“Opportunity should not be limited to a wealthy few”

Inflation, labour shortages and high energy prices the product of global forces says Sunak [and nothing to do with Brexit, he doesn't say]

Sunak says UK is scheduled to return to 0.7% aid spending target in 2024/25

Sunak now reading out all those news releases we have had over the past week

Public spending in Scotland, Wales and N Ireland to rise by more than the Barnett formula requires

Red ensign joke: "I'm sure the opposition will be glad the red flag is still flying somewhere"

Sunak cuts air passenger duty for return domestic flights & puts up tax on longest long haul flights

Business rates: Sunak attacks opposition's "reckless unfunded promise to abolish a tax that raises £25bn a year"

Alcohol duties introduced in 1643 to help pay for the Civil War, he says

Sunak: we are taking advantage of leaving the EU to announce the most radical simplification of alcohol taxes

3p off a pint of beer in 2023: "I can't wait for the opposition to accuse me of beer barrel politics"

So we left the EU so we could simplify our alcohol taxes

"Last year the state grew to over half the economy; I don't like it, but I cannot apologise for it"

Now we face a choice, Sunak says. Do we want the response when every time prices rise the answer is always the taxpayer must pay? – or do we choose to recognise that govt has limits; govt should have limits

Final announcement of my Budget concerns the "hidden tax on work" – the universal credit taper acts as a high tax

I have decided to cut the taper rate not by 1%, not by 2% but by 8%, from 63p in the £ to 55p

Change to be introduced within weeks and no later than 1 Dec

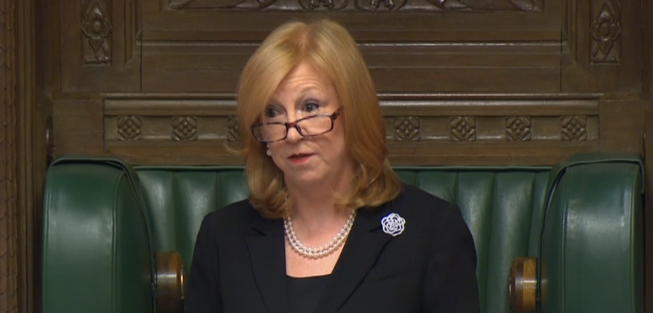

Therese Coffey, work and pensions sec, not wearing a mask, pleased with universal credit announcement, worth £2bn a year

So the surprise in the Budget was what we thought it would be, but a bigger cut in the effective tax rate of universal credit withdrawal

Here is the Chart of Everything: effect of all measures straightforwardly progressive assets.publishing.service.gov.uk/government/upl…

Most of the work done by benefits in kind from public services

• • •

Missing some Tweet in this thread? You can try to

force a refresh