Mondelez International (owns Oreo, Cadbury) will soon close a deal that will see it buy all or part of AVI (owns Spitz, Bakers, Five Roses).

International barbarians are at the gates SA listed companies.

Recent acquisitions include;

Afrox

Imperial

Clover

Pioneer Foods

SABMiller

International barbarians are at the gates SA listed companies.

Recent acquisitions include;

Afrox

Imperial

Clover

Pioneer Foods

SABMiller

The acquisition of AVI could lead to its delisting from the JSE.

JSE is bleeding companies.

In 1999, JSE had 811 companies listed on the main board.

It now has less than ~325 listings.

15 companies delisted from the main board in H1 2021 with 10 more coming in H2.

JSE is bleeding companies.

In 1999, JSE had 811 companies listed on the main board.

It now has less than ~325 listings.

15 companies delisted from the main board in H1 2021 with 10 more coming in H2.

Neil Froneman, CEO of Sibanye-Stillwater caused a stir when he suggested that Sibanye, Gold Fields and AngloGold Ashanti should consolidate and create a world champion gold business or risk being bought by foreign entities because of their relatively low valuations.

These foregin based consortiums (Private Equity firms) have deep pockets.

From the takeovers we have seen, these buyers offer serious premiums.

SA investors lick their lips when a takeover offer is tabled because they know that the "premium" is going to be high.

From the takeovers we have seen, these buyers offer serious premiums.

SA investors lick their lips when a takeover offer is tabled because they know that the "premium" is going to be high.

The potential acquisition of AVI by Mondelez is another example of international barbarians at the gates of South African companies.

These firms are on a shopping spree with their eyes set on SA companies.

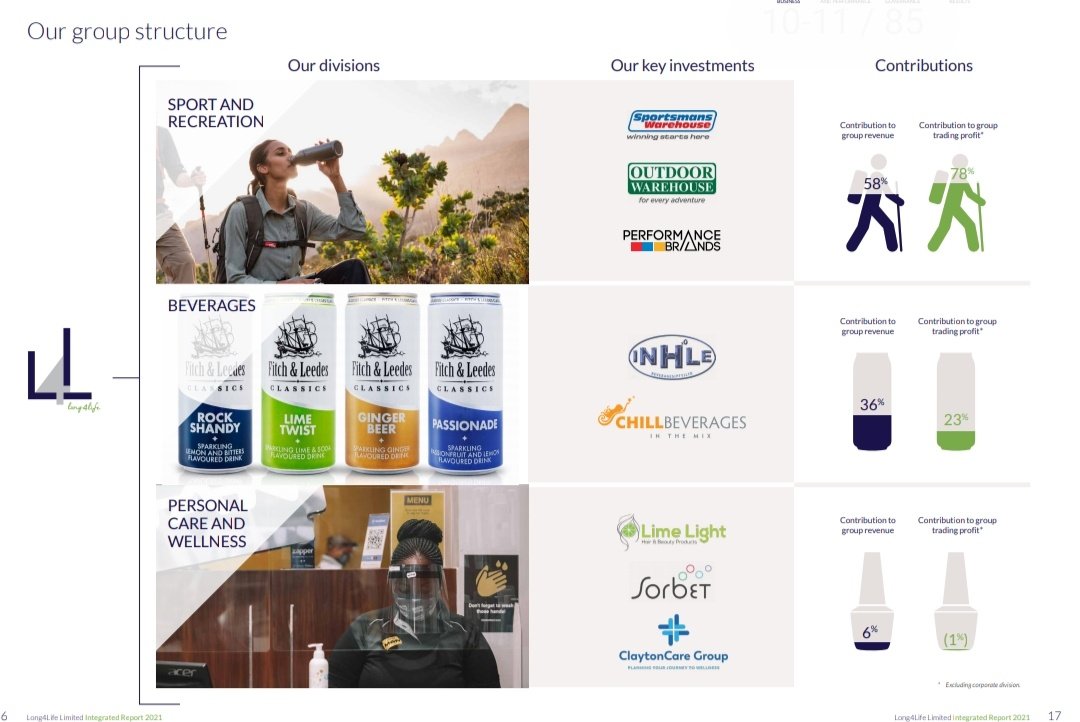

Quick look at some takeover and subsequent distlings over the years.

These firms are on a shopping spree with their eyes set on SA companies.

Quick look at some takeover and subsequent distlings over the years.

1) Nov 2021, Heineken NV concluded a deal to buy Distell for R38.5bn. Distell's market cap is R37.2bn.

Remgro and PIC have a total economic interest of ~31,4% and ~31,7%, with Remgro having 56% voting rights and PIC has 20,3% voting rights in Distell

Remgro and PIC have a total economic interest of ~31,4% and ~31,7%, with Remgro having 56% voting rights and PIC has 20,3% voting rights in Distell

https://twitter.com/MaanoMadima/status/1460155349734940675?t=nRABNuos9JlsYtWmrnbvnQ&s=19

2) 2020, a German entity by the name Linde Group took over Afrox (African Oxygen) and delisted it.

Linde has scored big here as Afrox has a contract to supply govt healthcare facilities in KZN, FS, NW & MP. Afrox will supply more than 400 hospitals and 1,600 clinics across SA.

Linde has scored big here as Afrox has a contract to supply govt healthcare facilities in KZN, FS, NW & MP. Afrox will supply more than 400 hospitals and 1,600 clinics across SA.

The Linde Group owned a 50.47% stake in Afrox and made an offer to buy the shares of the Afrox that it did not already own.

The offer by the Linde Group represented a premium of 58.2% to Afrox's adjusted 30-day volume weighted average price (VWAP) of Afrox shares as at Oct 15.

The offer by the Linde Group represented a premium of 58.2% to Afrox's adjusted 30-day volume weighted average price (VWAP) of Afrox shares as at Oct 15.

3) DP World will be taking over Imperial Logistics after it made an offer to acquire all of the issued ordinary shares in Imperial for a cash consideration of R66/share (premium of 39.5% to Imperial share price as at 7 Jul).

Total cash of R12.7 bn.

Imperial will be delisted.

Total cash of R12.7 bn.

Imperial will be delisted.

4) Metrofile is (was) on the verge of leaving the JSE with a takeover offer from an American private equity group, Housatonic Consortium.

Housatonic made R3,30/share offer in 2019 which valued the deal at R1.5bn, an 18% premium on the company's R1.27bn market cap at the time.

Housatonic made R3,30/share offer in 2019 which valued the deal at R1.5bn, an 18% premium on the company's R1.27bn market cap at the time.

5) Adapt IT is going to Volaris after Volaris beat the Huge Group and will be delisted.

https://twitter.com/MaanoMadima/status/1442849166661664772?t=zKY8wWqyyoD0BR7WEopn3w&s=19

6) Clover was bought out a Milco which is a consortium led by Israel-based Central Bottling Company.

Clover shareholders were offered R25/share which was a 25% premium and valued Clover at R4.8bn.

Clover shareholders were offered R25/share which was a 25% premium and valued Clover at R4.8bn.

7) Pepsico bought Pioneer Foods in a mega deal worth R26 billion.

How it went was that, Simba (Pty) Ltd, an indirect subsidiary of PepsiCo Inc acquired the entire issued share capital, excluding shares held by subsidiary companies, of Pioneer.

How it went was that, Simba (Pty) Ltd, an indirect subsidiary of PepsiCo Inc acquired the entire issued share capital, excluding shares held by subsidiary companies, of Pioneer.

The offer by PepsiCo offer of R110 a share was more than 50% of the value of Pioneer Foods’ shares in the month preceding the offer.

The deal is one of PepsiCo's biggest investments outside the US.

Pioneer Foods is the maker of Weet-Bix, Liqui Fruit, and Sasko and Bokomo.

The deal is one of PepsiCo's biggest investments outside the US.

Pioneer Foods is the maker of Weet-Bix, Liqui Fruit, and Sasko and Bokomo.

8) The biggest to date.

AB InBev took over SABMiller in a R1.64trillion deal.

On a per share, the final offer was £45 a share which was more than 50% above the share price before the deal.

Before SAB delisted, it's weighting in the FTSE/JSE top 40 index was 12.7%.

AB InBev took over SABMiller in a R1.64trillion deal.

On a per share, the final offer was £45 a share which was more than 50% above the share price before the deal.

Before SAB delisted, it's weighting in the FTSE/JSE top 40 index was 12.7%.

SABMiller’s market cap in 2016 was around R1.3 trillion and accounted for ~8.6% of the JSE’s total market cap and ~5.3% of the R24.3bn in daily trading.

AB InBev hasn't shot the lights out since the 2016 takeover.

AB InBev hasn't shot the lights out since the 2016 takeover.

AB InBev's acquisition of SABMiller ended the corporate use of the name SABMiller and it ceased trading on the JSE, London Stock Exchange and became a business division of Anheuser Busch Inbev.

AB InBev listed on the JSE at a price of R1,938 in 2016. The stock has since ⬇️ 54% to R890.

AB InBev loaded its balance sheet with so much debt to make the takeover of SABMiller possible.

AB InBev is carrying $106bn in debt taken on to pay for the deal.

AB InBev loaded its balance sheet with so much debt to make the takeover of SABMiller possible.

AB InBev is carrying $106bn in debt taken on to pay for the deal.

How is AB InBev dealing with the debt pile?

Between 2016 and 2019, AB InBev has sold off parts of SABMiller worth nearly 1/3 of the SABMiller’s enterprise value of $122.5bn. AB InBev has lost ~50% of the $7.1bn in EBITDA that it acquired through SABMiller.

Between 2016 and 2019, AB InBev has sold off parts of SABMiller worth nearly 1/3 of the SABMiller’s enterprise value of $122.5bn. AB InBev has lost ~50% of the $7.1bn in EBITDA that it acquired through SABMiller.

AB InBev scored big.

In 2001, SABMiller and Castel reached a strategic alliance which saw SABMiller take a 20% stake in Castel beer and soft drinks operations in Africa.

In return, Castel acquired a 38% stake in SABMiller’s Africa subsidiary.

In 2001, SABMiller and Castel reached a strategic alliance which saw SABMiller take a 20% stake in Castel beer and soft drinks operations in Africa.

In return, Castel acquired a 38% stake in SABMiller’s Africa subsidiary.

As part of the conditions to approve the merger of AB InBev with SABMiller, the Competition Tribunal required AB InBev to dispose of its 26.4% Distell shareholding.

26.4% was sold to the Public Investment Corporation, acting on behalf of the Government Employees Pension Fund.

26.4% was sold to the Public Investment Corporation, acting on behalf of the Government Employees Pension Fund.

AB InBev also made another disposal.

This time, it was the sale of its (SABMiller’s) 54.5% equity stake in Coca-Cola Beverages Africa.

See quoted tweet for more on Coca-Cola Beverages Africa and the potential for it to list on the JSE soon.

This time, it was the sale of its (SABMiller’s) 54.5% equity stake in Coca-Cola Beverages Africa.

See quoted tweet for more on Coca-Cola Beverages Africa and the potential for it to list on the JSE soon.

https://twitter.com/MaanoMadima/status/1448952413646376963?t=vG2iwoHavyQncgTi_ONFuA&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh