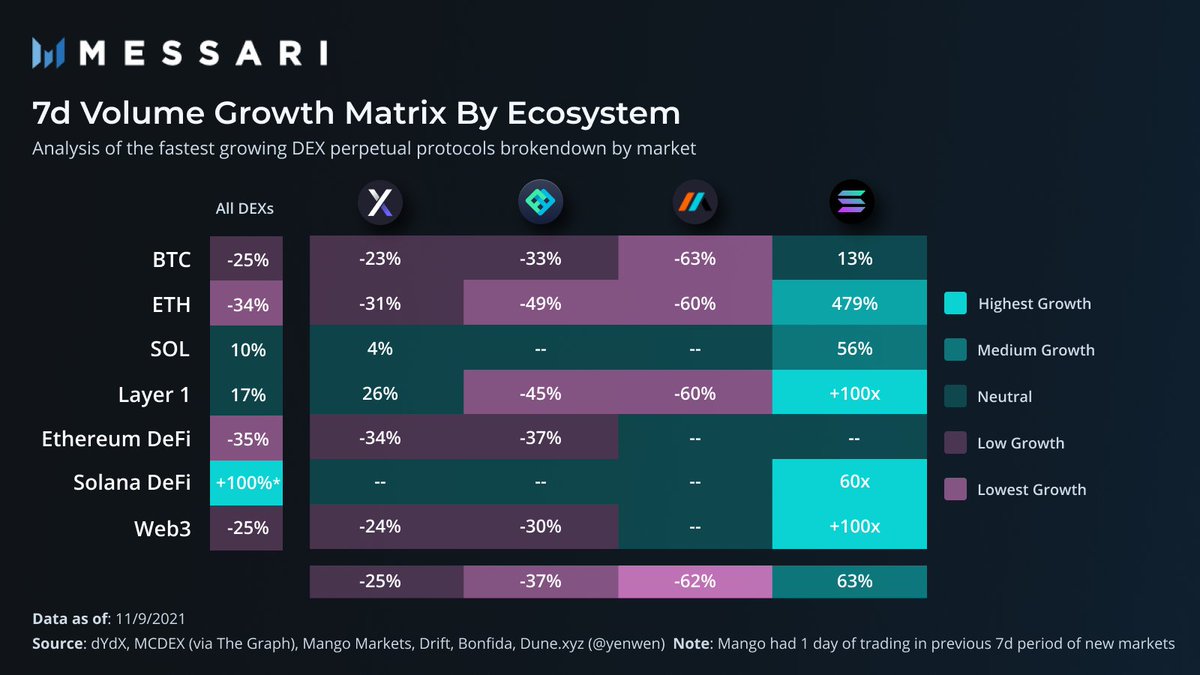

1/ The largest DEX perpetual markets primarily focus on @ethereum.

However, a market for @solana perpetuals has grown, with @mangomarkets, @DriftProtocol, and @bonfida leading the way.

The Solana ecosystem now accounts for 0.8% collective volume-share, and is actively growing.

However, a market for @solana perpetuals has grown, with @mangomarkets, @DriftProtocol, and @bonfida leading the way.

The Solana ecosystem now accounts for 0.8% collective volume-share, and is actively growing.

2/ The @solana ecosystem has grown significantly over the last month.

At the beginning of October, Solana accounted for roughly 5% of the non-@dydxprotocol DEX perpetual volume.

Fast forward to early November, the 7-day market share has grown just shy of 30%.

At the beginning of October, Solana accounted for roughly 5% of the non-@dydxprotocol DEX perpetual volume.

Fast forward to early November, the 7-day market share has grown just shy of 30%.

3/ Despite controlling >1% of total DEX perp market volume, @solana has gained a notable share in markets that matter most to its users.

Solana DEXs will likely be the first to launch markets for Solana ecosystem tokens too, which seeds additional volume and liquidity growth.

Solana DEXs will likely be the first to launch markets for Solana ecosystem tokens too, which seeds additional volume and liquidity growth.

4/ Learn more about the perpetual rise of @solana in the latest article from @Saypien_ messari.io/article/the-pe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh