1/ Major new research drop on “The Outlook for #DeFi” from @Bitwiseinvest. Key takeaways:

1. DeFi is positioned to disrupt finance like Amazon disrupted Sears

2. DeFi is currently undervalued using P/S & P/SG metrics

3. The market growth opportunity is up to 15X-114X

A thread…

1. DeFi is positioned to disrupt finance like Amazon disrupted Sears

2. DeFi is currently undervalued using P/S & P/SG metrics

3. The market growth opportunity is up to 15X-114X

A thread…

2/ What is DeFi?

DeFi creates a more accessible, efficient, & transparent financial system. It applies one of crypto’s greatest breakthroughs—programmable money—to financial services.

It’s completely changing the way we think about the financial system.

s3.amazonaws.com/static.bitwise…

DeFi creates a more accessible, efficient, & transparent financial system. It applies one of crypto’s greatest breakthroughs—programmable money—to financial services.

It’s completely changing the way we think about the financial system.

s3.amazonaws.com/static.bitwise…

3/ There has been a widespread failure to innovate across the global financial industry over the past 30+ years. Fintech has been a long-promised revolution that never arrived.

DeFi fixes this. It rewires the back end of the legacy system while offering fintech-like front ends.

DeFi fixes this. It rewires the back end of the legacy system while offering fintech-like front ends.

4/ This new way to render financial services combines a number of advantages that put DeFi in position to disrupt the legacy system:

- Lower Cost

- Higher Speed

- Wider Reach

- Agile Composability

- Two-Sided Markets

- Self-Executing Services

- Lower Cost

- Higher Speed

- Wider Reach

- Agile Composability

- Two-Sided Markets

- Self-Executing Services

5/ Take costs & speed.

DeFi apps have lower operating expenses than legacy finance b/c they use public infrastructure (blockchains) on the back end, & b/c they are decentralized & automated: that is, governed by code w/o the need for offices, employees, or other related costs.

DeFi apps have lower operating expenses than legacy finance b/c they use public infrastructure (blockchains) on the back end, & b/c they are decentralized & automated: that is, governed by code w/o the need for offices, employees, or other related costs.

6/ Composability allows financial services to be built & operated through a modular, open-source framework.

It’s as if any entrepreneur could take @jpmorgan’s infrastructure & build on top of it, w/o engaging in a multi-year effort to strike a partnership

It’s as if any entrepreneur could take @jpmorgan’s infrastructure & build on top of it, w/o engaging in a multi-year effort to strike a partnership

https://twitter.com/cdixon/status/1451703067213066244?s=20

7/ Two-sided markets unlock supply: @Uber connects drivers/vehicles w/ passengers in need of a ride; @Airbnb connects homeowners looking for extra cash w/ short-term renters.

DeFi connects market makers looking for yield w/ users who pay for liquidity

forbes.com/sites/matthoug…

DeFi connects market makers looking for yield w/ users who pay for liquidity

forbes.com/sites/matthoug…

8/ DeFi users engage with smart contracts through an ecosystem of DeFi applications.

These are just like the apps on your phone, but w/ one key difference: There is no company running things behind the scenes. Instead, self-executing smart contracts operate the applications.

These are just like the apps on your phone, but w/ one key difference: There is no company running things behind the scenes. Instead, self-executing smart contracts operate the applications.

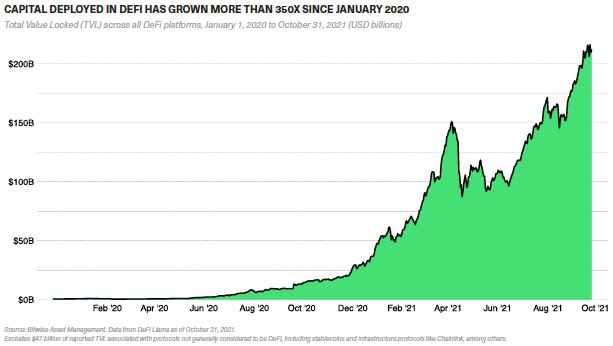

9/ In less than three years, DeFi has grown to an ecosystem of more than 534 crypto applications that provide financial services like lending, borrowing, & asset management.

The capital allocated to these financial applications (i.e. TVL) has grown to more than $212B.

The capital allocated to these financial applications (i.e. TVL) has grown to more than $212B.

10/ The main subsectors that make up the DeFi ecosystem mirror those of traditional financial services: Lending & Borrowing, Trading, Asset Management, & Insurance.

Lending & Borrowing along with Trading currently dominate the space, representing 80% of TVL in DeFi.

Lending & Borrowing along with Trading currently dominate the space, representing 80% of TVL in DeFi.

