Phenomenal curation of Howard Marks' memos by @BlasMoros.👏

So many excellent points on Market/Credit/Economic cycles & investor psychology. Few of my fav parts in the thread below.⬇️

blas.com/wp-content/upl…

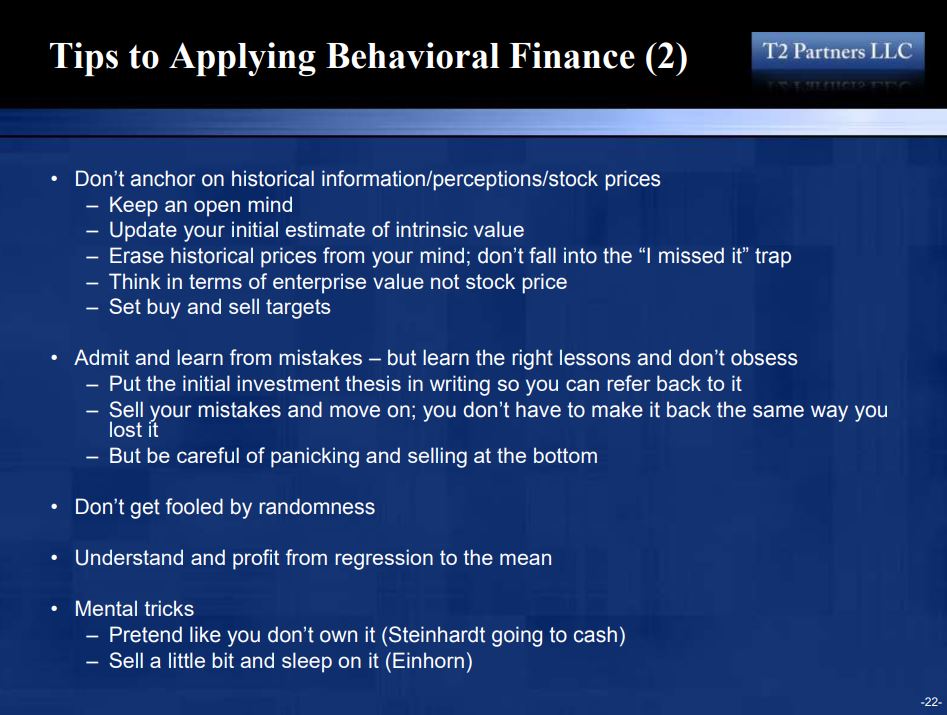

✔️Some of the recurring mistakes investors make

So many excellent points on Market/Credit/Economic cycles & investor psychology. Few of my fav parts in the thread below.⬇️

blas.com/wp-content/upl…

✔️Some of the recurring mistakes investors make

✔️Overall cycles that can affect the Markets & investors.

-Economic cycle

-Business cycle

-Profit cycle

-Credit cycle

-Market cycle

-Economic cycle

-Business cycle

-Profit cycle

-Credit cycle

-Market cycle

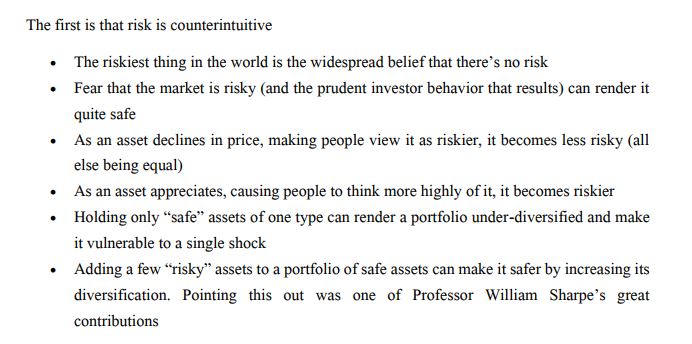

✔️Excellent points on Risk. It's so important to not let the falling stock prices (on good Businesses with plenty of future growth) determine the actual value/riskiness of the Business if you plan to buy it for the long-term.

Learn how investor psychology and Market cycles feed each other, so that you are not too easily influenced by the falling/rising prices.

Don't let the Market teach you these lessons the hard way (getting hyped into the market at highs, and capitulating during the lows).

Don't let the Market teach you these lessons the hard way (getting hyped into the market at highs, and capitulating during the lows).

• • •

Missing some Tweet in this thread? You can try to

force a refresh