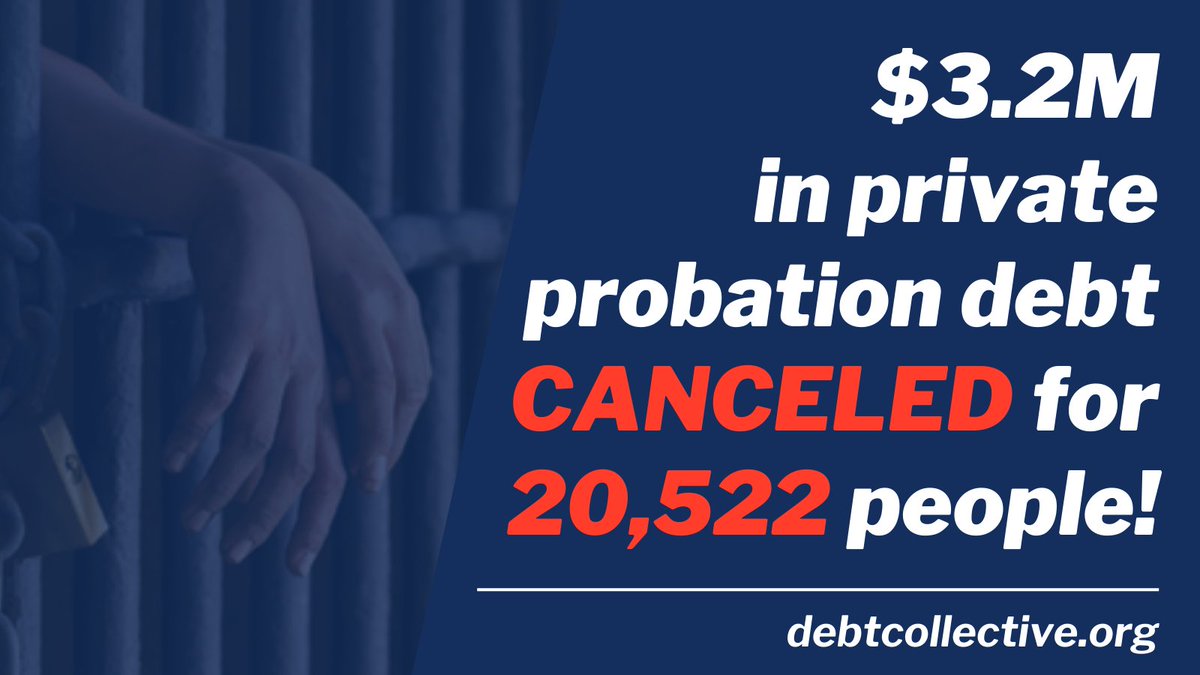

Exciting news today! We have purchased—and erased—$3M of private probation debt for over 20,500 debtors. This particular debt is gone, and with no strings attached. We've revived our Rolling Jubilee effort of abolishing debts that shouldn't exist!

Thread.

debtcollective.org

Thread.

debtcollective.org

For less than $100,000, we bought over $3 million of debt — essentially 3 cents on the dollar — or 97% off. Our debts are sold on a market while we struggle to pay. So in an act of solidarity, we abolished this illegitimate debt for 20,000+ mostly Mississippians and Floridians.

We believe the entire prison industrial complex needs to be abolished—and debt for our own incarceration is wrong. This will take more than us buying debt. We'll have to organize. That's why TODAY we're launching an ABOLISH BAIL DEBT TOOL for Californians.

essence.com/news/nonprofit…

essence.com/news/nonprofit…

This is truly good news—and only possible because of our debtors union. When debtors band together, we can demand and win discharges of debts. The absolute BEST WAY you can be helpful is by joining our union and/or contributing whatever you can.

Join!

debtcollective.org/debt-union

Join!

debtcollective.org/debt-union

• • •

Missing some Tweet in this thread? You can try to

force a refresh