Northam Holdings is now the majority shareholder of Royal Bafokeng Platinum after acquiring 32.8% for R17bn.

Northam will settle R17bn by issue of ~34.4m Northam shares to RBH which is ~8.7% of Northam and R8.6bn in cash.

R3.6bn of the R8.6bn cash will be paid upfront.

Northam will settle R17bn by issue of ~34.4m Northam shares to RBH which is ~8.7% of Northam and R8.6bn in cash.

R3.6bn of the R8.6bn cash will be paid upfront.

A sale of shares agreement was entered into between Northam, Royal Bafokeng Holdings and Royal Bafokeng Investment Holding in terms of which Northam may acquire up to 33.3% of all the Royal Bafokeng Platinum ordinary shares in issue.

Northam bought 93 930 378 (32.8%) RBPlat shares from RBIH, for an aggregate purchase consideration of R17billion representing R180.50 per RBPlat share.

The R17bn was settled through a combination of the issue of ordinary shares of Northam Holdings and cash.

The R17bn was settled through a combination of the issue of ordinary shares of Northam Holdings and cash.

Northam Holdings, Royal Bafokeng Holdings (RBH and Royal Bafokeng Investment Holding (RBIH) have also entered into a put and call option arrangement (RBIH Put and Call) in terms of which Northam may acquire a further 0.5% of the RBPlat's shares for R135 per RBPlat share.

Implats announced first that it has entered into negotiations with RBH.

What delayed things between Royal Bafokeng Platinum and Implats was the (split) purchase consideration - cash and/or equity- payable by Implats.

RBH owns 40.2% of RBPlat.

What delayed things between Royal Bafokeng Platinum and Implats was the (split) purchase consideration - cash and/or equity- payable by Implats.

RBH owns 40.2% of RBPlat.

https://twitter.com/MaanoMadima/status/1453269744287633410?t=jdBS0Aw8XhHsaH8jrOZdVQ&s=19

Impala Platinum (Implats) lost out big here. 🤞🏿

Implats and Royal Bafokeng Nation share a very long and complicated history that involved, among many things, a royalties-equity swap that led to Royal Bafokeng Nation owning 13.2% of Implats.

Implats and Royal Bafokeng Nation share a very long and complicated history that involved, among many things, a royalties-equity swap that led to Royal Bafokeng Nation owning 13.2% of Implats.

Let's start here.

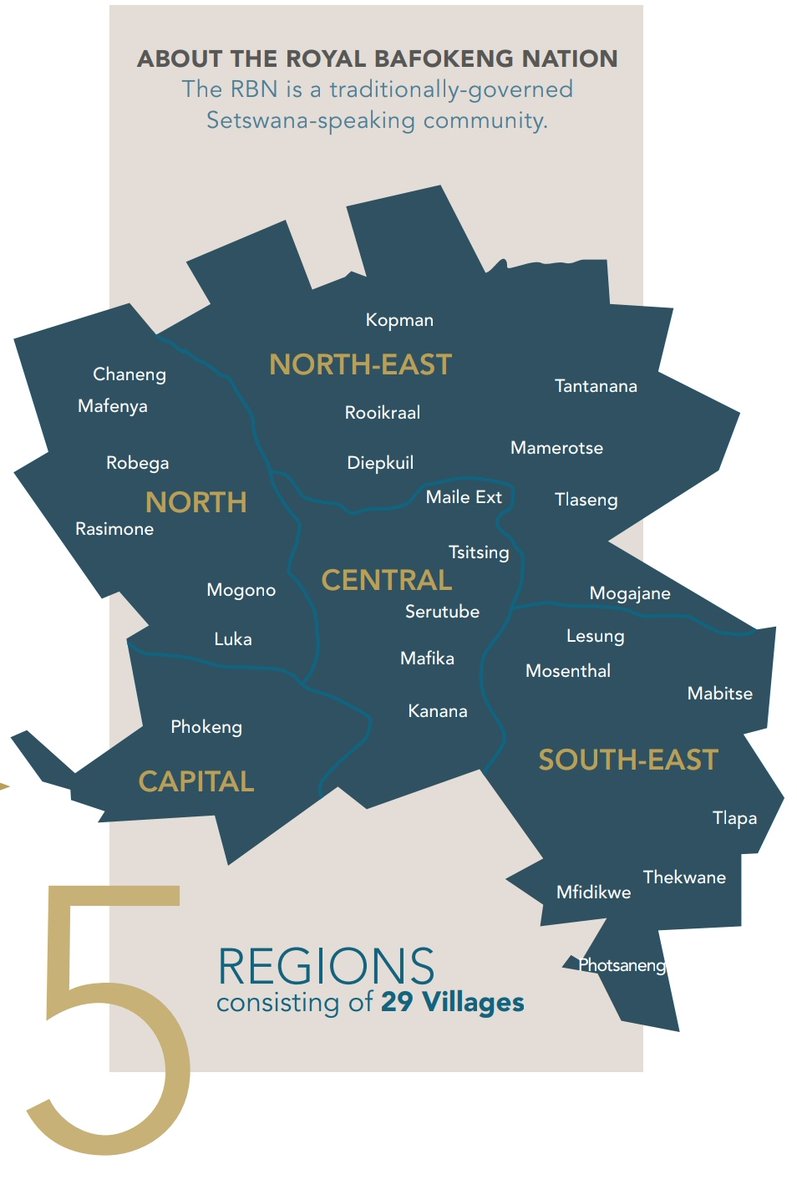

The Royal Bafokeng Nation owns and inhabits +-1 200km2 of land in the Rustenburg Valley, which is home in the North West Province.

Royal Bafokeng Nation holds various mineral and mining rights and

investments mainly in PGMs and ferrochrome.

The Royal Bafokeng Nation owns and inhabits +-1 200km2 of land in the Rustenburg Valley, which is home in the North West Province.

Royal Bafokeng Nation holds various mineral and mining rights and

investments mainly in PGMs and ferrochrome.

2003, Notarial Mineral Lease was entered into between the Royal Bafokeng Nation, Minister of Land Affairs

and Impala Platinum.

Royal Bafokeng Nation leased to Impala Platinum the exclusive

right of prospecting and/or mining for certain minerals in, on and under the Lease Area.

and Impala Platinum.

Royal Bafokeng Nation leased to Impala Platinum the exclusive

right of prospecting and/or mining for certain minerals in, on and under the Lease Area.

The terms of the Notarial Mineral Lease provided for payment of the initial royalty and an increase in the annual royalty to Royal Bafokeng Nation of 22% of taxable income from the Lease Area, subject to a minimum of 1% of the gross selling price of PGMs from the Lease Area.

Simultaneously with the entering into of the NML, Royal Bafokeng Nation acquired a 1.3% stake in Implats for R98.2m which it paid in cash.

Royal Bafokeng Nation also gained the right to nominate a director to the board of Implats.

Royal Bafokeng Nation also gained the right to nominate a director to the board of Implats.

In 2007, Implats decided that it will pay all royalties due and payable to Royal Bafokeng Nation for the 31-year period from July 1 2007 to the last day of the lease period being 30 June 2038, valued at R10.6 billion.

Impala Platinum paid an amount of R10,58bn to the Royal Bafokeng Nation in cash in respect

of all royalties outstanding.

R10.58bn was calculated using an exchange rate of $1:R7.50, a platinum price of between $900/oz-$1 000/oz and a palladium price of between $250/oz-$300/oz.

of all royalties outstanding.

R10.58bn was calculated using an exchange rate of $1:R7.50, a platinum price of between $900/oz-$1 000/oz and a palladium price of between $250/oz-$300/oz.

As this was a royalties-equity swap,

Royal Bafokeng Nation used the R10.58bn to subscribe for 9.39m shares in Implats.

Royal Bafokeng Nation owned 1.3% of Implats at the time of this transaction.

The complexity didn't stop there.

Royal Bafokeng Nation used the R10.58bn to subscribe for 9.39m shares in Implats.

Royal Bafokeng Nation owned 1.3% of Implats at the time of this transaction.

The complexity didn't stop there.

Royal Bafokeng Nation, through Royal Bafokeng Impala Investment Holding (RBIIH) and Royal Bafokeng Tholo Investment Holding (RBTIH), subscribed for the 75 115 200 (12.1%) Implats shares as

follows:

RBIIH: 56,556,208 Implats shares and

RBTIH: 18,558,992 Implats shares.

follows:

RBIIH: 56,556,208 Implats shares and

RBTIH: 18,558,992 Implats shares.

Based on a closing price of R1,290 per Implats share as of 22 Sept 2006, value of the shares subscribed for by RBIIH and RBTIH was R12.1 billion.

Difference between R12.1bn and R10.6bn was a discount of R1.5bn which was reflected in Implats’ income

statement as a BEE charge.

Difference between R12.1bn and R10.6bn was a discount of R1.5bn which was reflected in Implats’ income

statement as a BEE charge.

The net effect of the royalties-equity swap was that Impala Platinum discharged its obligation to pay royalties periodically to

the Royal Bafokeng Nation from 1 July 2007 and the Royal Bafokeng Nation obtained 13.4% of the fully diluted issued ordinary share capital of Implats.

the Royal Bafokeng Nation from 1 July 2007 and the Royal Bafokeng Nation obtained 13.4% of the fully diluted issued ordinary share capital of Implats.

Implats had a conditional right to repurchase from the Royal Bafokeng Nation 2.5m of the 75.116m Implats shares.

Royal Bafokeng Impala Investment Holding (RBIIH) and Royal Bafokeng Tholo Investment Holding (RBTIH) were locked in couldn't sell any of the shares before 31 May 2014

Royal Bafokeng Impala Investment Holding (RBIIH) and Royal Bafokeng Tholo Investment Holding (RBTIH) were locked in couldn't sell any of the shares before 31 May 2014

Implats had a conditional right to repurchase from the Royal Bafokeng Nation 2.5m of the 75.116m Implats shares.

Royal Bafokeng Impala Investment Holding (RBIIH) and Royal Bafokeng Tholo Investment Holding (RBTIH) were locked in couldn't sell any of the shares before 31 May 2014

Royal Bafokeng Impala Investment Holding (RBIIH) and Royal Bafokeng Tholo Investment Holding (RBTIH) were locked in couldn't sell any of the shares before 31 May 2014

Royal Bafokeng Holdings has since sold its entire 13.2% stake in Implats.

2015 - Implats’ share placement dilutes RBH’s stake to 11.3%,

2016 - RBH sells 5% stake of

Implats and

2018 - RBH sells remaining 6.3% stake in Implats and used the proceeds to reduce its debt

by 30%.

2015 - Implats’ share placement dilutes RBH’s stake to 11.3%,

2016 - RBH sells 5% stake of

Implats and

2018 - RBH sells remaining 6.3% stake in Implats and used the proceeds to reduce its debt

by 30%.

There was a time when 80% of Royal Bafokeng Holdings' income was from royalty payments.

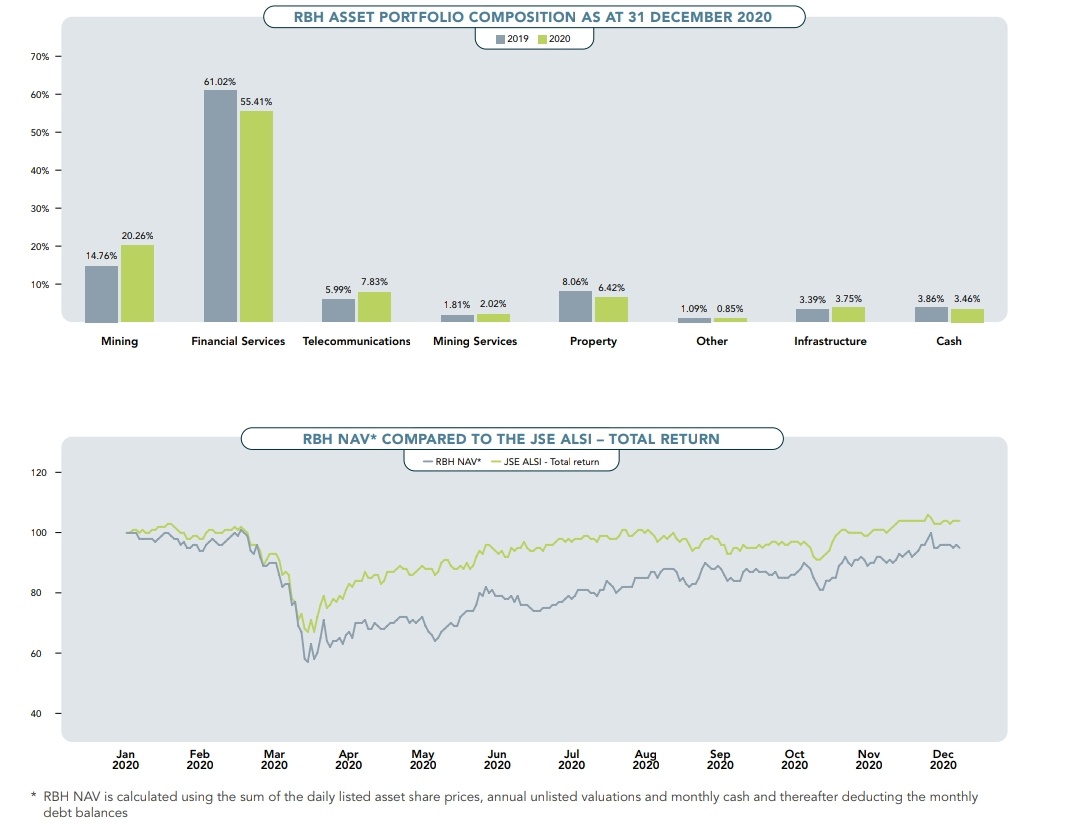

RBH has diversified over the years and is moving away from mining.

It has received R12.5bn in dividends since its formation in 2006.

As at 31 Dec 2020, RBH’s net asset value was R29bn.

RBH has diversified over the years and is moving away from mining.

It has received R12.5bn in dividends since its formation in 2006.

As at 31 Dec 2020, RBH’s net asset value was R29bn.

• • •

Missing some Tweet in this thread? You can try to

force a refresh