Founders: Uncertainty is expensive. Build a plan for your journey to Unicorn Land that focuses on increasing your probability of success - solving for unknowns and demonstrating capability.

Let's dig in

#startups #Entrepreneurship #VC

Let's dig in

#startups #Entrepreneurship #VC

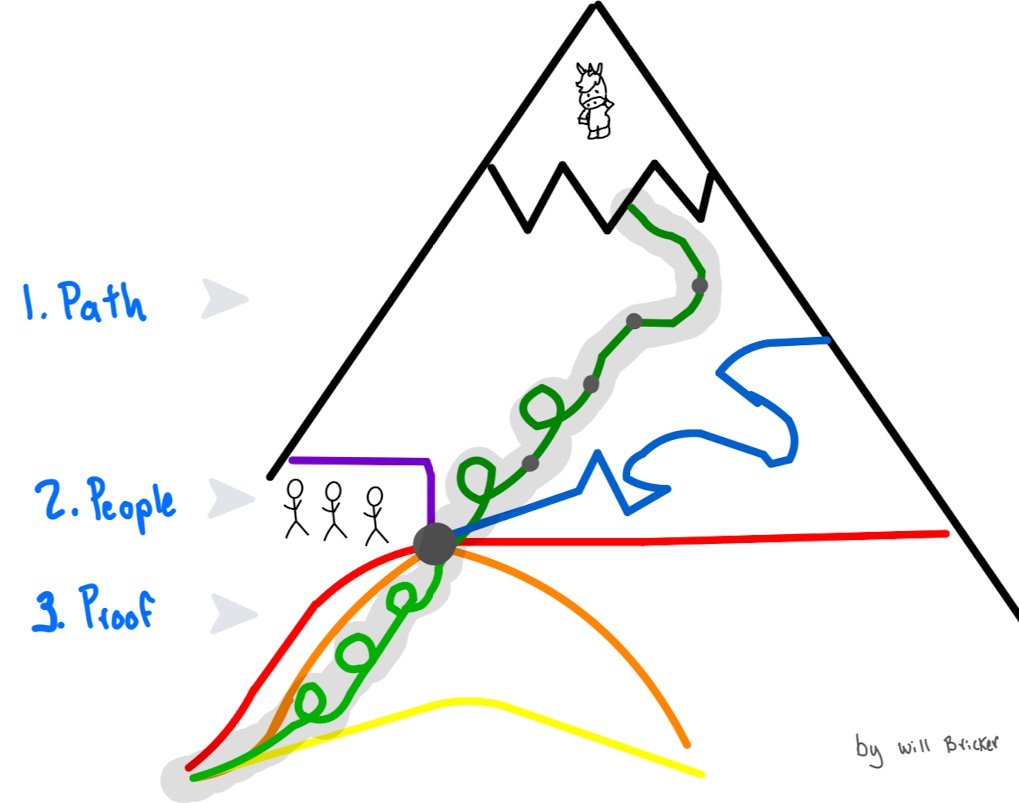

IMO, a good plan consists of 3 pieces - your path, people, and proof. Each piece should be designed to maximize the probability that your journey will be successful. Here is a picture that 1) is amazing 2) tells you everything you need to know. But in case you're a words person..

A good path consists of a combination of product/customer segment/distribution model that is specifically tailored to the problem you are solving.

A good path also contains milestones that balance value and achievability.

A good path also contains milestones that balance value and achievability.

Valuable things are achievements that provide 1) evidence that your plan is the right one 2) a foundation to build upon for your next achievement. EG. By doing X, I prove I can probably do Y, and you should believe I can do Z next.

Achievable things are interim steps that 1) have a who what and when 2) can be plausibly accomplished given the resources and time you have to achieve them.

I'm not the biggest fan of people, but even I agree that they are the key to your journey's success - especially since at the early stage, they are a massive part of what you are relying on to make it Unicorn Land.

Good people provide values, abilities, and skills that are 1)complimentary to what has already been assembled 2) relevant to the problem you are solving.

Good people are also more than just people who know how to do helpful stuff right now. they are people who 1) you enjoy working with 2) balance determination and adaptability to help you when your plan inevitably changes

Good proof is doing the work that eliminates as much uncertainty as possible. It's taking a theory and doing the research and testing to make sure it's right.

That means getting as much of an MVP of a product as possible - to prove that you can build something and can translate customer pain into solutions.

That also means getting as much of an MVP of acquisition up and running as possible - to prove that people want the thing you are building, and you have some reasonable way of getting it to them.

End.

Thanks to the handful of you who have made it this far. Feedback and questions are always welcome!

Thanks to the handful of you who have made it this far. Feedback and questions are always welcome!

• • •

Missing some Tweet in this thread? You can try to

force a refresh