This is a very weird market. Some of the recent IPOs doing well. Old gen stocks not so much. This doesn't augur that well really - needs a trigger to take it back up

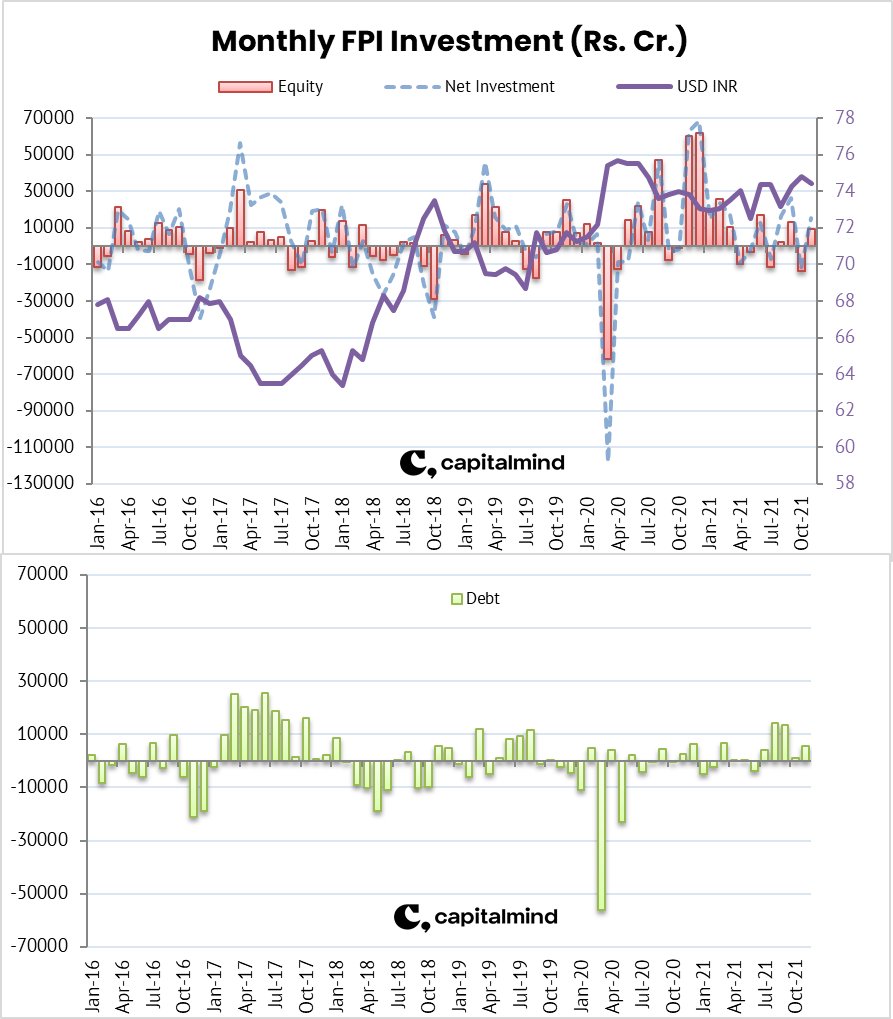

One look at the FII data, and god, they are selling like crazy, you would think. But THEY ARE NOT.

FPI data from NSDL (This is the accurate source, not the exchanges) shows that FIIs have put in a whopping 27,000 cr. into IPOs, while taking money out of other stocks.

FPI data from NSDL (This is the accurate source, not the exchanges) shows that FIIs have put in a whopping 27,000 cr. into IPOs, while taking money out of other stocks.

In fact FII investments in total have been very very high in 2021 with over 95,000 cr. invested. Biggest year for Debt since 2017.

• • •

Missing some Tweet in this thread? You can try to

force a refresh