1/ DeFi has once again resurfaced among crypto's leading narratives, this time dubbed "DeFi 2.0".

The nickname has sparked infighting over the categorization of DeFi protocols and has pulled the attention away from what's actually happening.

So what actually IS happening?

The nickname has sparked infighting over the categorization of DeFi protocols and has pulled the attention away from what's actually happening.

So what actually IS happening?

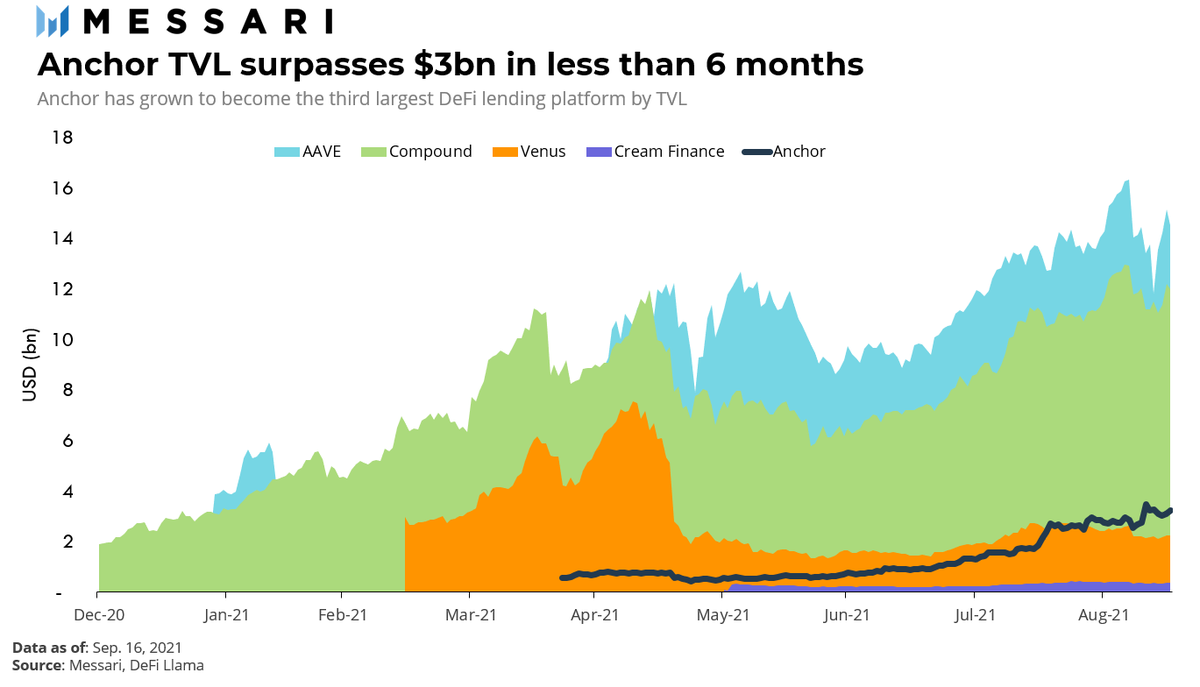

2/ Liquidity mining, the heart and soul of DeFi Summer 2020, has fallen off as protocols struggle through the effects of mercenary capital providers draining value.

Projects realize they need better systems to ensure sustainable liquidity while aligning w/ long-term incentives.

Projects realize they need better systems to ensure sustainable liquidity while aligning w/ long-term incentives.

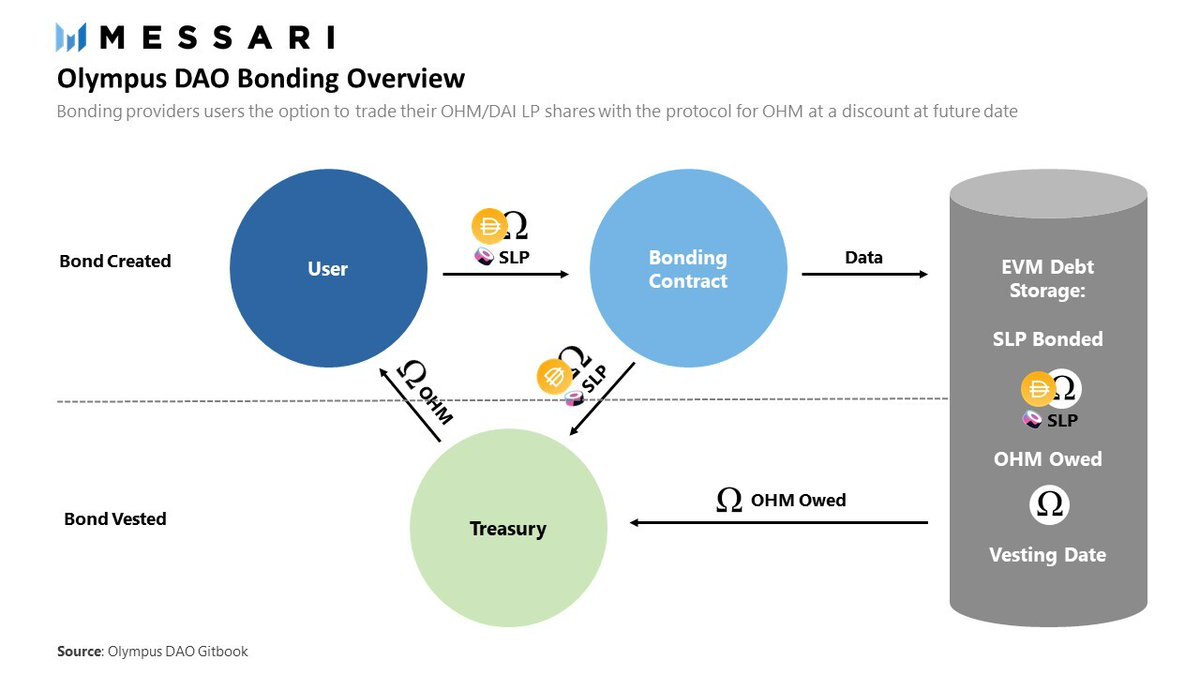

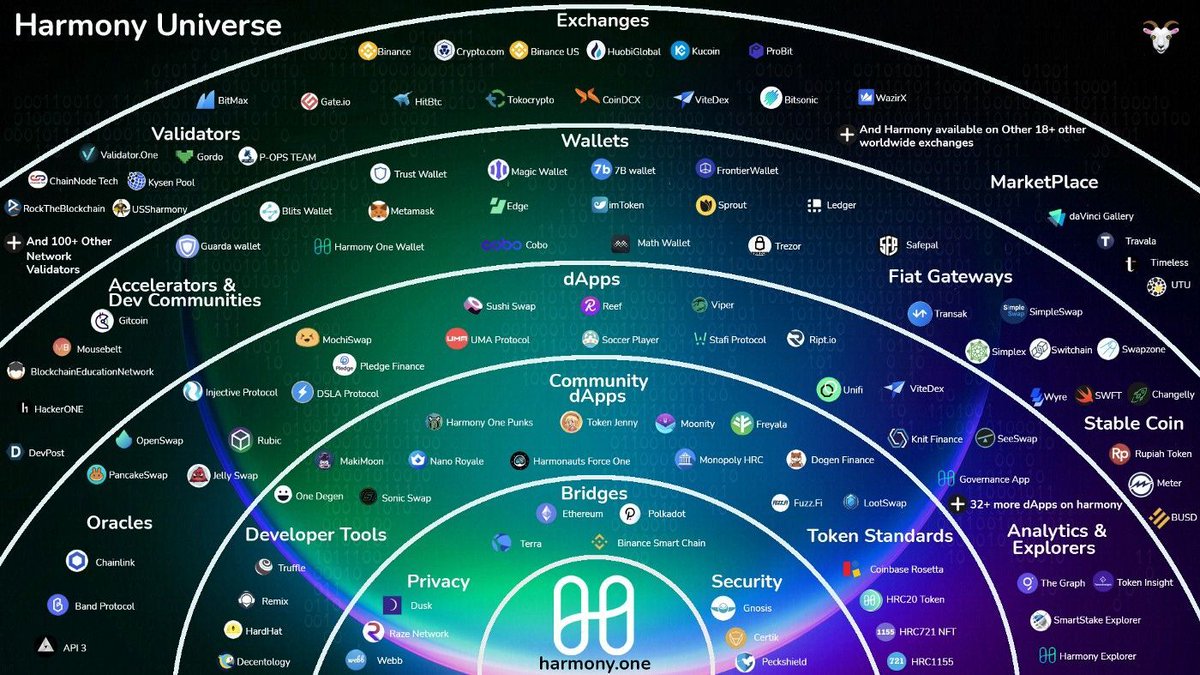

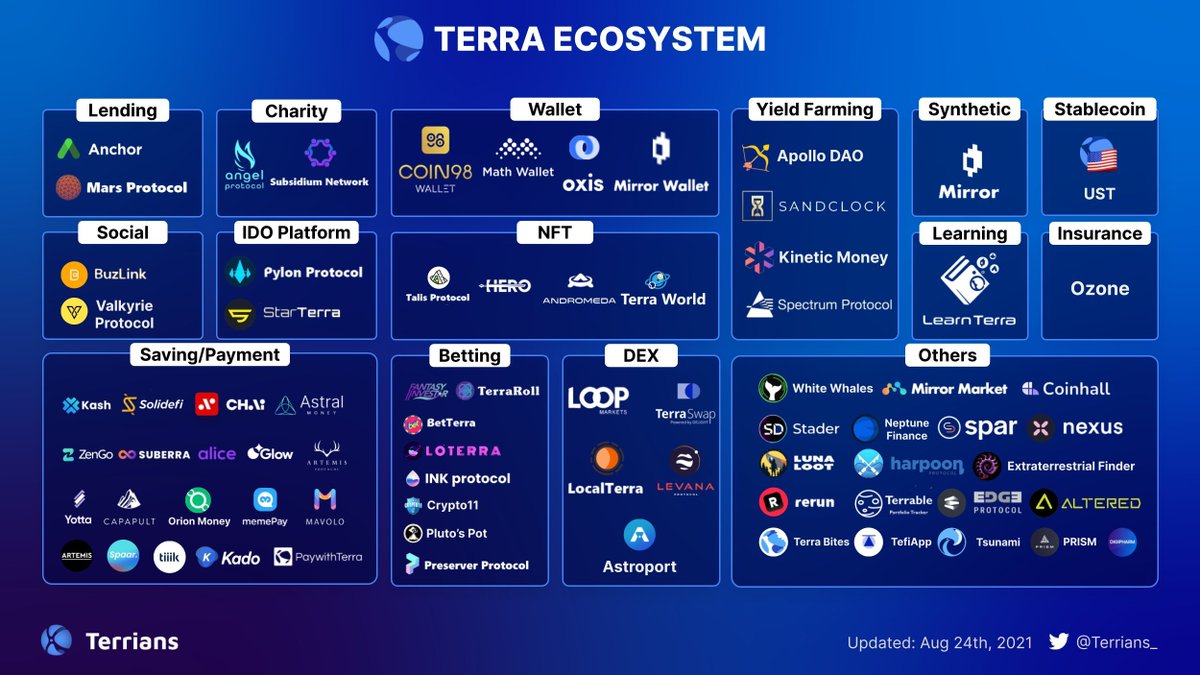

3/ Additionally, "second order" protocols are coming to life.

Leveraging DeFi’s composable nature, these projects build on top of existing DeFi infrastructure to automate, enhance, or extend existing DeFi economic models and processes.

This comes at the cost of compounded risk.

Leveraging DeFi’s composable nature, these projects build on top of existing DeFi infrastructure to automate, enhance, or extend existing DeFi economic models and processes.

This comes at the cost of compounded risk.

4/ Learn more about DeFi's innovation drivers in the full article from @chasedevens messari.io/article/beyond…

• • •

Missing some Tweet in this thread? You can try to

force a refresh