THE ASML ODD LOTS

After teasing it as part of our chip series for months, @tracyalloway and I finally did an episode on $ASML, the Dutch powerhouse in advanced lithography

Great chat with our guest @crmiller1, who is writing a book on the company bloomberg.com/news/articles/…

After teasing it as part of our chip series for months, @tracyalloway and I finally did an episode on $ASML, the Dutch powerhouse in advanced lithography

Great chat with our guest @crmiller1, who is writing a book on the company bloomberg.com/news/articles/…

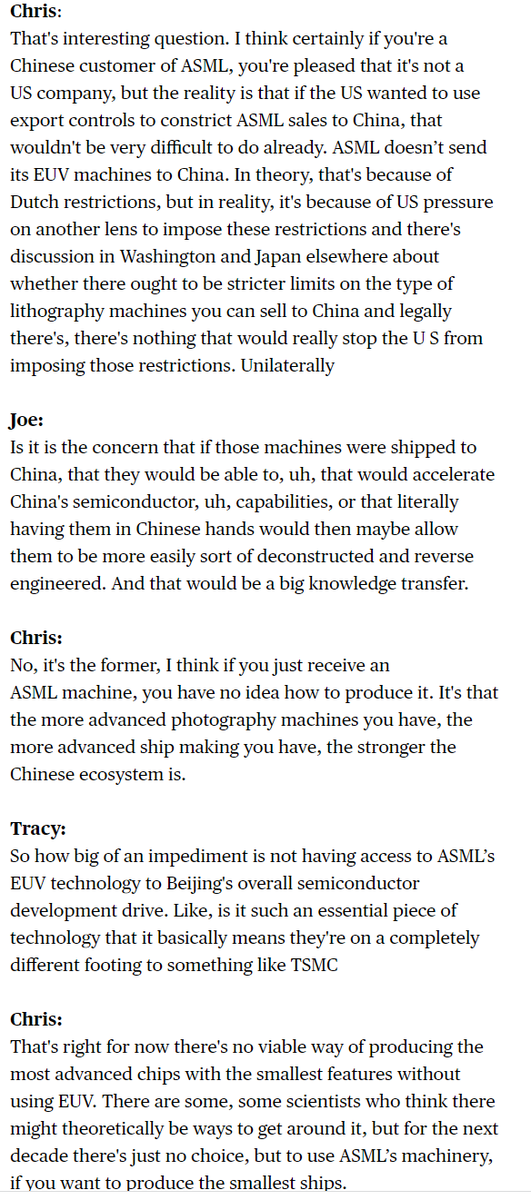

@tracyalloway @crmiller1 As our guest notes, $ASML has zero competition at its level of its sophistication. None. Nobody else can achieve the scale it can, with its reliability. So if you want to make the most cutting edge chips, you are an ASML customer.

@tracyalloway @crmiller1 As I wrote about on Friday, what's impossible for competitors to replicate is not its technological knowledge per se, but its supply chain mastery, dealing with at least 4000 distinct independent suppliers

https://twitter.com/TheStalwart/status/1459205866755092480

@tracyalloway @crmiller1 Yes, this is an insane fact. A greater than $300 billion co that made less than 400 units. (And most of those units weren't its most advanced EUV ones). It just makes a few of those per year.

https://twitter.com/azakmay/status/1460247256586723331

• • •

Missing some Tweet in this thread? You can try to

force a refresh