How many people could still die of #Covid19 in the UK?

It’s an unpalatable question I know, but is worth pondering given cases are on the rise in many parts of Europe.

The good news is that, well, this thread contains better news than you might have thought.

First, the data:

It’s an unpalatable question I know, but is worth pondering given cases are on the rise in many parts of Europe.

The good news is that, well, this thread contains better news than you might have thought.

First, the data:

Here’s the big picture. Covid may have been out of the headlines in recent months but the death toll has been creeping higher.

Now up to nearly 168k in the UK, 142k in England.

These are deaths where Covid is mentioned in certificate. Abt 90% were directly attributed to Covid.

Now up to nearly 168k in the UK, 142k in England.

These are deaths where Covid is mentioned in certificate. Abt 90% were directly attributed to Covid.

You can split it into three broad phases:

1 Wave 1 last spring.

2. Wave 2 (arguably two waves in one) last winter.

3 The period since May.

Here’s the death toll in each (for England). Raising the question: what next. How many more deaths…?

1 Wave 1 last spring.

2. Wave 2 (arguably two waves in one) last winter.

3 The period since May.

Here’s the death toll in each (for England). Raising the question: what next. How many more deaths…?

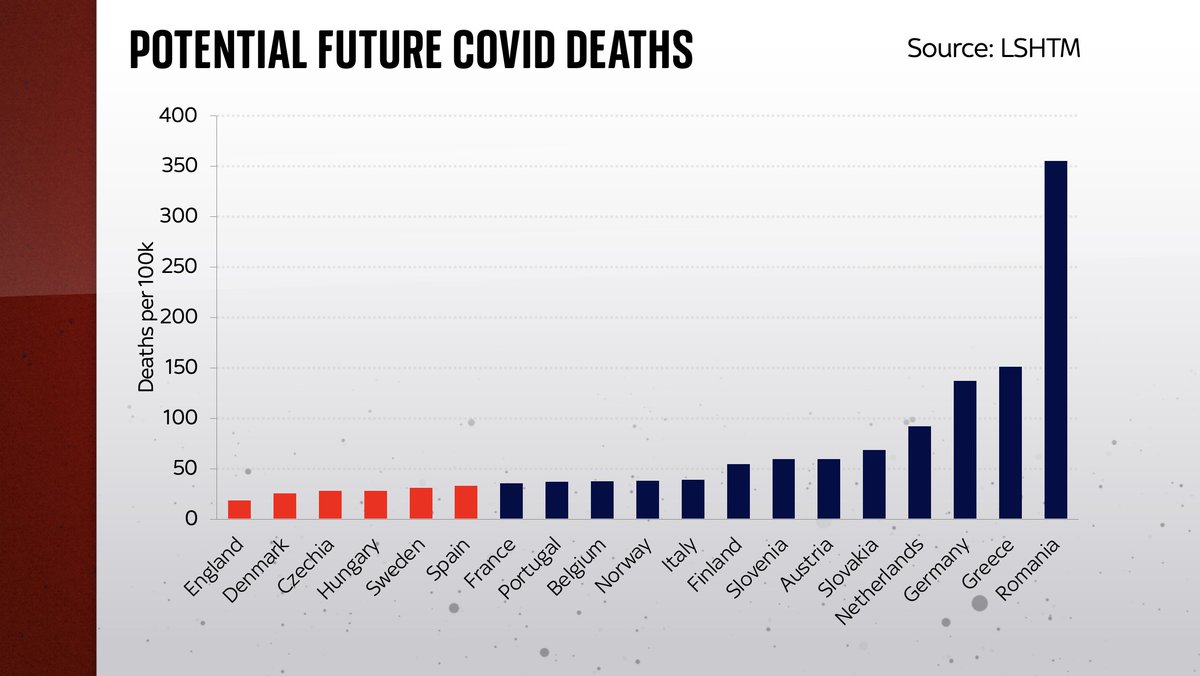

Some of the boffins at @LSHTM inc @Lloyd_Chapman_ & @AdamJKucharski have an intriguing paper out with some intriguing answers. They’ve looked at lots of factors from age breakdown to vaccine status to previous infections. Full thing here: medrxiv.org/node/433124.ex…

In short, and at the risk of oversimplifying, their model suggests that if Covid were to spread across the population now, there would be just over 10k deaths in England. Clearly more deaths is nothing to celebrate. But the level is strikingly low.

When you adjust for population, England faces the lowest “maximum remaining COVID-19 deaths” of any country the epidemiologists at @LSHTM looked at in Europe. Germany, Austria, the Netherlands and Romania, on the other hand, look v exposed.

Why is England's potential mortality so low here when, say, Germany is so high?

Mostly cos of vaccines.

Germany has more unvaccinated elderly people. So unvaccinated people (the red slice) is v v big in the German potential deaths numbers. V small in UK where so many are jabbed.

Mostly cos of vaccines.

Germany has more unvaccinated elderly people. So unvaccinated people (the red slice) is v v big in the German potential deaths numbers. V small in UK where so many are jabbed.

Do the @LSHTM numbers mean England/UK can relax this winter?

Let’s have a look.

Here are the deaths figs for the top 5 (eg most vulnerable) countries acc to their model. Indeed deaths are rising there quite sharply. Seems to bear out their analysis.

Let’s have a look.

Here are the deaths figs for the top 5 (eg most vulnerable) countries acc to their model. Indeed deaths are rising there quite sharply. Seems to bear out their analysis.

Now look at the countries with the lowest “potential deaths”. Most of them do indeed have low deaths numbers.

BUT now look at Czech rep and Hungary. Deaths are rising v sharply there despite the @LSHTM numbers implying they’re less vulnerable.

BUT now look at Czech rep and Hungary. Deaths are rising v sharply there despite the @LSHTM numbers implying they’re less vulnerable.

So the fact that England has a comparatively low level of modelled vulnerability doesn’t necessarily preclude a spike in deaths.

But this analysis is worth keeping in mind next time you hear someone shouting we’re just as vulnerable - or more vulnerable! - than our neighbours.

But this analysis is worth keeping in mind next time you hear someone shouting we’re just as vulnerable - or more vulnerable! - than our neighbours.

*deleted and corrected a tweet above which mixed up Hungary and Bulgaria. Apologies to all Hungarians and Bulgarians.

How many more people could die of Covid in this country? The answer, according to a new study, is strikingly low.

There are provisos aplenty; but there's also hope. Here's a longer explanation about the new study: news.sky.com/story/covid-19…

There are provisos aplenty; but there's also hope. Here's a longer explanation about the new study: news.sky.com/story/covid-19…

Here, for those who prefer their charts in video form, is a quick run through the numbers on how many people have died from #COVID19 and how high the toll could eventually get

https://twitter.com/skynews/status/1463528658618957830

• • •

Missing some Tweet in this thread? You can try to

force a refresh