First some highlights

GMV 🆙 30%

items sold 🆙 26%

Managed network penetration 🆙 22 PP

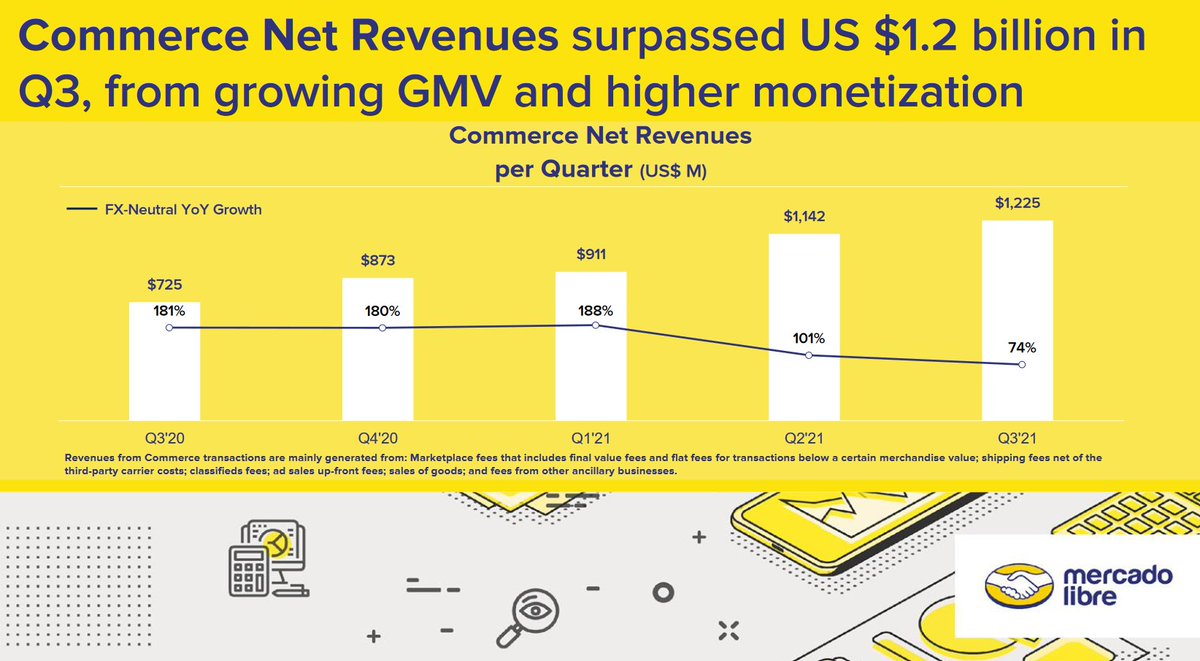

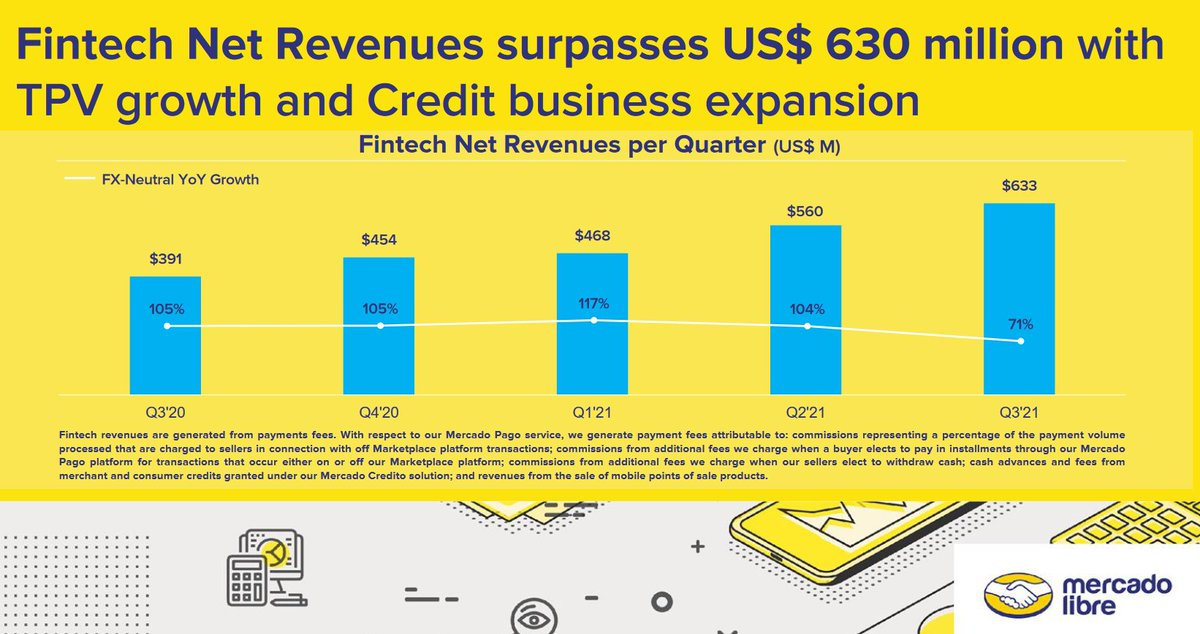

Revenues 🆙73%

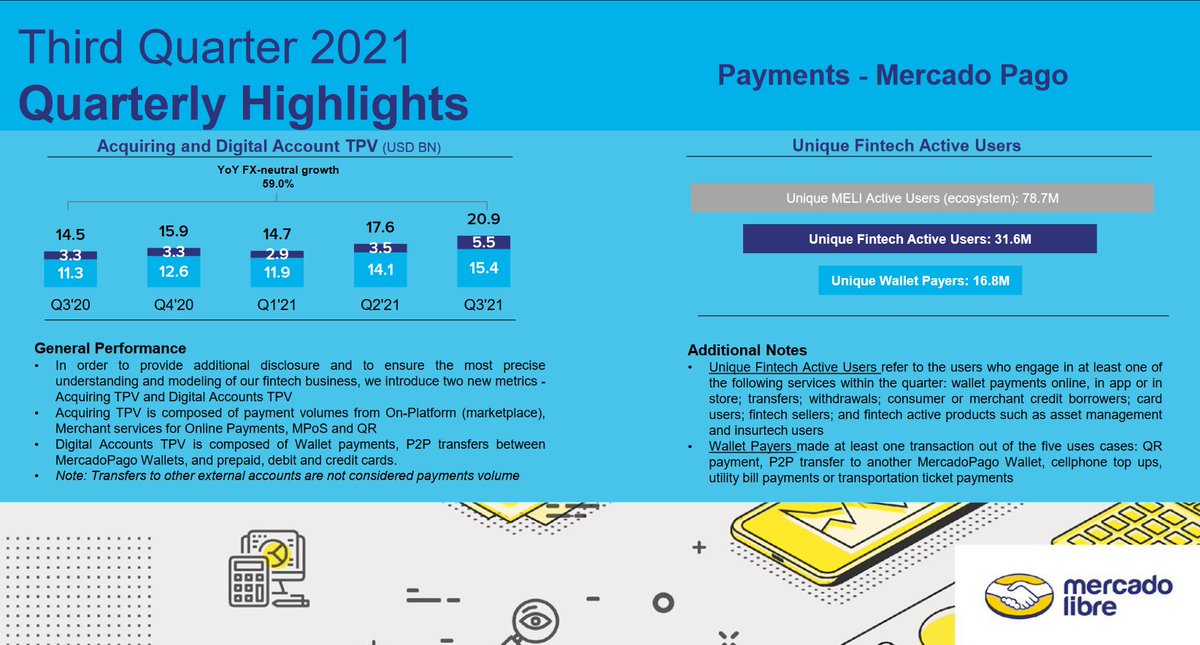

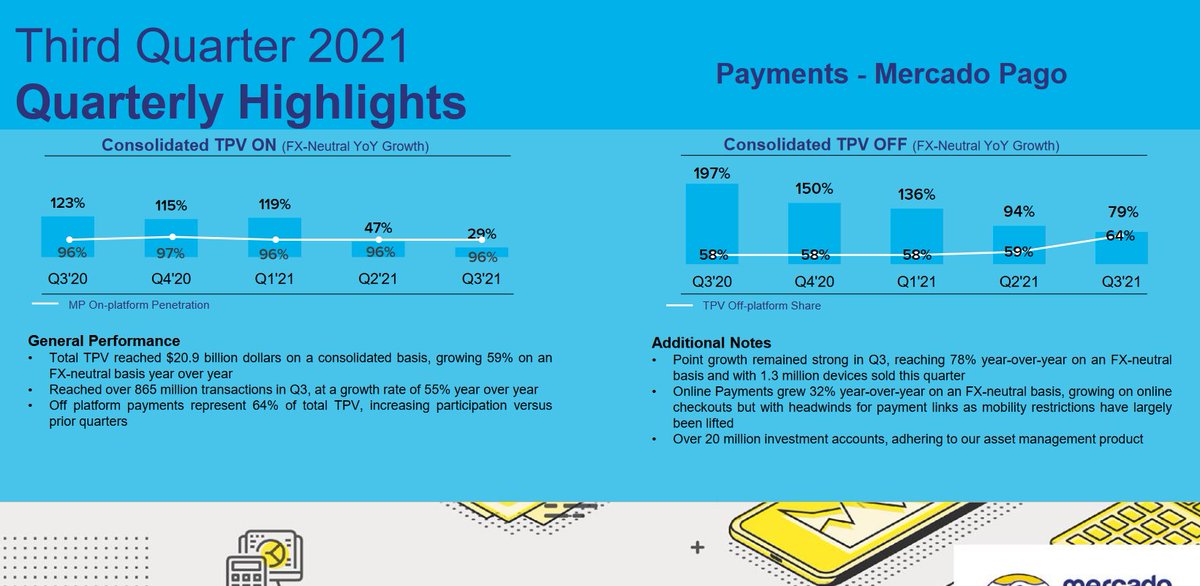

TPV 🆙59%

TPV off 🆙79%

Credit portfolio 🆙296%

GMV 🆙 30%

items sold 🆙 26%

Managed network penetration 🆙 22 PP

Revenues 🆙73%

TPV 🆙59%

TPV off 🆙79%

Credit portfolio 🆙296%

What I really liked here is the comment about MELIs platform being "the main source of income for over 900 thousand Famlies", stating how relevant $MELI is for the LATAM region.

$MELI Libre

All key metrics are up, compared to strong Covid Q3 20.

The only exception is items sold in Argentina which is flat with -1%.

Great growth even with aggressive expansion of players like $SE

All key metrics are up, compared to strong Covid Q3 20.

The only exception is items sold in Argentina which is flat with -1%.

Great growth even with aggressive expansion of players like $SE

$MELI Envios

Managed Network Penetration continuing to skyrocket, already up to 86% now. MELI continues to cement its network with the best logistics network, delivering over 80% of volume in <48 hours in the challenging LATAM region.

Fulfillment up to 37% now( Mexico 65%! )

Managed Network Penetration continuing to skyrocket, already up to 86% now. MELI continues to cement its network with the best logistics network, delivering over 80% of volume in <48 hours in the challenging LATAM region.

Fulfillment up to 37% now( Mexico 65%! )

$MELI Pago

New metrics: Acquiring TPV and Digital Accounts TPV disclosed, with a strong 59% YoY Growth

New metrics: Acquiring TPV and Digital Accounts TPV disclosed, with a strong 59% YoY Growth

We see TPV off outpacing TPV on by a lot (79% vs 29% growth).

With Payment Volume Off/Outside the ecosystem growing much faster we once again see how $MELI is becoming the Paypal of LATAM.

With Payment Volume Off/Outside the ecosystem growing much faster we once again see how $MELI is becoming the Paypal of LATAM.

Revenue continues the strong growth, but its slowing from quarter to quarter. We can't forget that we are comparing to extreme growth from the Covid boost though. Very impressive in my opinion.

Commerce and Fintech growth seems to correlate strongly, showing the ecosystem effect and the lock in.

Gross profit margin up slightly mainly driven by improvements in overall collection fees. I really like this slide, very details how they are investing their money. 1,9% margin reduction due to expansion of the managed network. Great investment.

Ebit expanding 1.2 PP, dragged down by 4 PP due to higher levels of bad debt. Something to keep an eye on in the future.

Net Income up 4x or 3.8PP, but mainly driven by favorable foreign exchange rates and a one off effect (1.4% and 1.7% respectively). Great to see this level of easy to diggest transparency)

To end they also gave us a great summary of some key figures. Some other IRs could take this as an example for their Reporting.

To conclude, I love where MELI is going. Continued high growth in Commerce, with a focus on expanding the logistics and driving the fintech adoption OFF ecosystem will further cement their leadership in LATAM eCom. $MELI is moving up in my conviction!

I hope you liked this, consider liking, RT and following.

Tagging some #fintwit people who might be interested

@FromValue @Couch_Investor @MaxTheComrade @BuyandHoldd @punchcardinvest @Brian_Stoffel_ @BrianFeroldi

Tagging some #fintwit people who might be interested

@FromValue @Couch_Investor @MaxTheComrade @BuyandHoldd @punchcardinvest @Brian_Stoffel_ @BrianFeroldi

• • •

Missing some Tweet in this thread? You can try to

force a refresh