A Stablecoin Overview Thread

Looking to spread your risk?

In this thread, I will show you places that you can gain passive income with APY ranging from:

-10% to 160% from stablecoins only.

I'll look at both decentralized and centralized exchanges.

THREAD

1/

Looking to spread your risk?

In this thread, I will show you places that you can gain passive income with APY ranging from:

-10% to 160% from stablecoins only.

I'll look at both decentralized and centralized exchanges.

THREAD

1/

1. Anchor Protocol

19.5% APY on $UST --> read my guide here:

You may increase your APY to 40-60% by using:

-Mirror Protocol --> read my guide here:

-Spectrum Protocol --> read my guide here:

/2

19.5% APY on $UST --> read my guide here:

https://twitter.com/Route2FI/status/1442835869879181312?s=20

You may increase your APY to 40-60% by using:

-Mirror Protocol --> read my guide here:

https://twitter.com/Route2FI/status/1454065822515830787?s=20

-Spectrum Protocol --> read my guide here:

https://twitter.com/Route2FI/status/1454519452888969220?s=20

/2

Or if you're a degen you can use Anchor Protocol with leverage and get 160% on stablecoins!

This DeFi hack is probably my most popular thread, so check out how you can do it here:

I've covered Anchor Protocol in these 4 threads, so let's move on.

3/

This DeFi hack is probably my most popular thread, so check out how you can do it here:

https://twitter.com/Route2FI/status/1450771403490447363?s=20

I've covered Anchor Protocol in these 4 threads, so let's move on.

3/

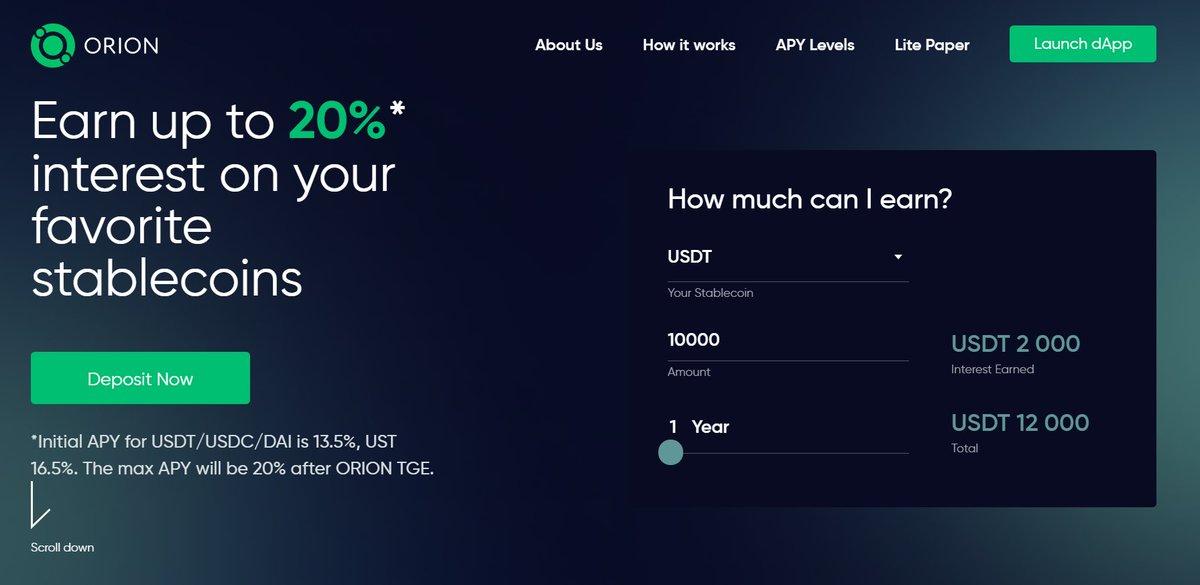

2. Orion Money

On Orion you can deposit:

$USDT

$USDC

$DAI

$BUSD

$UST

and recieve from 13.5% - 20% APY.

The APY will be higher if you choose to hold and get paid in the $ORION token.

If you want to get paid in your native token and hold no $ORION the APY is always 13,5%.

4/

On Orion you can deposit:

$USDT

$USDC

$DAI

$BUSD

$UST

and recieve from 13.5% - 20% APY.

The APY will be higher if you choose to hold and get paid in the $ORION token.

If you want to get paid in your native token and hold no $ORION the APY is always 13,5%.

4/

3. Kash DeFi

Kash is a DeFi product that makes it easier for people to save, invest and spend with decentralized cash.

You get 18% APY on your $UST deposit.

They also have a VISA card, and in some countries they let you insure up to $100,000.

/5

Kash is a DeFi product that makes it easier for people to save, invest and spend with decentralized cash.

You get 18% APY on your $UST deposit.

They also have a VISA card, and in some countries they let you insure up to $100,000.

/5

4. Celsius Network

For those of you that prefer centralized exchanges, Celsius offers 8.88% - 11.21% APY (depending on if you want to be paid in your native token or in $CEL).

They have mostly every stablecoins that exists.

Celsius has also very good rates on borrowing.

/6

For those of you that prefer centralized exchanges, Celsius offers 8.88% - 11.21% APY (depending on if you want to be paid in your native token or in $CEL).

They have mostly every stablecoins that exists.

Celsius has also very good rates on borrowing.

/6

5. Venus Protocol

Venus is a decentralized marketplace for lenders and borrowers built on the Binance Smart Chain.

You can get 9-12% APY on $USDT, $USDC and $BUSD.

Their borrow rates are really low too!

/7

Venus is a decentralized marketplace for lenders and borrowers built on the Binance Smart Chain.

You can get 9-12% APY on $USDT, $USDC and $BUSD.

Their borrow rates are really low too!

/7

6. YieldYak

YY uses leveraged farming.

This is considered a low-risk leverage strategy because both lending and borrowing use the same asset.

31% APY on $USDT.e

29% APY on $DAI.e

24% APY on $USDC.e

Really easy to use this platform.

It's on the Avalanche network ($AVAX).

8/

YY uses leveraged farming.

This is considered a low-risk leverage strategy because both lending and borrowing use the same asset.

31% APY on $USDT.e

29% APY on $DAI.e

24% APY on $USDC.e

Really easy to use this platform.

It's on the Avalanche network ($AVAX).

8/

7. Kava

Kava is a DeFi platform focused on making finance openly accessible to anyone, anywhere in the world.

You can lend out your $BUSD for 22% APY + get an additional 36% APY paid out in $HARD (which is Kava's Lend token).

/9

Kava is a DeFi platform focused on making finance openly accessible to anyone, anywhere in the world.

You can lend out your $BUSD for 22% APY + get an additional 36% APY paid out in $HARD (which is Kava's Lend token).

/9

8. Tokemak

Tokemak allows you to deposit single assets like USDC and let them do the yield farming for you without worrying about impermanent loss.

Earnings are paid out in $TOKE so that the underlying assets can continue to be put to work.

26% APR --> 29.5% APY.

/10

Tokemak allows you to deposit single assets like USDC and let them do the yield farming for you without worrying about impermanent loss.

Earnings are paid out in $TOKE so that the underlying assets can continue to be put to work.

26% APR --> 29.5% APY.

/10

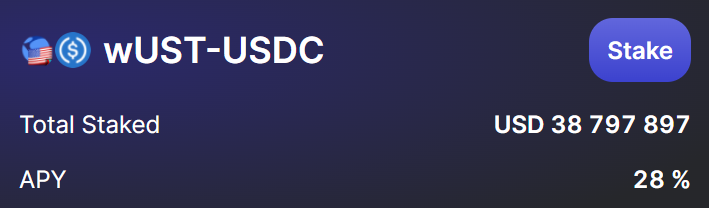

9. Saber

Saber is the leading cross-chain stablecoin and wrapped assets exchange on Solana.

One example I found is 28% APY on staking wUST-$USDC.

However, they have lots of different stablecoin-pairs.

An overall great platform!

/11

Saber is the leading cross-chain stablecoin and wrapped assets exchange on Solana.

One example I found is 28% APY on staking wUST-$USDC.

However, they have lots of different stablecoin-pairs.

An overall great platform!

/11

10. Orca

A DEX with nearly zero fees. Also on @solana.

You may provide liquidity to a trading pool and get 18% APY on $USDC/$USDT as an example.

Lots of pools here, and I am sure you'll find something you like.

/12

A DEX with nearly zero fees. Also on @solana.

You may provide liquidity to a trading pool and get 18% APY on $USDC/$USDT as an example.

Lots of pools here, and I am sure you'll find something you like.

/12

There are tons of other places you can gain yield on stablecoins, but I've mentioned the ones I like the most in this thread.

You may have noticed that I haven't mentioned $ETH platforms. I love $ETH, but the gas prices now are too high for small coiners.

/13

You may have noticed that I haven't mentioned $ETH platforms. I love $ETH, but the gas prices now are too high for small coiners.

/13

Other places you can gain yield on your stablecoins includes:

1. @VesperFi

2. @investvoyager

3. @BlockFi

4. @YouHodler

5. @SushiSwap

6. @AaveAave

7. @compoundfinance

8. @BalancerLabs

9. @CurveFinance

10. @iearnfinance

11. @MIM_Spell

12. @traderjoe_xyz

+++

/14

1. @VesperFi

2. @investvoyager

3. @BlockFi

4. @YouHodler

5. @SushiSwap

6. @AaveAave

7. @compoundfinance

8. @BalancerLabs

9. @CurveFinance

10. @iearnfinance

11. @MIM_Spell

12. @traderjoe_xyz

+++

/14

Some personal thoughts about the products that I've mentioned:

I use @anchor_protocol and @kashdefi daily as my main go-to savings banks.

If you have ERC-20 tokens and/or don't fully trust $UST, take a look at @orion_money.

/15

I use @anchor_protocol and @kashdefi daily as my main go-to savings banks.

If you have ERC-20 tokens and/or don't fully trust $UST, take a look at @orion_money.

/15

If you rather prefer a centralized exchange I think @CelsiusNetwork is a great option.

I love the concept of $TOKE (@TokenReactor), and I probably have to do a thread about it soon, because what they do seems rather unique. DeFi 2.0-vibes!

/16

I love the concept of $TOKE (@TokenReactor), and I probably have to do a thread about it soon, because what they do seems rather unique. DeFi 2.0-vibes!

/16

@kava_platform and @yieldyak_ will be the next platforms I'll use to spread some risk by diversifying some of my $UST that I have on Anchor and in Kash DeFi.

I haven't personally used @VenusProtocol, @orca_so or @Saber_HQ, but they seems like great options for sure!

/17

I haven't personally used @VenusProtocol, @orca_so or @Saber_HQ, but they seems like great options for sure!

/17

There are too many platforms to cover them all, but I hope this thread got you an idea about where to start.

I would love it if you could retweet and bookmark this thread so that we all survive in the next bear market!

WAGMI

/18

I would love it if you could retweet and bookmark this thread so that we all survive in the next bear market!

WAGMI

/18

I would also love it if you could share your favorite places to get APY on stablecoins.

Maybe the platform you mention is an undervalued gem that more people need to be aware of?

/19

Maybe the platform you mention is an undervalued gem that more people need to be aware of?

/19

There’s a lot of strategies you can use to increase your yield in DeFi.

Check out my newsletter where you'll learn more about this.

I write about DeFi, financial freedom, and crypto in general.

It's ofc completely free 👇

getrevue.co/profile/route2…

/20

Check out my newsletter where you'll learn more about this.

I write about DeFi, financial freedom, and crypto in general.

It's ofc completely free 👇

getrevue.co/profile/route2…

/20

If you could help me spread the word by retweeting the first tweet I would be forever grateful 🙏

/21

https://twitter.com/Route2FI/status/1455845816627834883?s=20

/21

Want to earn money from both crypto and Twitter?

My book helps you get 1,000+ followers every month and shows you how to earn $1,000's

The method I show you in my book was how I went from 2K followers to 71K in 1 year

187 x ⭐⭐⭐⭐⭐

30% off

👇

gumroad.com/l/YeeYF/3030

/22

My book helps you get 1,000+ followers every month and shows you how to earn $1,000's

The method I show you in my book was how I went from 2K followers to 71K in 1 year

187 x ⭐⭐⭐⭐⭐

30% off

👇

gumroad.com/l/YeeYF/3030

/22

• • •

Missing some Tweet in this thread? You can try to

force a refresh