Do u make/have "view" on all stocks u see???

Read this 👇👇

When I was new into the market, i was fortunate to be guided by good senior traders. They used to answer my doubts, share their views with me and tell me how did they come to certain trend via a after analysis.

1/11

Read this 👇👇

When I was new into the market, i was fortunate to be guided by good senior traders. They used to answer my doubts, share their views with me and tell me how did they come to certain trend via a after analysis.

1/11

This reduced my learning curve a big way. I did not had to wander around aimlessly for too much of my initial times.

But this interaction had a worse effect too. Majority of those who were around me had a view on all the stocks.

2/11

But this interaction had a worse effect too. Majority of those who were around me had a view on all the stocks.

2/11

It made me to think that having a view on all the stocks come across my way is the epitome of expertise. I was working towards that goal.

But how?

That's what I want u all to know.

I was using nearly all tools in charting platforms such as moving averages of all lengths,

3/11

But how?

That's what I want u all to know.

I was using nearly all tools in charting platforms such as moving averages of all lengths,

3/11

all the indicators, Bollinger bands, ichimoku, Elliott wave theory, Gann, classical patterns and what not.

I knew anyone of the tool would comply with what I was looking for in the chart.

Essentially what I was doing is I wanted to make a view and

4/11

I knew anyone of the tool would comply with what I was looking for in the chart.

Essentially what I was doing is I wanted to make a view and

4/11

I was searching for the pattern or indicator which matches with it. If the indicator as such doesnt match, I had a short cut to make it work. Play with the indicator values. RSI 10 may show an oversold location which RSI14 doesn't or

5/11

5/11

EMA 89 might show a support level which EMA 100 doesn't. For that purpose I could even use WMA/TMA/TEMA/VWMA etc based on whichever suits my purpose. Soon I started wearing an expert hat across groups in Facebook and whatsapp.

6/11

6/11

"The man who is capable of creating view on any stocks of anyone's choice"

As u could have guessed it didn't continue that way for long. Simple reason is it creates good image, but bad in trading.

"When u force something, what comes out is Shit"

7/11

As u could have guessed it didn't continue that way for long. Simple reason is it creates good image, but bad in trading.

"When u force something, what comes out is Shit"

7/11

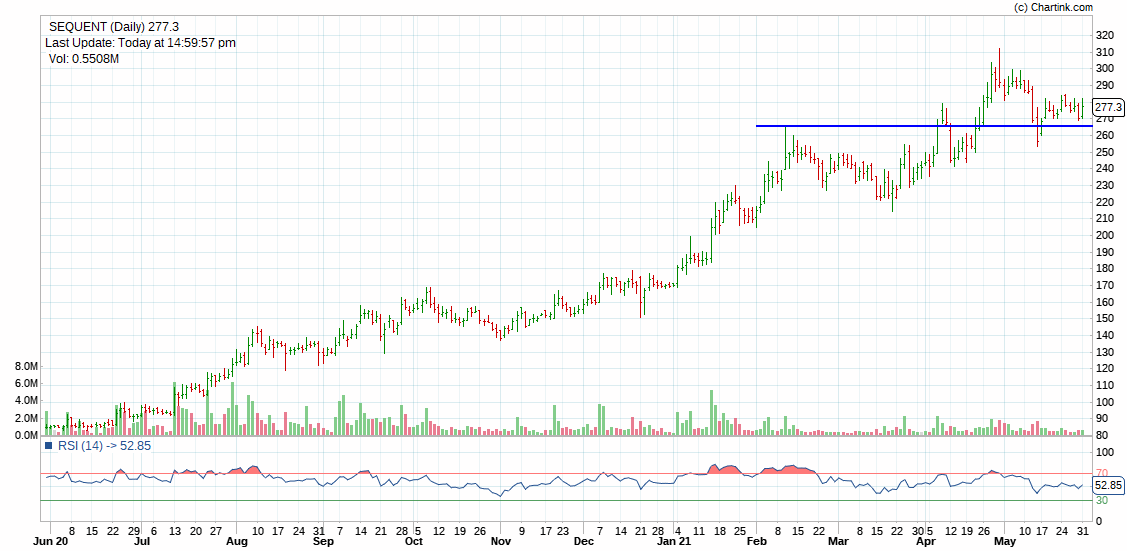

This was the standard of my charting. But I couldn't afford to keep an image at the cost of monetary loses I was making at own trading. That's when I started thinking about my approach. With help of few people such as @sanstocktrader I learned to see charts as it is

8/11

8/11

Not how i want it to be. That was a pivotal shift in my approach. And was a great turning point too. I stopped looking for decorated and complex tools. I made a fresh start with basic tools for analysis

Price with candle stick charting

Supply/demand using volume & OI

9/11

Price with candle stick charting

Supply/demand using volume & OI

9/11

Momentum using RSI

Volatility using Bollinger bands & candle spread.

It was insanely simple and just one line in chart was enough to define my trend analysis. But the result was I stopped being a losing trader

10/11

Volatility using Bollinger bands & candle spread.

It was insanely simple and just one line in chart was enough to define my trend analysis. But the result was I stopped being a losing trader

10/11

Ever since that i never had a rethink or doubt about my approach.

Avoiding a preconceived notion

Avoid bending the chart to fit own bias

Keeping the charts simple and Repeatable

This is the crux of the tweet.

11/11

Avoiding a preconceived notion

Avoid bending the chart to fit own bias

Keeping the charts simple and Repeatable

This is the crux of the tweet.

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh