1/ Since our last update on 10 November. BTC went from a 69,000 high to a 58,638 low today (-15%) and ETH has gone from a 4,868 high to a 4,108 low today (-15.6%).

A series of negative factors could be the reason for this sell-off. Here’s a quick timeline. 🧵

A series of negative factors could be the reason for this sell-off. Here’s a quick timeline. 🧵

2/ 10 November: Shock US inflation print at 6.2%, the highest since November 1990, creates a ‘risk-off’ sentiment across global markets. How long can the Fed continue to claim inflation is transitory before being forced to take corrective action?

3/ 12 November: The SEC rejects VenEck’s proposal to launch a physical Bitcoin ETF.

4/ 14 November: Disappointing reaction to the successful BTC taproot upgrade. There was some expectation that this would be a catalyst for a leg higher in price. The lack of reaction caused a ‘buy the rumour, sell the fact’ effect.

5/ 16 November (today):

China - The National Development and Reform Commission reiterated their firm no-crypto stance, emphasizing that virtual currency mining is “extremely harmful”.

China - The National Development and Reform Commission reiterated their firm no-crypto stance, emphasizing that virtual currency mining is “extremely harmful”.

6/ US - President Joe Biden signed into law a bill with cryptocurrency tax reporting requirements, essentially tagging one’s personal information to each trade above 10,000 USD.

7/ While many have dismissed this as priced-in and somewhat nominal, seemingly innocuous tax measures have been notorious for marking highs in bull markets.

8/ From the 3G auctions in the 1990s that marked the high for the telecoms sector to the special taxes on Australian mining companies in the 2000s that marked the top of the commodity bull cycle.

9/ Today’s headlines triggered a very sharp leg lower across the crypto market.

BTC broke below the 60,000 level convincingly but has since bounced back above.

BTC broke below the 60,000 level convincingly but has since bounced back above.

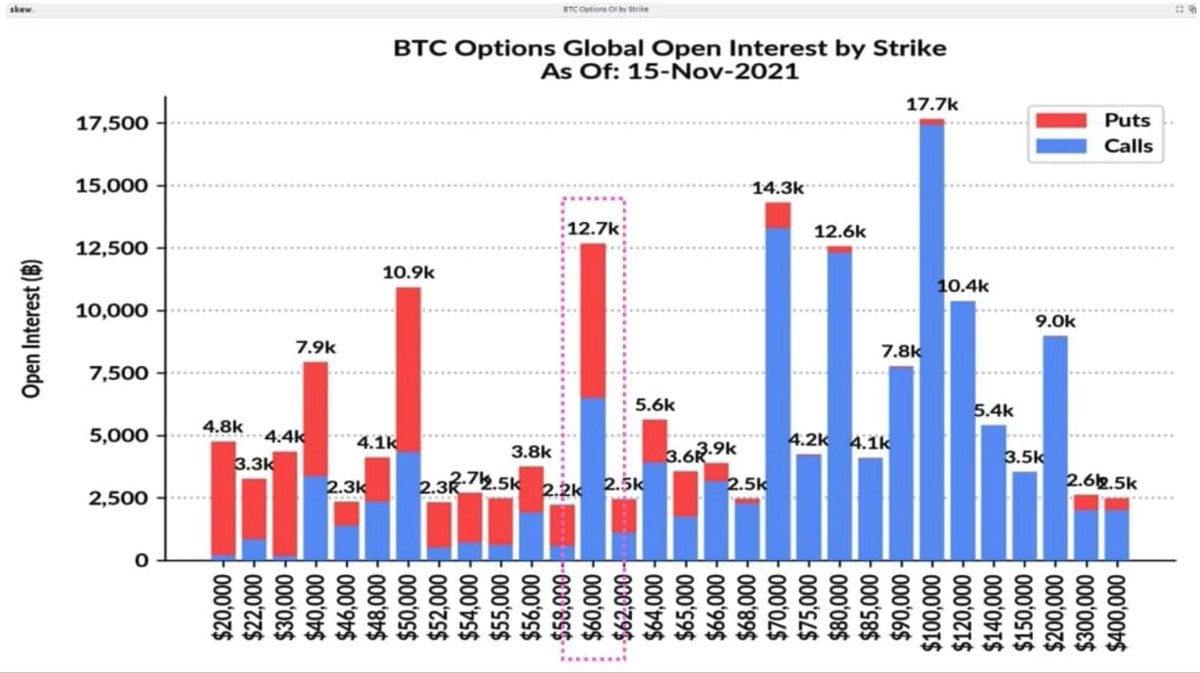

10/ We expect some gravity around this 60,000 level given the sheer size of options open interest at the 60,000 strike. Almost 13,000 BTC!

11/ We were neutral BTC last Wednesday across the greeks and have turned slightly long BTC spot and also small short gamma and vega on this move down.

12/ BTC profit came mostly from our short position in the December forwards. We squared up completely today at 7-8%, a significant drop from the highs at almost 25%!

13/ ETH capitulated more strongly than BTC today and we think that this will continue. In options, the ‘Raoul effect’ was undone in a big way with the March risk reversal collapsing from a call skew of +15% to a put skew of -5%.

14/ The November risk reversal also saw a stunning straight line down to a put skew of more than -10%.

15/ Yesterday through the night, institutional players were buying large sizes of March puts at 3,000 strike and selling calls at 8,000 and 10,000 strikes. Very sharp flow.

16/ Last Wednesday, we bought back our short tenor ETH option shorts. And on Friday, we bought a record amount of ETH gamma, largely from Defi protocols.

17/ This was the perfect protection for today’s dump and we were able to take profit on the long gamma amidst the violent move today. We remain small long gamma and small short vega in ETH.

18/ Overall, we’ve turned quite neutral after this awaited leverage wash-out. We expect BTC to be stuck around 60,000 given the strike gravity. And perhaps more volatility in ETH and Altcoins.

19/ On a side note, the past week has been momentous for Altcoin Defi options. We traded a million USD of AAVE options with ribbon.finance also a million USD of LUNA options on thetanuts.finance.

20/ This is opening up a scalable avenue for Altcoiners to earn genuine yield (not just token incentives) through accessible instruments on Defi. Watch this space for the coming Defi 2.0 explosion.

21/ Our market updates are also available on our telegram broadcast here t.me/QCPbroadcast

• • •

Missing some Tweet in this thread? You can try to

force a refresh