@NexusProtocol

1/ What is Nexus ?

- yield optimizer vault built on @anchor_protocol in terra ecoystem

- 65m AUM in a few days

- vaults: Anchor vaults

coming soon : delta-neutral mirror & EthNexus vaults

1/ What is Nexus ?

- yield optimizer vault built on @anchor_protocol in terra ecoystem

- 65m AUM in a few days

- vaults: Anchor vaults

coming soon : delta-neutral mirror & EthNexus vaults

2/ How to bridge to Nexus?

1. DeFi: Cross-chain DEX: app.rango.exchange/?ref=HGlsDr

2. KUCOIN/GATE: Buy $UST --> Terra Network

3. Binance: buy $LUNA --> Terra network -> swap $UST

4. BSC: Buy $UST on Nerve.fi --> bridge: bridge.terra.money

5. from @anchor_protocol

1. DeFi: Cross-chain DEX: app.rango.exchange/?ref=HGlsDr

2. KUCOIN/GATE: Buy $UST --> Terra Network

3. Binance: buy $LUNA --> Terra network -> swap $UST

4. BSC: Buy $UST on Nerve.fi --> bridge: bridge.terra.money

5. from @anchor_protocol

3/ Nexus anchor vaults

- Deposit bLUNA or bETH

- 3 modes: Optimal mode(99% Max LTV),Safe mode(80% Max LTV), emergency mode(50% Max LTV)

- Deposit bLUNA or bETH

- 3 modes: Optimal mode(99% Max LTV),Safe mode(80% Max LTV), emergency mode(50% Max LTV)

4/ Safety is #1 Priority

- Optimal mode 99% LTV: front-run anchor's price data (every 15 secs update vs anchor's: 30secs)

- Safe mode(50% LTV) if price oracle fails

- Optimal mode 99% LTV: front-run anchor's price data (every 15 secs update vs anchor's: 30secs)

- Safe mode(50% LTV) if price oracle fails

5/ Delta Neutral Vault (Upcoming)

- automates @mirror_protocol Delta neutral strategy

- positioning based on the highest weighted APRs

- automated mirror mint LTV optimization

- automated $MIR rewards claiming

- automates @mirror_protocol Delta neutral strategy

- positioning based on the highest weighted APRs

- automated mirror mint LTV optimization

- automated $MIR rewards claiming

6/ EthNexus (Upcoming) I

- allows native ETH from to be deposited on nexus webapp directly using wallets like metamask

- Nexus converts ETH to bETH to generate yield

- TVL of @anchor_protocol expected to go up

- potentially working with other ecosystems eg. Solana

- allows native ETH from to be deposited on nexus webapp directly using wallets like metamask

- Nexus converts ETH to bETH to generate yield

- TVL of @anchor_protocol expected to go up

- potentially working with other ecosystems eg. Solana

7/ EthNexus (Upcoming) II

- higher yields than other ETH native yield solutions

- easier for ETH holders to reap the full benefit of bETH--> increase number of migration to bETH from ETH

- leads to higher TVL on @anchor_protocol -->more borrow --> more value on ANC token

- higher yields than other ETH native yield solutions

- easier for ETH holders to reap the full benefit of bETH--> increase number of migration to bETH from ETH

- leads to higher TVL on @anchor_protocol -->more borrow --> more value on ANC token

8/ n Assets

-nAsset tokens: assets deposited in Nexus Vaults receives nAsset tokens. Holders of nAssets entitled to the vault's yield.

- Pool arbitrage: all nAssets generate $PSI rewards, $PSI goes back to nAsset-PSI LP --> imbalance.. abritrage

- flywheel effect on $PSI

-nAsset tokens: assets deposited in Nexus Vaults receives nAsset tokens. Holders of nAssets entitled to the vault's yield.

- Pool arbitrage: all nAssets generate $PSI rewards, $PSI goes back to nAsset-PSI LP --> imbalance.. abritrage

- flywheel effect on $PSI

9/ $PSI buy backs

- Nexus protocol has the highest buyback in Terra ecosystem. current: 8.5%, optimal mode: 10% of AUM

-@anchor_protocol : 0.3% of AUM

-@pylon_protocol: 4% of AUM

- Nexus protocol has the highest buyback in Terra ecosystem. current: 8.5%, optimal mode: 10% of AUM

-@anchor_protocol : 0.3% of AUM

-@pylon_protocol: 4% of AUM

10/ $PSI use cases

- Governance token: key decision and entitlements

- Staking token: earn share of protocol fees

- value accrual: yields collected be used for $PSI buybacks

- Governance token: key decision and entitlements

- Staking token: earn share of protocol fees

- value accrual: yields collected be used for $PSI buybacks

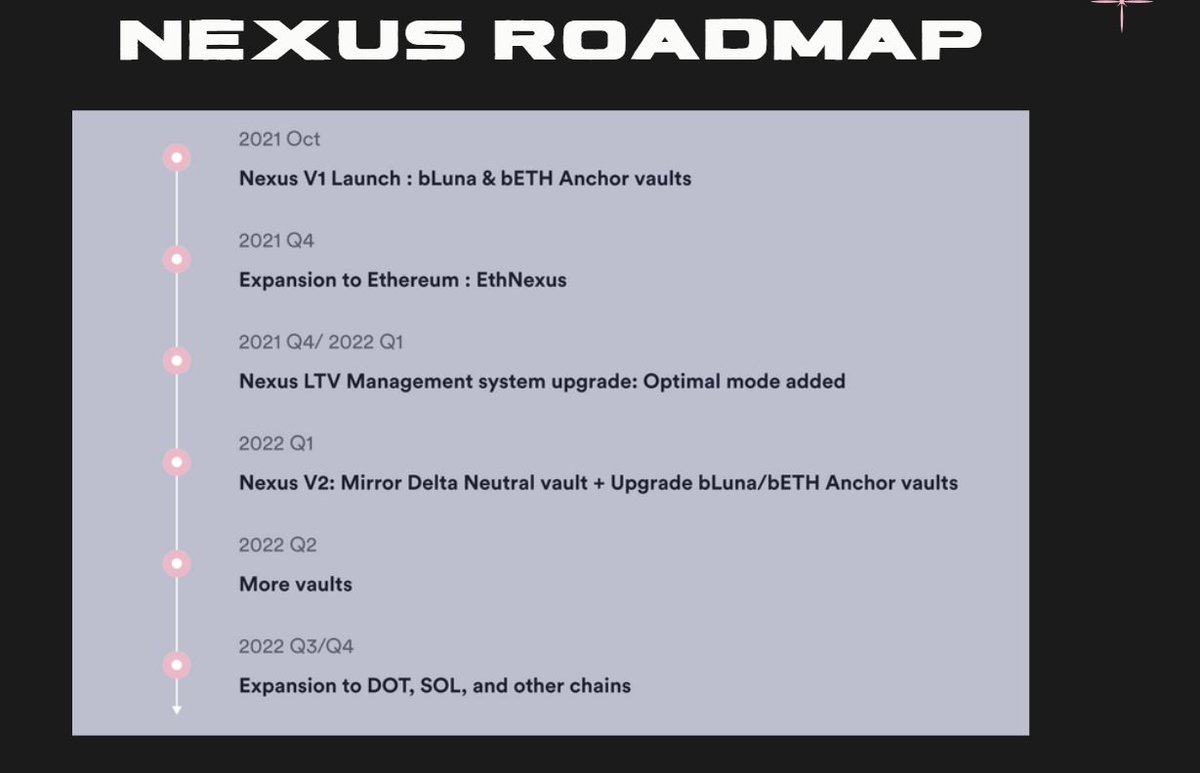

12/ why Nexus?

- cross-chain vaults for other ecosystems when IBC opens up

- more vaults -->more revenue--$PSI buying pressure

- program to attract talents for best yield optimization strategy

- small market cap compared to @iearnfinance and @PopsicleFinance

- cross-chain vaults for other ecosystems when IBC opens up

- more vaults -->more revenue--$PSI buying pressure

- program to attract talents for best yield optimization strategy

- small market cap compared to @iearnfinance and @PopsicleFinance

14/ Strategic Partners

@arringtonXRPcap @BlockTower @DeFianceCapital @SkyVisionCap @GSR_io @rarestonecap

@arringtonXRPcap @BlockTower @DeFianceCapital @SkyVisionCap @GSR_io @rarestonecap

15/

Conclusion

- 21mil TVL in less than 24 hours

- huge growth potential, passive income

- cross chain products --> more TVL

Conclusion

- 21mil TVL in less than 24 hours

- huge growth potential, passive income

- cross chain products --> more TVL

16/

Refer to my guide: How to Earn over 200% APR in Nexus Protocol and Introduction to Nexus Vaults!

Refer to my guide: How to Earn over 200% APR in Nexus Protocol and Introduction to Nexus Vaults!

• • •

Missing some Tweet in this thread? You can try to

force a refresh