Revenue growth is slowing a bit, 13,5% YoY.

Something slightly worrying is Fintech growing to a bigger chunck of the business. Easy target for a crackdown and this one could really hurt

Something slightly worrying is Fintech growing to a bigger chunck of the business. Easy target for a crackdown and this one could really hurt

Tencent still in the leading position in a lot of sectors in china and worldwide. This won't change in the foreseeable future imo.

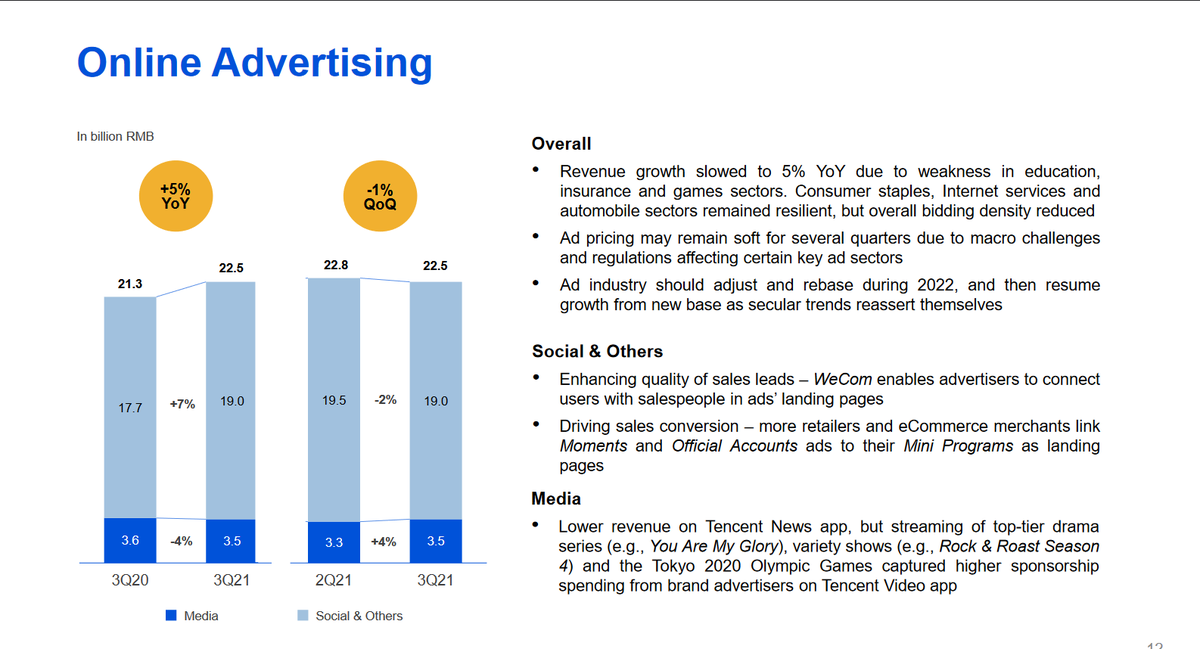

$TCEHY expects a slowdown in Advertising growth for a few quarters. Crackdowns are forcing companies to tune down marketing

Fintech and Business services are doing well, I'd really love them to disclose Fintech and Business services individually. I wanna know how much B services are growing in particular.

The fair value of $TCEHY equity investments is $185 billion or 31% of Tencents marketcap.

Also a small buyback, not really worth mentioning. I would expect them to spend more with this price. They have ~$40 billion in cash right now.

Also a small buyback, not really worth mentioning. I would expect them to spend more with this price. They have ~$40 billion in cash right now.

Summary: I'm not loving what I'm seeing, somethings like advertising slowdown are not great to see, since its a high margin business. Overall they will be fine. Let's see how the regulations will work out going forward.

• • •

Missing some Tweet in this thread? You can try to

force a refresh