Zee says there is no open offer in a merger - even if effectively Sony is adding cash to buy 53% of the entity that will be merged with Zee.

Is the AGM called off? Asks a caller

This call is for the merger, we cannot comment on whether the EGM called (by Invesco/Oppenheimer) will be called off.

Means those folks haven't been brought on board for the deal?

This call is for the merger, we cannot comment on whether the EGM called (by Invesco/Oppenheimer) will be called off.

Means those folks haven't been brought on board for the deal?

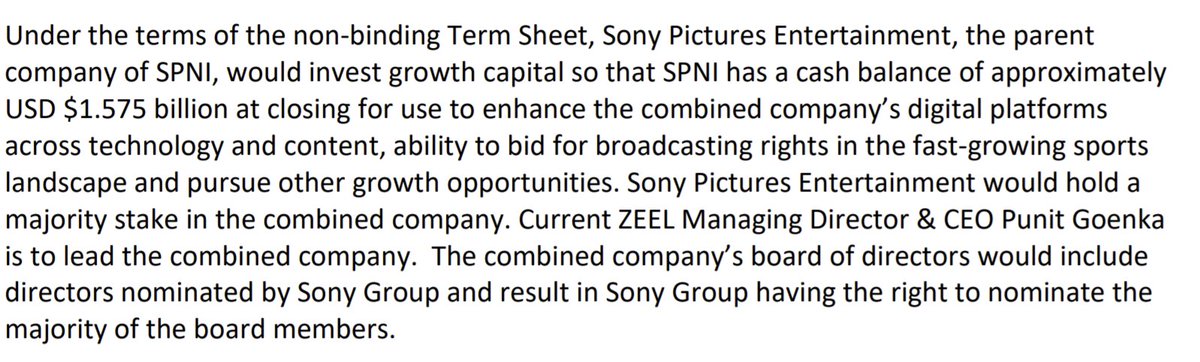

Valuation: Sony will add 1.6 billion roughly - so around 12,000 cr. - to Sony India, and then they merge, and then Sony will own 53% of the merged entity.

Yesterday's mcap of Zee was 24,000 cr. This means the current 24,000 cr. = 47% of eventual company.(contd)

Yesterday's mcap of Zee was 24,000 cr. This means the current 24,000 cr. = 47% of eventual company.(contd)

So post merger valuation is roundly 51,000 cr.

Meaning Sony india is valued at 27,000 cr - if Sony is adding Rs. 12,000 cr. that means the CURRENT Sony India is valued at 15,000 cr.

With the 30% upmove today, numbers are higher. But just saying.

Meaning Sony india is valued at 27,000 cr - if Sony is adding Rs. 12,000 cr. that means the CURRENT Sony India is valued at 15,000 cr.

With the 30% upmove today, numbers are higher. But just saying.

This is also interesting - Sony will add 12,000 cr., give the Sony India brand, and let Punit Goenka continue as chief for another 5 years?

We should perhaps hear from Sony about this.

We should perhaps hear from Sony about this.

The Sony deal will involves a transfer of about 2% from Sony to the promoters as a compensation for non-compete.

SEBI is quite likely to demand an open offer by Sony to remaining Zee shareholders (at least 26%) Because this is a defacto takeover of the company.

SEBI is quite likely to demand an open offer by Sony to remaining Zee shareholders (at least 26%) Because this is a defacto takeover of the company.

Sony press release is here: sony.com/en/SonyInfo/IR… Nicely worded such that: Clearly Sony is in control, reiterates that Punit Goenka is to lead for now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh