and outputted as a singular relationship of employer <> employee and fixed compensation with minimal variance? And why does this boundary appear where it does?

Isn't price information extremely important? Communism/central planning is supposed to be plagued by inefficiency because no one knows what the price of anything is.

We're always told communism failed because of the pricing problem/central planning. Paradoxically, Coase explains there is actually a certain point where market forces end. This boundary is where the firm begins. This actually INCREASES efficiency within the firm.

All DeFi 2.0 protocols are experimenting with algorithmic & social rules that formalize their capital deployment. They're differentiated by the kind of capital they have. Liquidity, collateral, stablecoins, incentives/gov tokens.

We are approaching a point in crypto where infrastructure, social acceptance, and usage make it more efficient to produce certain things, like liquidity, in a non-market environment. In a firm/DAO.

For example, @feiprotocol is DeFi 2.0. It has a bunch of ETH/collateral inside, it hypothecates it as a stablecoin, $FEI. It's basically a giant MakerDAO CDP with formalized ways to deploy it. Notice how this mechanism is more efficient than market based, individual CDPs.

It is internalized as a firm/DAO operation. It is less expensive to run, coordinate, and scale. It is more organized.

Likewise, renting liquidity aka paying the open market price of market making at every moment, is as inefficient as your secretary charging you to book a meeting, your dev charging the company per feature etc.

People think @OlympusDAO is only worth the amount of assets inside the treasury like an ETF. So if the mcap of OHM is 10x the value of the assets inside, it must be a scam. This is misses the subtle point. There is only 1 token, OHM, so the speculative/mcap growth is all there.

An ETF has no mcap above its risk free value because an ETF does nothing. It sits idly for investors to buy its shares as an indexed exposure. You're not buying OHM to be exposed to a basket of stablecoins+ETH. You're buying OHM because it is a new way to organize a firm/entity.

It's an open secret that @fraxfinance v3 will blow minds because veFXS holders will directly control where $FRAX supply expands in AMOs and where it contracts to stabilize the peg. This is a formalized mechanism for controlling money printing onchain.

Frax is focusing on monetary policy within the firm. Expanding and contracting supply of stablecoins through AMO modules. This lets us target a peg while having a formalized mechanism of how $FRAX is produced, kept stable, & how capital comes and goes through the protocol.

Frax v3 does monetary policy within the firm, producing a stablecoin/cash, then giving algorithmic rules to veFXS holders to control the protocol in a more efficient way than incentivizing stability. It's much more efficient than one-off stablecoin mechanisms+farming.

So there you have it. Definition of DeFi 2.0: Creating new boundaries between the firm/DAOs and onchain market forces..such as producing liquidity/assets within the firm and creating a novel consensus/social mechanism to deploy them into the market.

The leading DeFi 2.0 protocols will create, own, and deploy capital, assets, stablecoins in unique ways not seen before. It goes way beyond just having token holders vote. They create socially coordinated mechanisms, processes, and incentives to produce & deploy within the firm.

• • •

Missing some Tweet in this thread? You can try to

force a refresh