I want to give you a breakdown of one of the most bullish plays in DeFi 2.0:

$TIME

Too many DeFi people still think the concept is hard to understand.

Instead of telling them NGMI, we should strive to get everybody on board.

It's $TIME (🎩,🎩) for a THREAD

/1

$TIME

Too many DeFi people still think the concept is hard to understand.

Instead of telling them NGMI, we should strive to get everybody on board.

It's $TIME (🎩,🎩) for a THREAD

/1

$TIME is a fork of the successful project @OlympusDAO ($OHM).

$TIME is on the Avalance network ($AVAX) founded by the chad, @danielesesta and his team.

Right now, you get 71,208% APY for staking $TIME.

Too good to be true?

Let's dig in!

2/

$TIME is on the Avalance network ($AVAX) founded by the chad, @danielesesta and his team.

Right now, you get 71,208% APY for staking $TIME.

Too good to be true?

Let's dig in!

2/

Okey, but let's take one step back.

Why was $TIME created in the first place?

Dollar-pegged stablecoins have become an essential part of crypto due to their stability.

But the dollar is controlled by the US gov. and the FED.

/3

Why was $TIME created in the first place?

Dollar-pegged stablecoins have become an essential part of crypto due to their stability.

But the dollar is controlled by the US gov. and the FED.

/3

This means a depreciation of USD also means a depreciation of these stablecoins.

The $TIME token aims to solve this by creating a non-pegged stablecoin.

Instead of being backed by $USD, the TIME token is instead backed by several assets ($MIM, $TIME-AVAX LP tokens ++).

/4

The $TIME token aims to solve this by creating a non-pegged stablecoin.

Instead of being backed by $USD, the TIME token is instead backed by several assets ($MIM, $TIME-AVAX LP tokens ++).

/4

This means that 1 $TIME has an intrinsic value that it can't fall below.

Right now the intrinsic value of $TIME is $1,138.

But the price is $8,350 which means it's trading at a 7.3x premium.

And why wouldn't the price be high if you can stake for 71K % APY?

/5

Right now the intrinsic value of $TIME is $1,138.

But the price is $8,350 which means it's trading at a 7.3x premium.

And why wouldn't the price be high if you can stake for 71K % APY?

/5

Most cryptocurrencies have either an infinite supply cap, or a fixed supply.

Rebase tokens (like $TIME) are adjusted by an algorithm, either expanding or contracting the supply.

So if #BTC is digital gold, $TIME is algorithmic gold.

/6

Rebase tokens (like $TIME) are adjusted by an algorithm, either expanding or contracting the supply.

So if #BTC is digital gold, $TIME is algorithmic gold.

/6

On Wonderland you can do 3 things:

1. Stake

2. Bond

3. Sell

Staking and minting are considered beneficial to the protocol, while selling is considered detrimental.

The best scenario is that we stake --> APY goes up

The worst scenario is when we sell --> APY goes down

/7

1. Stake

2. Bond

3. Sell

Staking and minting are considered beneficial to the protocol, while selling is considered detrimental.

The best scenario is that we stake --> APY goes up

The worst scenario is when we sell --> APY goes down

/7

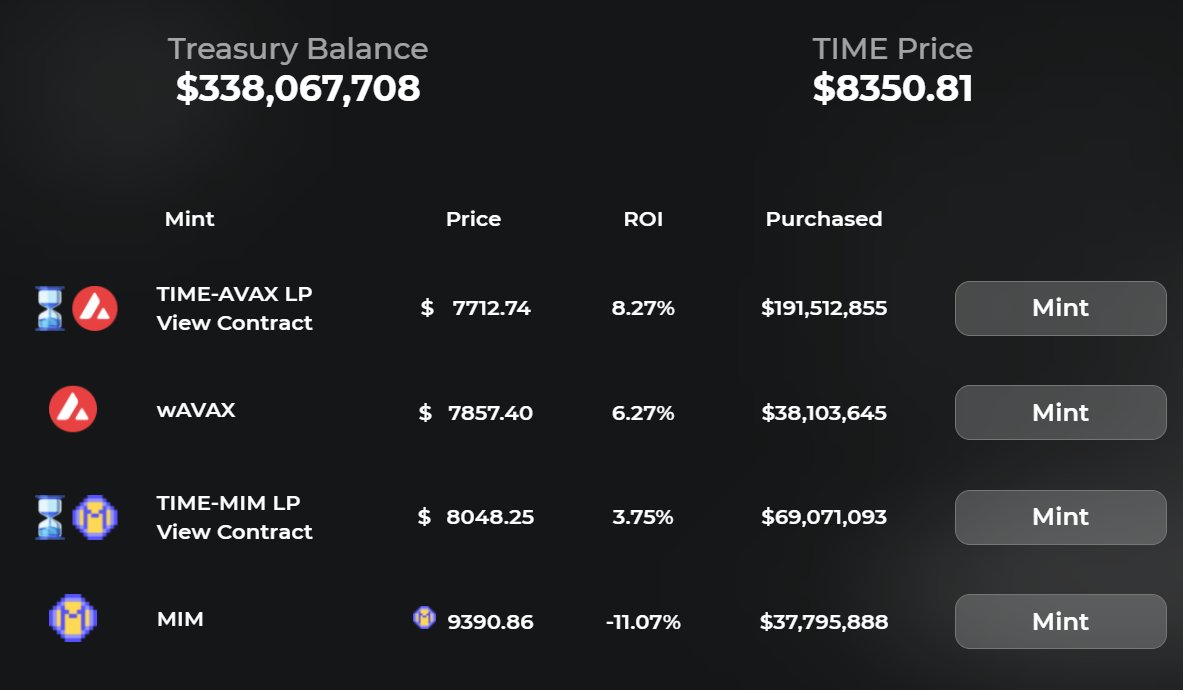

The treasury balance of Wonderland increases when people purchase bonds

If the treasury increases, the intrinsic value ($1,138) goes up

If the treasury decreases, the intrinsic value goes down

You stake if the ROI for staking > mint

You bond if the ROI for staking < mint

/8

If the treasury increases, the intrinsic value ($1,138) goes up

If the treasury decreases, the intrinsic value goes down

You stake if the ROI for staking > mint

You bond if the ROI for staking < mint

/8

If the market price of $TIME spikes up, the algorithm mints more $TIME.

If the market price of $TIME spikes down, the algorithm burns $TIME.

The incentives in this system are designed to make the protocol grow.

$TIME can't be evaluated by looking at market cap & charts.

9/

If the market price of $TIME spikes down, the algorithm burns $TIME.

The incentives in this system are designed to make the protocol grow.

$TIME can't be evaluated by looking at market cap & charts.

9/

Here is what people don't understand and why people think $TIME and @Wonderland_fi is a ponzi:

The APY for staking is 71,200%.

That would normally mean that if you had $1,000 today, you would have $712,000 in 1 year.

But that's not the case for $TIME.

Let me explain...

/10

The APY for staking is 71,200%.

That would normally mean that if you had $1,000 today, you would have $712,000 in 1 year.

But that's not the case for $TIME.

Let me explain...

/10

The APY is only telling you how much your $TIME balance will increase based on the minting schedule.

So if you buy 1 $TIME today you might have 712 $TIME tokens in 1 year, but there would probably also be many more $TIME tokens in circulation.

/11

So if you buy 1 $TIME today you might have 712 $TIME tokens in 1 year, but there would probably also be many more $TIME tokens in circulation.

/11

If the price of an $TIME continues to rise, you would see crazy returns.

And even if the price stays flat or drops some you’d see pretty great gains, since the additional number of $TIME you’re receiving may outpace the decreasing price.

/12

And even if the price stays flat or drops some you’d see pretty great gains, since the additional number of $TIME you’re receiving may outpace the decreasing price.

/12

Let's say you buy 1 TIME for $8,350 now and the market decides that in 1 year time, the intrinsic value of TIME will be $10.

Assuming a daily compound interest rate of 2%, your balance would grow to about 1377 TIME by the end of the year, which is worth around $13,770.

/13

Assuming a daily compound interest rate of 2%, your balance would grow to about 1377 TIME by the end of the year, which is worth around $13,770.

/13

This is still a $5,420 profit (65% gain).

So the reason you are paying a 7.3x premium for $TIME now, is that you do it in exchange for a long-term benefit.

/14

So the reason you are paying a 7.3x premium for $TIME now, is that you do it in exchange for a long-term benefit.

/14

What will be the intrinsic value in 1 year? We don't know yet.

This is game theory and this is why I wanted to be a part of it.

Massive upside, but limited downside IMO.

How can the staking rewards have 71K % APY?

/14

This is game theory and this is why I wanted to be a part of it.

Massive upside, but limited downside IMO.

How can the staking rewards have 71K % APY?

/14

If the protocol fails to achieve a certain number of bond sales (depending on the number of $TIME staked), the APY of 71K% cannot be guaranteed.

In fact, you will see that the APY fluctuates quite a bit.

I remember the APY was around 30K% APY a month ago.

/15

In fact, you will see that the APY fluctuates quite a bit.

I remember the APY was around 30K% APY a month ago.

/15

You've learned the basics, it's $TIME to learn staking:

1. Buy $AVAX

2. Connect your MM to Trader Joe

3. Buy $TIME with your $AVAX

4. Go to app.wonderland.money/stake#/stake

5. Stake your $TIME --> get MEMO

My brother @takegreenpill has a step by step🧵:

/16

1. Buy $AVAX

2. Connect your MM to Trader Joe

3. Buy $TIME with your $AVAX

4. Go to app.wonderland.money/stake#/stake

5. Stake your $TIME --> get MEMO

My brother @takegreenpill has a step by step🧵:

https://twitter.com/takegreenpill/status/1443083272767119364

/16

But as always it gets crazier in DeFi.

You're not happy with 71,000% APY, are you anon?

You may actually use leverage to your position to get more $TIME = more $TIME staked = potentially higher rewards (or loss).

How?

1. Go to Borrow on Abracadabra

/17

You're not happy with 71,000% APY, are you anon?

You may actually use leverage to your position to get more $TIME = more $TIME staked = potentially higher rewards (or loss).

How?

1. Go to Borrow on Abracadabra

/17

2. Go to "Wrap"

3. Wrap your MEMO into wMEMO

4. Change your wMEMO to the stablecoin $MIM

5. Use your $MIM to buy $TIME

/18

3. Wrap your MEMO into wMEMO

4. Change your wMEMO to the stablecoin $MIM

5. Use your $MIM to buy $TIME

/18

Choose "Change leverage" and choose your risk level.

You may loop it 10x and you can choose your liquidation %.

Be careful. This may be a huge extra risk!

NFA. DYOR.

Learn more about ut here:

docs.abracadabra.money/intro/leverage…

/19

You may loop it 10x and you can choose your liquidation %.

Be careful. This may be a huge extra risk!

NFA. DYOR.

Learn more about ut here:

docs.abracadabra.money/intro/leverage…

/19

Risks:

If the whole community lost their trust in $TIME there would only be the intrinsic value left.

My main concern is therefore a bank run (everybody gets out at the same time).

Other than that I feel this is huge gameplay and too big to sleep on.

/20

If the whole community lost their trust in $TIME there would only be the intrinsic value left.

My main concern is therefore a bank run (everybody gets out at the same time).

Other than that I feel this is huge gameplay and too big to sleep on.

/20

This is not financial advice, but if you choose to try $TIME:

Start with a small amount in order to feel more comfortable.

See how it works.

If it feels okay, maybe buy some more.

If not, just get out.

Yes, $TIME may be risky.

But so is staying in fiat.

21/

Start with a small amount in order to feel more comfortable.

See how it works.

If it feels okay, maybe buy some more.

If not, just get out.

Yes, $TIME may be risky.

But so is staying in fiat.

21/

Staking $TIME is a huge asymmetrical bet, and every crypto portfolio should have at least a small exposure to the magic that happens in Wonderland.

Btw, here's a staking/minting calculator you can use:

docs.google.com/spreadsheets/d…

/22

Btw, here's a staking/minting calculator you can use:

docs.google.com/spreadsheets/d…

/22

That was it.

I hope you learned something new, and if you did I would love it if you shared this thread with your friends.

I also have a free newsletter that focuses on DeFi, crypto, and financial freedom.

It's 100% free to sign up:

/23

getrevue.co/profile/route2…

I hope you learned something new, and if you did I would love it if you shared this thread with your friends.

I also have a free newsletter that focuses on DeFi, crypto, and financial freedom.

It's 100% free to sign up:

/23

getrevue.co/profile/route2…

I also recommend you to follow these legends to learn more about DeFi:

@danielesesta

@TraderDefi

@blocmatesdotcom

@FarmerBrownDeFi

@takegreenpill

@0xUnihax0r

@scupytrooples

@archon_0x

@0x_Sats

@westonnelson

@GuttaCap

@PastryEth

@CroissantEth

@AltcoinGordon

/24

@danielesesta

@TraderDefi

@blocmatesdotcom

@FarmerBrownDeFi

@takegreenpill

@0xUnihax0r

@scupytrooples

@archon_0x

@0x_Sats

@westonnelson

@GuttaCap

@PastryEth

@CroissantEth

@AltcoinGordon

/24

If you could help me spread the word by retweeting the first tweet I would be forever grateful 🙏

/25

https://twitter.com/Route2FI/status/1456275514889433091?s=20

/25

Are you dreaming of an escape from the 9-5?

Do you want to reach financial independence within 5 years?

Learn how I did it at 33 years old and how you can too in my book.

30% off with this link 👇

DM for crypto.

gumroad.com/l/SvwIc/release

/26

Do you want to reach financial independence within 5 years?

Learn how I did it at 33 years old and how you can too in my book.

30% off with this link 👇

DM for crypto.

gumroad.com/l/SvwIc/release

/26

• • •

Missing some Tweet in this thread? You can try to

force a refresh