1/ @Barn_Bridge is a cross-chain risk management protocol founded in 2019.

It provides composable solutions for investors to hedge against interest rate fluctuations and price volatility.

Their latest product, launched September 2021, is called SMART Alpha.

It provides composable solutions for investors to hedge against interest rate fluctuations and price volatility.

Their latest product, launched September 2021, is called SMART Alpha.

2/ SMART Alpha allows investors to calibrate exposure by choosing a Jr/Sr position in an aggregated pool.

The senior side is better protected when the underlying asset dips but in turn loses out on gains; the opposite applies for jr. users who take leverage on price volatility.

The senior side is better protected when the underlying asset dips but in turn loses out on gains; the opposite applies for jr. users who take leverage on price volatility.

3/ Every asset pool runs on an epoch-based timeline. The default period advances weekly on Mondays at 14:00 UTC.

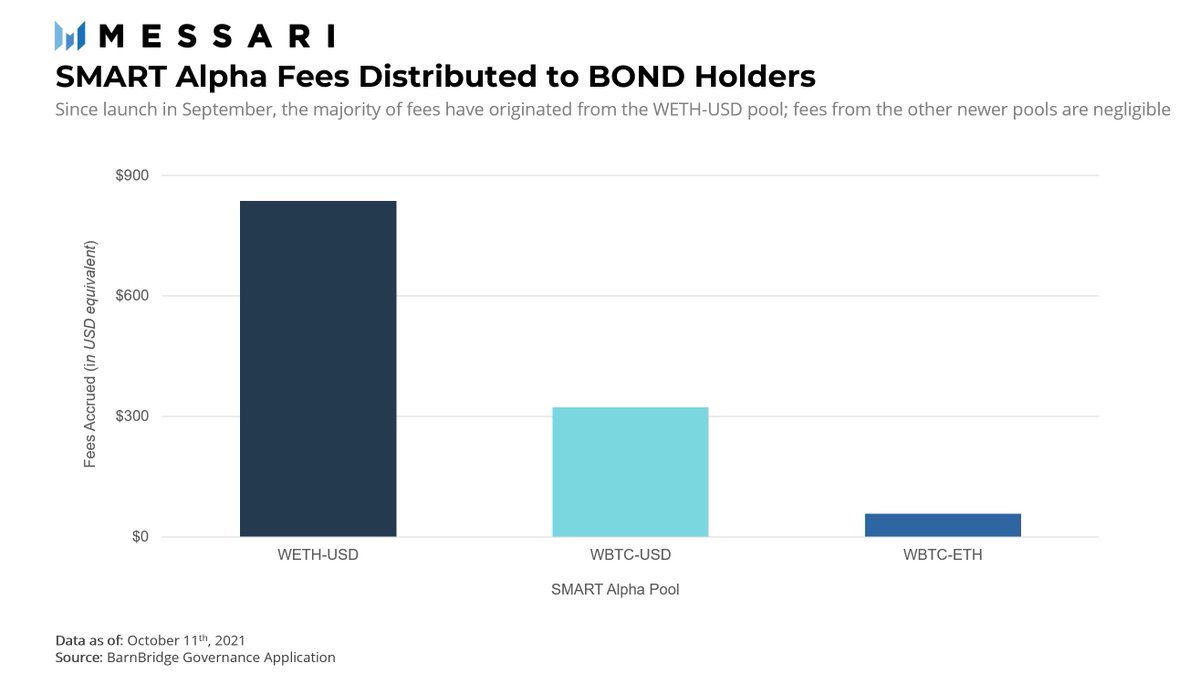

Protocol revenue is earned through a fee taken at the end of each epoch, which currently stands at .5% of a given week’s profits and applies to the winning side only.

Protocol revenue is earned through a fee taken at the end of each epoch, which currently stands at .5% of a given week’s profits and applies to the winning side only.

• • •

Missing some Tweet in this thread? You can try to

force a refresh