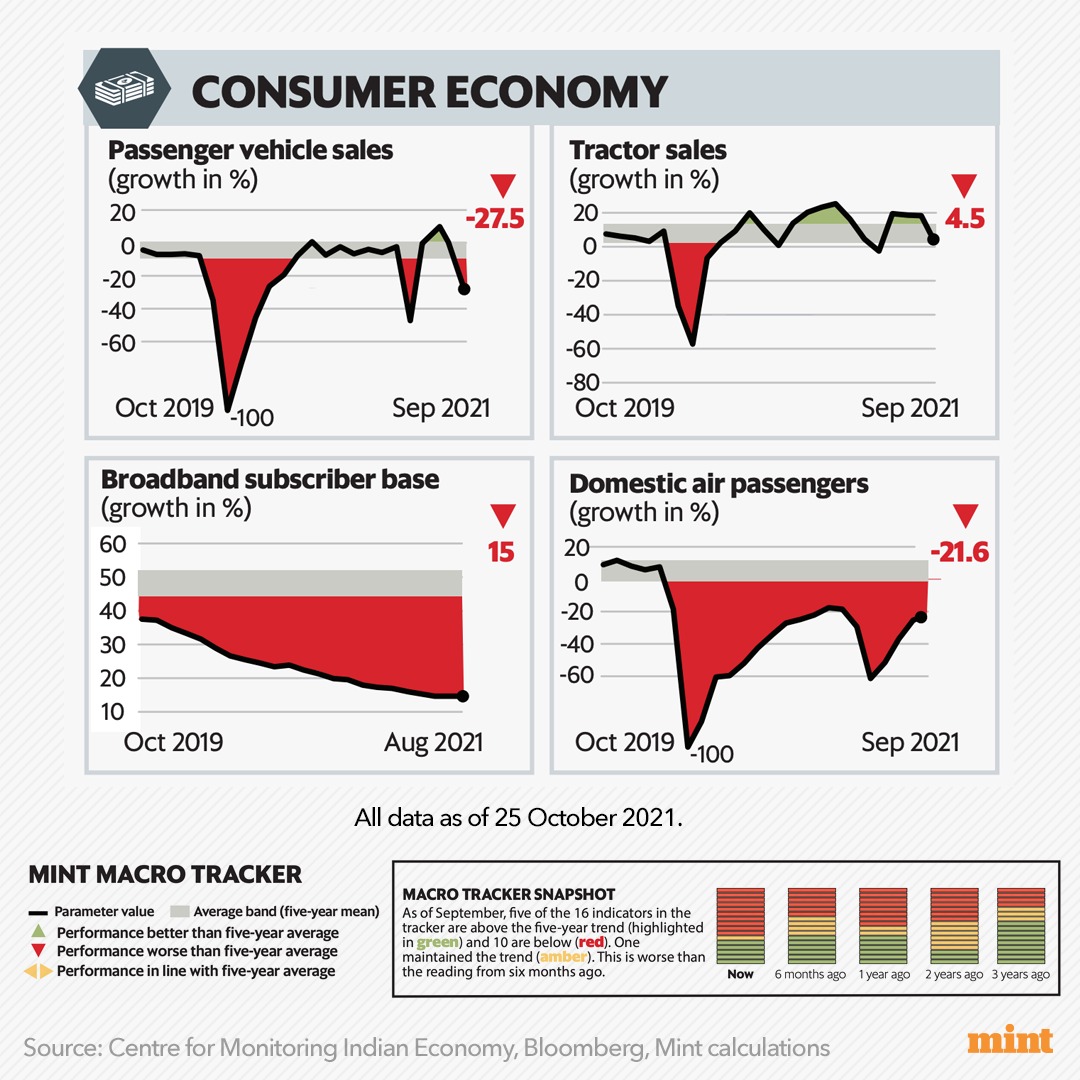

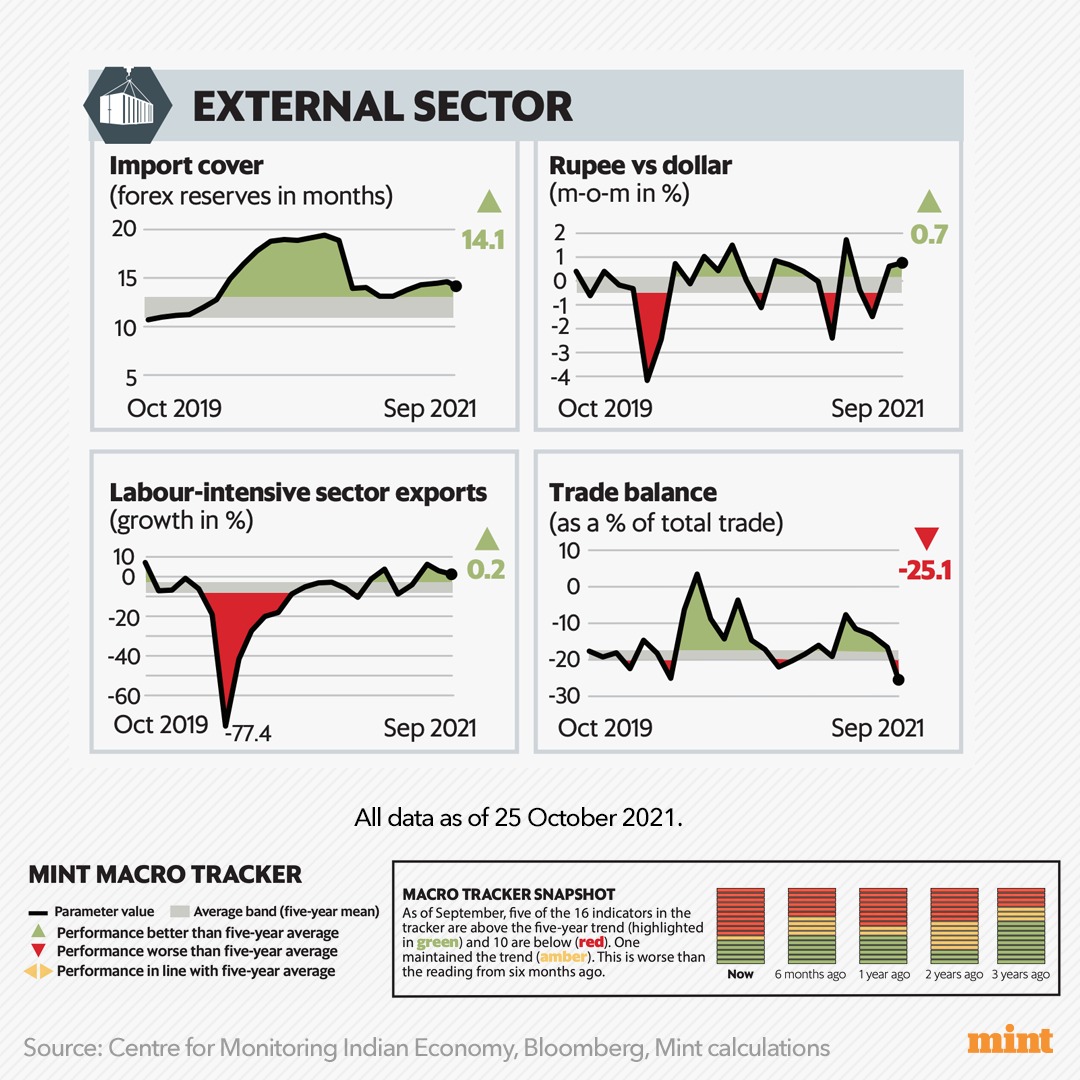

#MintPlainFacts | India’s economy appears to have faced hiccups in its recovery trajectory in September as global supply constraints and an upbeat domestic mood resulted in divergent trends.

Read here: livemint.com/economy/indias…

Read here: livemint.com/economy/indias…

#MintPremium | The deterioration was driven by the consumption segment, even as the ease of living segment remained worrisome. In August, the tracker had reported its best performance in five months, with just seven indicators in red.

livemint.com/economy/indias…

livemint.com/economy/indias…

In a report on 21 October, credit rating agency #ICRA noted that India's recovery had continued into the September quarter as the second covid-19 wave subsided, but turned “multi-speed".

livemint.com/economy/indias…

livemint.com/economy/indias…

Data from the Federation of Automobile Dealers Association (#FADA) shows vehicle registrations fell 5.3% year-on-year but the decline was a much sharper 7% (annualized) compared to September 2019.

livemint.com/economy/indias…

livemint.com/economy/indias…

Domestic air travel continued its gradual uptick, rising 5.5% since August, but stayed significantly behind pre-pandemic levels. Revenge travel and increased public mobility could aid recovery in coming months.

livemint.com/economy/indias…

livemint.com/economy/indias…

• • •

Missing some Tweet in this thread? You can try to

force a refresh