Lending/borrowing apps are like automated banks—users can deposit crypto assets in exchange for interest income or borrow crypto by posting collateral.

Currently, the main users are traders who post collateral to operate on leverage, with DeFi acting in the role of prime brokers

Currently, the main users are traders who post collateral to operate on leverage, with DeFi acting in the role of prime brokers

12/ Trading is the other dominant subsector of DeFi, led by Decentralized Exchanges (DEXs).

They are like the @NYSE or @Nasdaq, or decentralized versions of crypto brokerages like @coinbase, but they run autonomously & don’t have an operating company or thousands of employees.

They are like the @NYSE or @Nasdaq, or decentralized versions of crypto brokerages like @coinbase, but they run autonomously & don’t have an operating company or thousands of employees.

13/ Some of the largest DEXs rival their centralized counterparts in terms of trading volume, cost, & efficiency.

@Uniswap, a DEX that launched in 2018, continues to capture market share relative to CEXs like @coinbase & @ftx_app despite having no employees.

@Uniswap, a DEX that launched in 2018, continues to capture market share relative to CEXs like @coinbase & @ftx_app despite having no employees.

14/ DeFi asset management apps provide services like yield optimization & portfolio management. @iearnfinance is the DeFi equivalent of a robo-advisor (think @Wealthfront).

@Wealthfront was founded in 2008 & has $27B AUM. @iearnfinance launched last year & already has $6B AUM.

@Wealthfront was founded in 2008 & has $27B AUM. @iearnfinance launched last year & already has $6B AUM.

15/ @enzymefinance & @SetProtocol allow anyone to create & manage baskets of tokens, while automating back-end processes of fund management/accounting, & collect/distribute fees.

@indexcoop is a DeFi asset manager that works w/ experts like @BanklessHQ to create crypto indexes.

@indexcoop is a DeFi asset manager that works w/ experts like @BanklessHQ to create crypto indexes.

16/ Unlike crypto assets like $BTC & $ETH that behave more like commodities, DeFi apps typically have revenue streams (transaction revenue, interest income, etc.).

This makes it possible to evaluate them w/ some of the same tools investors use for early-stage equities.

This makes it possible to evaluate them w/ some of the same tools investors use for early-stage equities.

17/ Some DeFi apps channel part of the revenue to token holders in the form of dividends & buy-backs:

@SushiSwap distributes 0.05% of all fees to $SUSHI token holders, like a dividend.

@AaveAave uses a portion of its revenue to buy & “burn” $AAVE tokens, like a stock buy-back.

@SushiSwap distributes 0.05% of all fees to $SUSHI token holders, like a dividend.

@AaveAave uses a portion of its revenue to buy & “burn” $AAVE tokens, like a stock buy-back.

18/ With the presence of revenues & profits, we can apply standard valuation tools to DeFi apps, like price-to-sales (P/S).

The top DeFi apps boast a median P/S of 14.5x, very close to the 13.8x median P/S of the companies in the Ark Fintech Innovation ETF run by @CathieDWood

The top DeFi apps boast a median P/S of 14.5x, very close to the 13.8x median P/S of the companies in the Ark Fintech Innovation ETF run by @CathieDWood

19/ The difference? The rate of growth that DeFi apps have been experiencing.

Over the last six months, the median YoY revenue growth for DeFi apps was 764%.

By comparison, the median projected revenue growth for the constituents of the $ARKF is significantly lower, at 37%.

Over the last six months, the median YoY revenue growth for DeFi apps was 764%.

By comparison, the median projected revenue growth for the constituents of the $ARKF is significantly lower, at 37%.

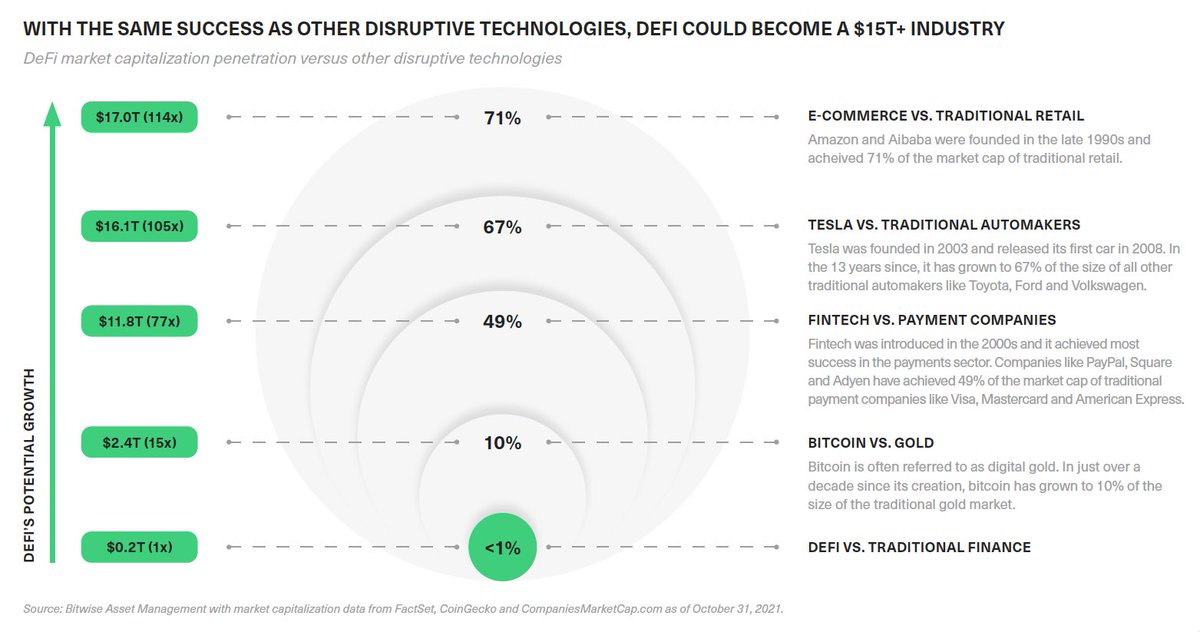

20/ From a top-down view, DeFi’s $152b market cap is tiny compared to the size of the industry that it aims to disrupt: <1% of the $24T legacy finance market.

@jpmorgan, the world's largest bank, boasts a market cap of $508B—more than 3x the combined value of all 534 DeFi apps.

@jpmorgan, the world's largest bank, boasts a market cap of $508B—more than 3x the combined value of all 534 DeFi apps.

21/ How successful have disruptors been historically?

The most successful disruptors captured 50%-70% of incumbents’ market cap in a 10-20 year period: Fintech vs payment processors (49%), @Tesla vs other automakers (67%), @amazon & @AlibabaGroup vs traditional retailers (71%).

The most successful disruptors captured 50%-70% of incumbents’ market cap in a 10-20 year period: Fintech vs payment processors (49%), @Tesla vs other automakers (67%), @amazon & @AlibabaGroup vs traditional retailers (71%).

22/ Based on this history of disruptive tech in other markets, we believe DeFi will expand from this modest start to be a $15T industry in the next 5-15 years—a potential upside of more than 100x from the current $152B market cap of DeFi.

23/ With significant revenue streams & soaring growth rates, many DeFi apps resemble—& compare favorably with—high-growth, early-stage equities.

These same characteristics can make DeFi apps more intelligible to investors than commodity-like cryptocurrencies such as bitcoin.

These same characteristics can make DeFi apps more intelligible to investors than commodity-like cryptocurrencies such as bitcoin.

24/ What was once the domain of crypto enthusiasts now has the attention of the world’s largest financial institutions.

Société Générale, the 6th largest bank in Europe, recently proposed a $20M deal w/ @MakerDAO, opening new possibilities between DeFi & traditional finance.

Société Générale, the 6th largest bank in Europe, recently proposed a $20M deal w/ @MakerDAO, opening new possibilities between DeFi & traditional finance.

25/ Still, DeFi uses emerging, complex technology that aims to automate highly regulated financial services.

Operating at this intersection carries a number of risk factors that could affect the long-term outlook for DeFi, including execution & regulatory risks, among others.

Operating at this intersection carries a number of risk factors that could affect the long-term outlook for DeFi, including execution & regulatory risks, among others.

26/ The industry has a long & unclear regulatory road ahead of it, a trait common in highly disruptive tech.

The pioneers of Web2 like @amazon & @Google were met with similar uncertainty from regulators in their early days & are now among the world’s most valuable companies.

The pioneers of Web2 like @amazon & @Google were met with similar uncertainty from regulators in their early days & are now among the world’s most valuable companies.

27/ Generally, the near-term impact of regulation is unclear; however, increased regulatory clarity & guidance should ultimately lead to more room for the DeFi industry to expand & more capital flowing into the ecosystem, driving growth.

28/ If you're interested in exploring these concepts & analysis further, follow @RasterlyRock & check out the full report (includes full risks and disclosures):

“Decentralized Finance (DeFi): A Primer for Investment Professionals”

s3.amazonaws.com/static.bitwise…

“Decentralized Finance (DeFi): A Primer for Investment Professionals”

s3.amazonaws.com/static.bitwise…

• • •

Missing some Tweet in this thread? You can try to

force a refresh