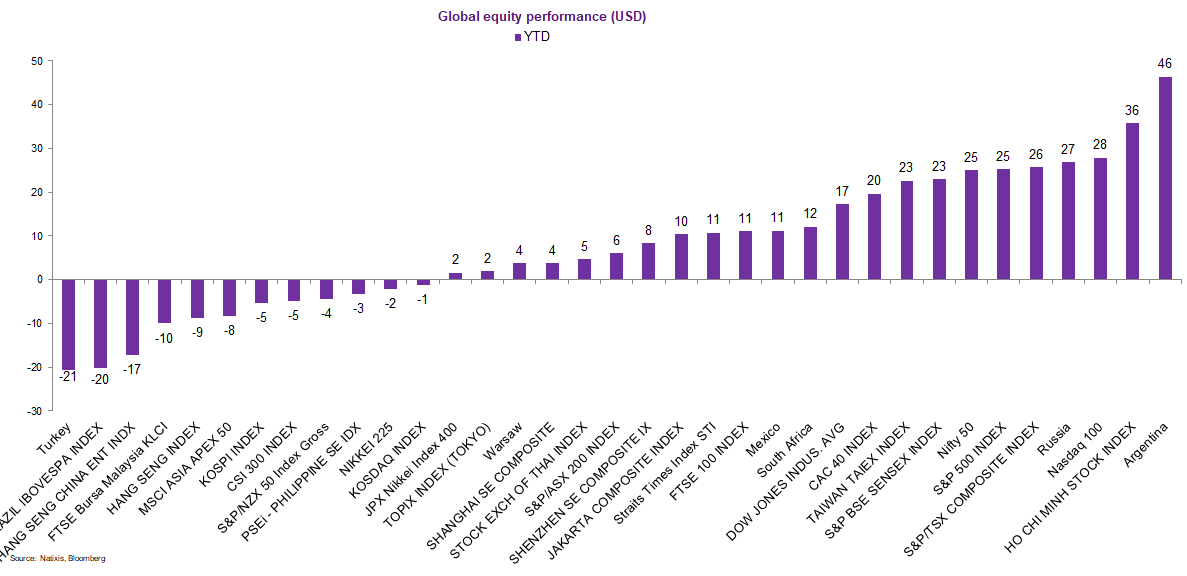

Ready? Let's talk about equity performance in this year in USD

Best? Argentina, Vietnam, Nasdaq, Russia, SPX, and India 🇦🇷🇻🇳🇺🇸🇷🇺🇮🇳 💪🏻

Worst: Turkey (roasted!), Brazil, mainland listed HSI stocks or China offshore, Malaysia, Hong Kong, Asia, Korea 🇹🇷🇧🇷🇨🇳🇲🇾🇭🇰🇰🇷🤮

What about 2022?

Best? Argentina, Vietnam, Nasdaq, Russia, SPX, and India 🇦🇷🇻🇳🇺🇸🇷🇺🇮🇳 💪🏻

Worst: Turkey (roasted!), Brazil, mainland listed HSI stocks or China offshore, Malaysia, Hong Kong, Asia, Korea 🇹🇷🇧🇷🇨🇳🇲🇾🇭🇰🇰🇷🤮

What about 2022?

Turkey was the worst, and a lot of it is FX driven. Want to hear a lira joke?

Knock, knock!

Who's there?

Turkish lira here!

TRY/USD! 😬🇹🇷

Jest aside, what expectations did u have about 2021 in end 2020 that weren't true?

How about a weaker USD?

Knock, knock!

Who's there?

Turkish lira here!

TRY/USD! 😬🇹🇷

Jest aside, what expectations did u have about 2021 in end 2020 that weren't true?

How about a weaker USD?

Vietnam yielded +36% while HSI Chinese enterprise -17% so that's a +53% gap

Is Vietnam doing better than China in terms of growth? Not if you look at the latest GPD which Vietnam bombed out at -6.2%YoY while China at 4.9. What's holding then China back? Itself, as in regulations

Is Vietnam doing better than China in terms of growth? Not if you look at the latest GPD which Vietnam bombed out at -6.2%YoY while China at 4.9. What's holding then China back? Itself, as in regulations

What about Vietnam? Well, the -6.2% is a once a quarter event & it is expected to bounce back strongly in Q4 and even more so in 2022.

Typing that listening to Birdy singing on a Vietnam assembled airpods.

Regarding China, it can boost equities but will it? Investors waiting..

Typing that listening to Birdy singing on a Vietnam assembled airpods.

Regarding China, it can boost equities but will it? Investors waiting..

• • •

Missing some Tweet in this thread? You can try to

force a refresh