1/ @ArweaveTeam has grown tremendously in the past few months.

On 10/16, the Blockweave – a blockchain-like structure designed to enable scalable, efficient on-chain storage – reached 20TB of data stored on the permaweb.

The first 10TB took 1,139 days, the second took only 87.

On 10/16, the Blockweave – a blockchain-like structure designed to enable scalable, efficient on-chain storage – reached 20TB of data stored on the permaweb.

The first 10TB took 1,139 days, the second took only 87.

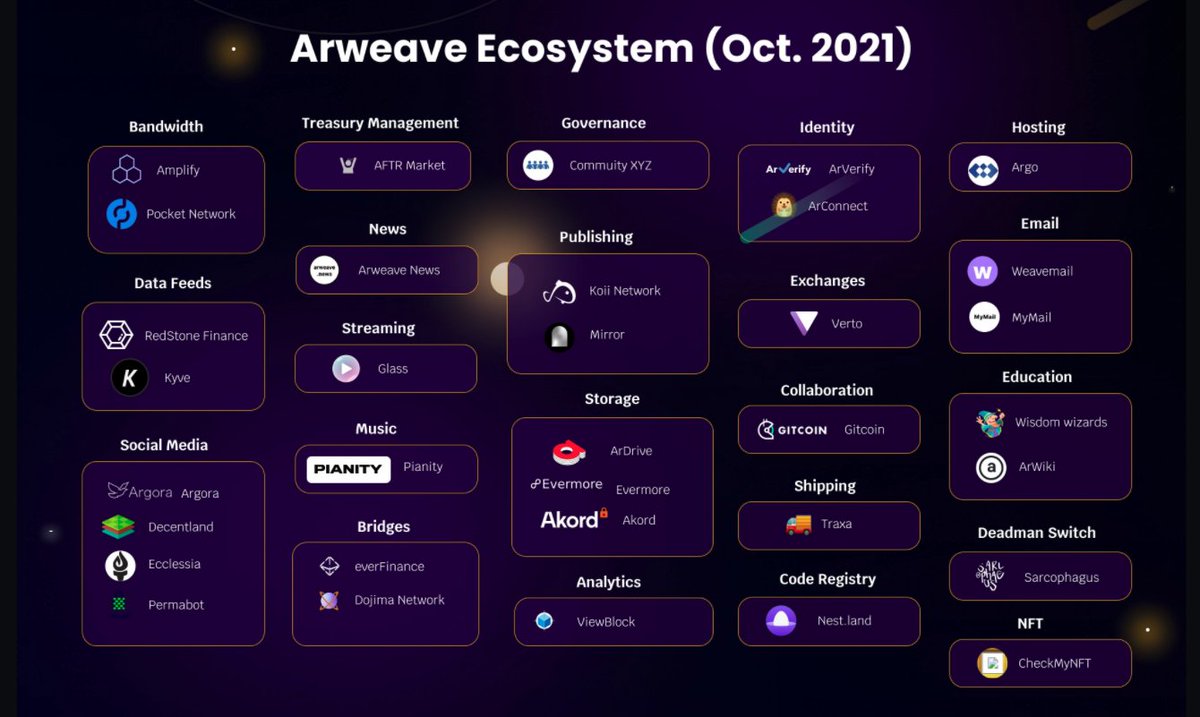

2/ The catalysts of @ArweaveTeam's exponential growth can be narrowed down to three categories:

+ inexpensive NFT on-chain storage

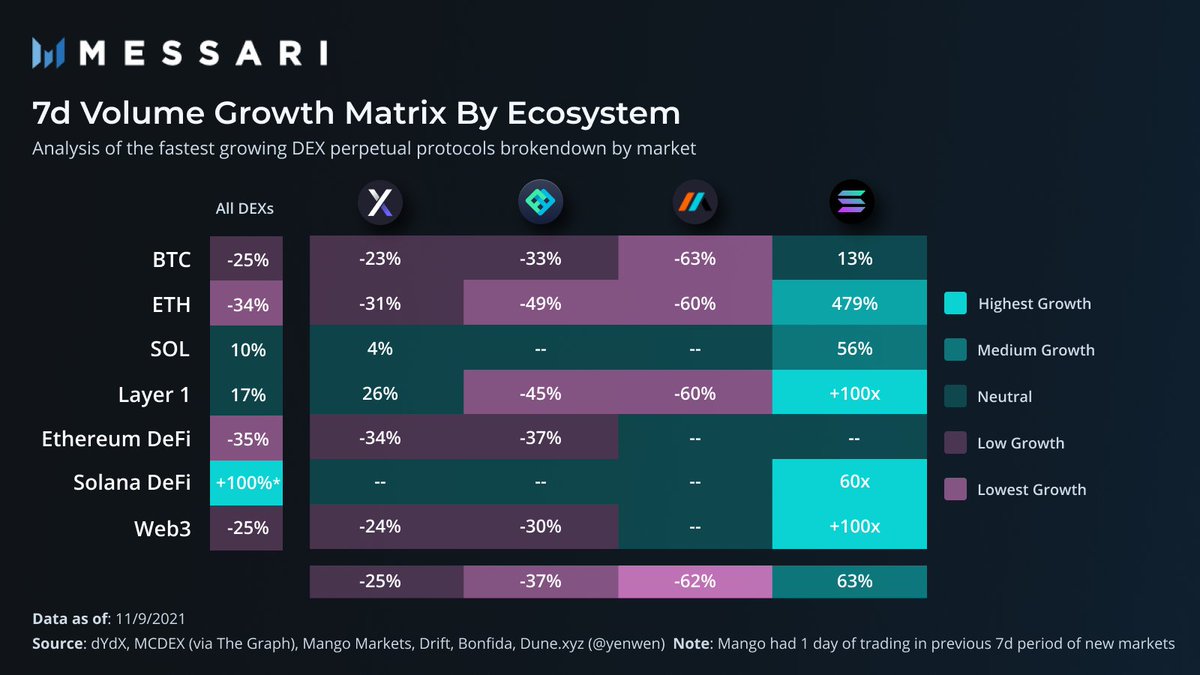

+ Web3 dApps: social media, music and movie streaming, etc.

+ blockchain storage for layer-1 smart contract platforms

+ inexpensive NFT on-chain storage

+ Web3 dApps: social media, music and movie streaming, etc.

+ blockchain storage for layer-1 smart contract platforms

3/ @ArweaveTeam's app ecosystem revenue has grown exponentially in the past few months.

According to the @web3index, Arweave has generated the highest network-usage Q3 revenue than any other protocol within the Web3 Index - 5x that of @Filecoin in September and 8x in October.

According to the @web3index, Arweave has generated the highest network-usage Q3 revenue than any other protocol within the Web3 Index - 5x that of @Filecoin in September and 8x in October.

• • •

Missing some Tweet in this thread? You can try to

force a refresh