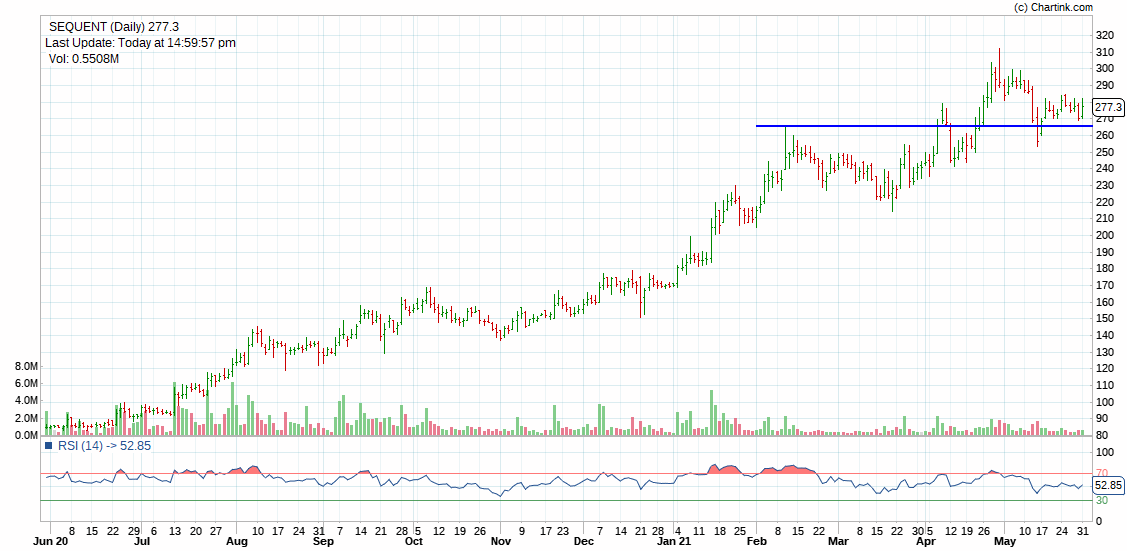

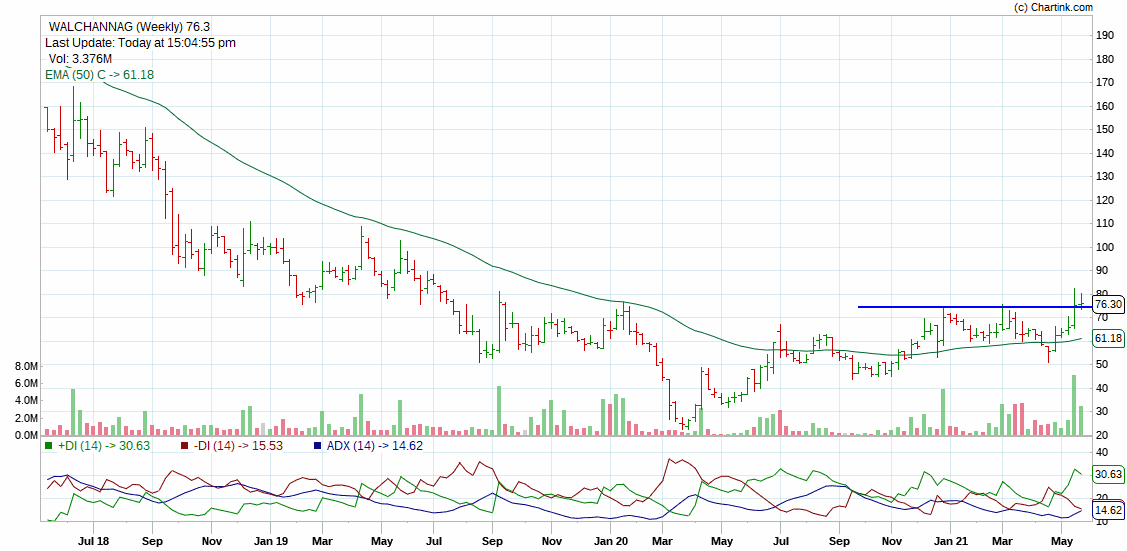

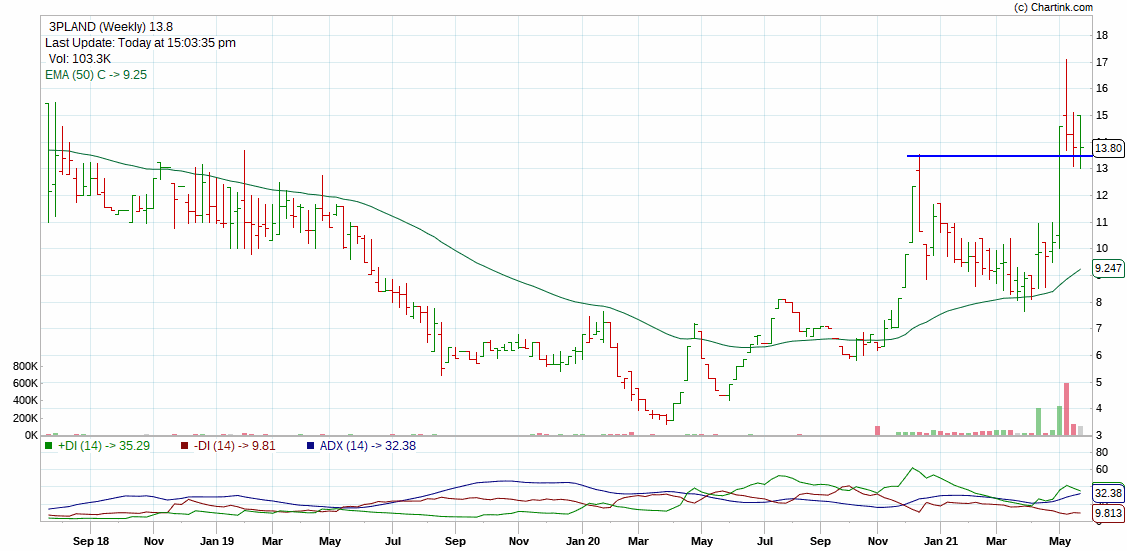

Successful bullish reversal after Retesting the recent breakout is the least risky method to go long in strong trending scrips.

Indorama

Welspunind

Mhril

Chennpetro

1/5

Indorama

Welspunind

Mhril

Chennpetro

1/5

Real challenge is finding the right scrips. Whiel making breakouts, stocks will be there in all sorts of news and websites while those on retest where its available far cheaper, will go unnoticed

Here is a list & charts

Kalpatpowr

Bharatgear

Tatamtrdvr

Precam

2/5

Here is a list & charts

Kalpatpowr

Bharatgear

Tatamtrdvr

Precam

2/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh