Tradingview Tricks Hacks and Tutorial

A thread 🔖

Tradingview is one of the most used Trading Websites in the world used by most traders .

Retweet Share !

@kuttrapali26 @AmitabhJha3

#stockstowatch #StockMarketindia

1/n

A thread 🔖

Tradingview is one of the most used Trading Websites in the world used by most traders .

Retweet Share !

@kuttrapali26 @AmitabhJha3

#stockstowatch #StockMarketindia

1/n

Trick to Add Unlimited Watchlists in

#Tradingview free Version

Step 1 : Open Trading View Mobile App

Step 2 : Click on " + "

Step 3 : Create Watchlist

This works only on Mobile app

After making Watchlist on Mobile app you can add stocks in Website also .

2/n

#Tradingview free Version

Step 1 : Open Trading View Mobile App

Step 2 : Click on " + "

Step 3 : Create Watchlist

This works only on Mobile app

After making Watchlist on Mobile app you can add stocks in Website also .

2/n

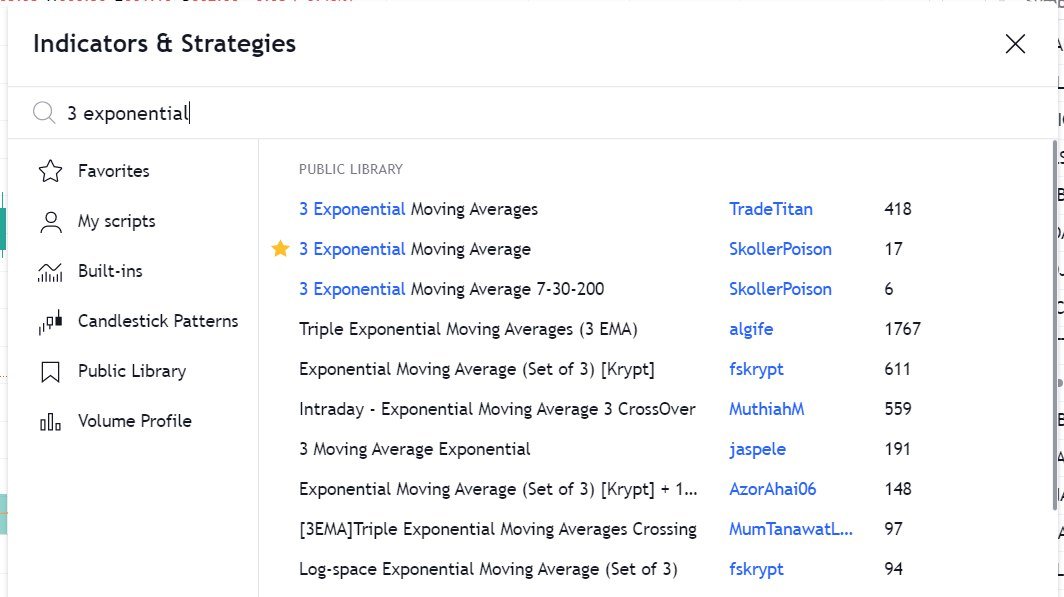

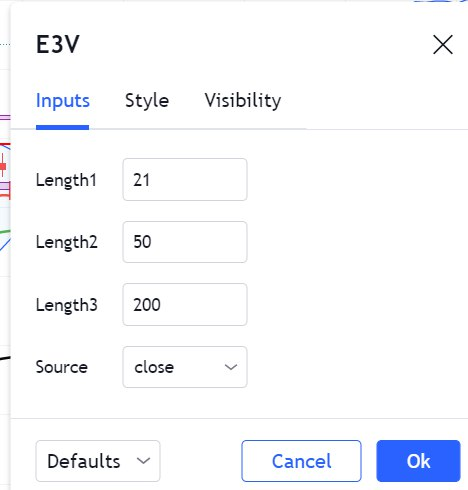

HOW TO APPLY MORE THAN 3 MOVING AVERAGES IN #TradingView Free Version

Step 1 : Just Write "3 expo "

You will get multiple Options

Select "skollerposion"

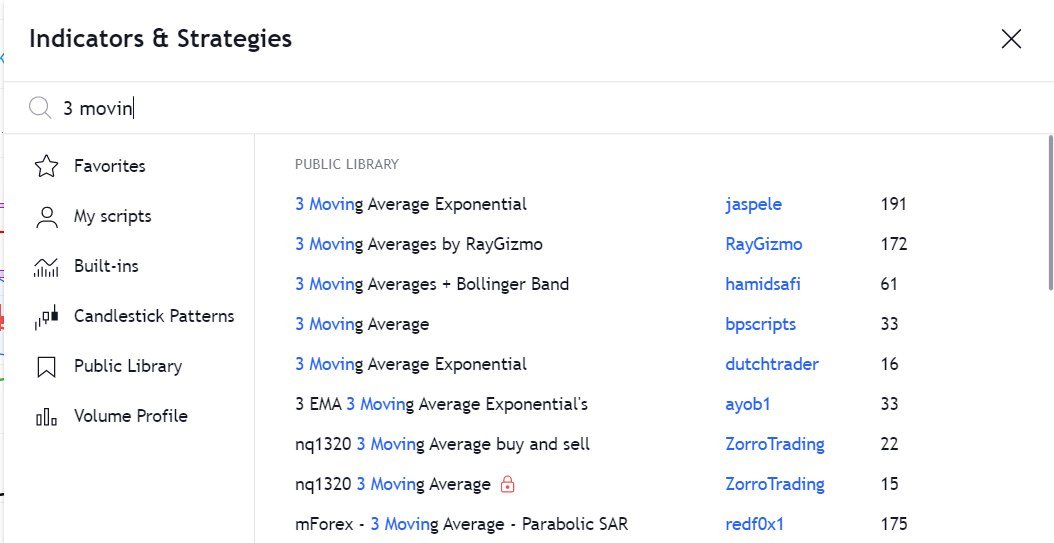

Step 2 : TO add Normal moving Averages refer the 2nd Picture

Add other indicators as your own

3/n

Step 1 : Just Write "3 expo "

You will get multiple Options

Select "skollerposion"

Step 2 : TO add Normal moving Averages refer the 2nd Picture

Add other indicators as your own

3/n

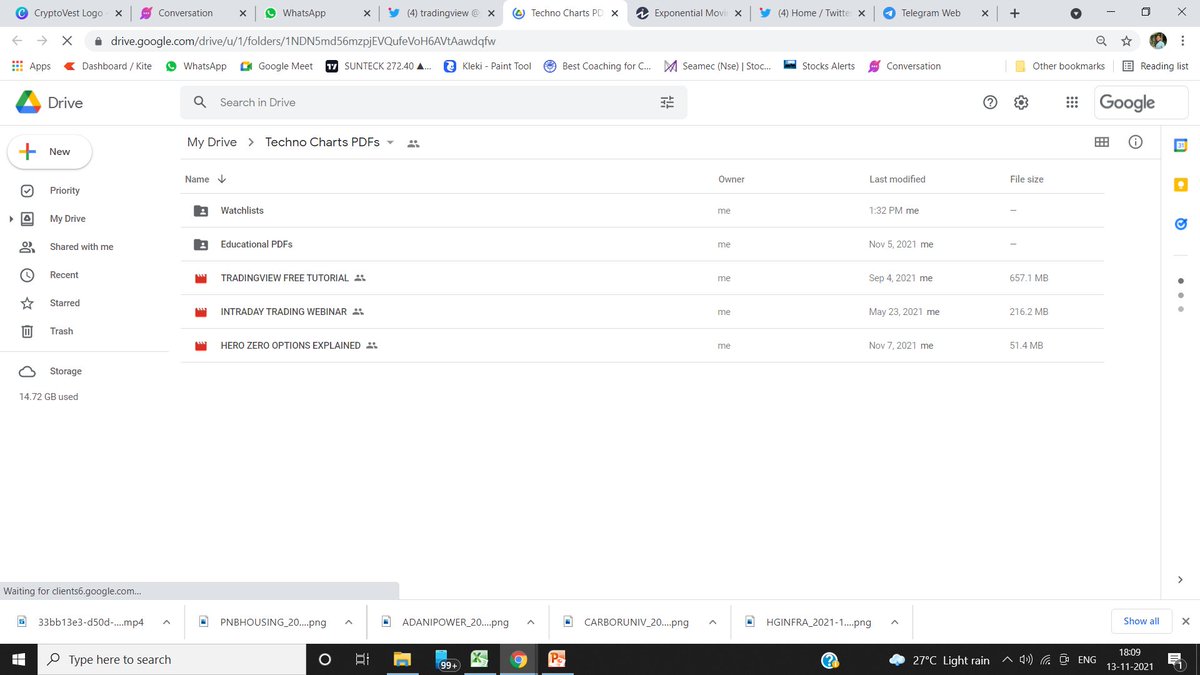

Link for Tradingview Free tutorial :

Watchlist of FnO Midcap Largecaps etc shared

Copy watchlist from the folder and paste it through webiste only .

Copy Paste doesnt work in App

4/n

https://twitter.com/JayneshKasliwal/status/1456493492797001728?s=20

Watchlist of FnO Midcap Largecaps etc shared

Copy watchlist from the folder and paste it through webiste only .

Copy Paste doesnt work in App

4/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh