1/ As expected, BTC is taking a breather after being stretched at new highs (67,000). ETH tested the previous high (4,385) and has come back off as well. BTC has broken below 60,000 and ETH has broken below 4,000.

2/ Despite this quick dip from the highs, the market feels relatively calm and perhaps even slightly optimistic that this is just a dip before a larger rally into year-end.

3/ In vols, besides a spike in front-end ETH vols, there has been no significant reaction to this move. In fact, the market remains optimistic with risk reversals still skewed to the call side (Chart)

4/ Our ETH and Altcoin option books have been particularly interesting this past week with a diversity of results across the books:

5/ 𝐄𝐓𝐇

Since our Flow Alert on 19 October highlighting unusually large call buying in the 15k March 2022 calls, ETH price really followed through on that flow, rallying 17% to hit the high on 21 October before retracing.

Since our Flow Alert on 19 October highlighting unusually large call buying in the 15k March 2022 calls, ETH price really followed through on that flow, rallying 17% to hit the high on 21 October before retracing.

6/ We found out that demand in the 15k March contract was driven by a high conviction recommendation from Raoul Pal to Real Vision subscribers (Raoul’s actual post in Pic). A testament to Real Vision’s influence amongst crypto investors.

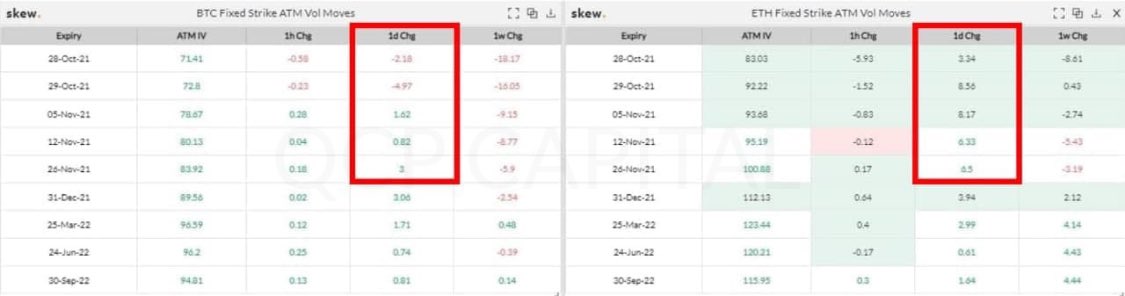

7/ ETH vols have been particularly sensitive to spot movements, compared to muted reactions in BTC vols (Chart). Although vols are starting to come off, we think ETH calls are a decent sell here especially with the call skew at heightened levels.

8/ 𝐒𝐎𝐋

SOL has been our top gamma performer with a strong breakout to make new highs (219) before retracing 19%. SOL 7-day realised vol has been amongst the highest in our Altcoin books (Chart).

SOL has been our top gamma performer with a strong breakout to make new highs (219) before retracing 19%. SOL 7-day realised vol has been amongst the highest in our Altcoin books (Chart).

9/ 𝐀𝐋𝐆𝐎

ALGO theta has performed well. This means that selling ALGO calls and puts for yield has been a decent trade with ALGO spot trading in a 1.60 - 2.10 range. ALGO is currently trading in the middle of the range at 1.8.

ALGO theta has performed well. This means that selling ALGO calls and puts for yield has been a decent trade with ALGO spot trading in a 1.60 - 2.10 range. ALGO is currently trading in the middle of the range at 1.8.

10/ Upside in ALGO has probably been capped in the past month by the increase in ALGO supply from accelerated vesting which ended on 5 October.

11/ A total of 3.1 billion Algo linked to the vesting program were vested in total, leaving the circulating supply of algo at 6.15 billion out of a total supply of 10 billion (algorand.foundation/news/accelerat…).

12/ However, there has also been price support from the validation of the Governance feature which was tolled out on 1 October. In this scheme, ALGO holders commit their ALGOs to a time lock and participate in voting on ecosystem decisions in return for rewards.

13/ By 15th Oct, close to 71k wallets had registered for Governance, with a total of 1.88 billion ALGOs committed to lockup. That is 30% of the circulating supply!

14/ We remain bullish ALGO especially going into the Decipher conference at the end of November. However, with the price stability from the mentioned supply/demand dynamics, selling ALGO calls and puts in the short to medium term could be a great play.

15/ 𝐃𝐎𝐆𝐄

DOGE has also been a gamma outperformer due to the volatility contagion in canine tokens, most prominently SHIBA which has been exploding to new highs (Chart).

DOGE has also been a gamma outperformer due to the volatility contagion in canine tokens, most prominently SHIBA which has been exploding to new highs (Chart).

16/ 𝐁𝐂𝐇

Surprisingly, BCH has the lowest 7-day realised vol, even lower than BTC and ETH! However, it’s been an outperforming book for us from trading tight delta ranges. We’ve also benefited from the spike in front end implied vols.

Surprisingly, BCH has the lowest 7-day realised vol, even lower than BTC and ETH! However, it’s been an outperforming book for us from trading tight delta ranges. We’ve also benefited from the spike in front end implied vols.

17/ Overall, our short spot position in BTC and ETH was timed well and we are starting to reduce at these levels and possibly turn neutral. Long downside from the usual Friday supply in OTC and Defi has also performed well this week.

18/ But the best performance in the book has come from funding and forward spreads in BTC. BTC perp funding hit a high of 65% is currently flattish.

19/ October forwards were trading at over 30% annualised and are about to settle. November futures were trading around 25% and have come down below 15%.

20/ We’ve now turned short ETH vega and gamma given the elevated levels. And we are holding this against long vega and gamma in BTC and the Altcoins.

21/ The books are relatively neutral and nimble as we head into the huge end-October option expiry. Uptober has not disappointed but we do not have any strong convictions heading into November.

• • •

Missing some Tweet in this thread? You can try to

force a refresh