What is HEIKIN ASHI i and How You

Use it ?

A Small Thread

Understand New type of Price Representation on charts.

Maximum Retweet and Share !

1/n

@kuttrapali26 @rohanshah619

Use it ?

A Small Thread

Understand New type of Price Representation on charts.

Maximum Retweet and Share !

1/n

@kuttrapali26 @rohanshah619

What is Heikin Ashi?

1. Heikin-Ashi, also called Heiken-Ashi, is translated as an "average bar" in Japanese.

2. The Heikin Ashi strategy is a useful tool used in identifying market trends and

predicting the future prices of assets.

2/N

1. Heikin-Ashi, also called Heiken-Ashi, is translated as an "average bar" in Japanese.

2. The Heikin Ashi strategy is a useful tool used in identifying market trends and

predicting the future prices of assets.

2/N

3. The Heikin Ashi can be used alone or in conjunction with candlestick charts.

4. These charts can be very useful as they make it easier to read candlestick charts

and analyze market trends , without noise

3/n

4. These charts can be very useful as they make it easier to read candlestick charts

and analyze market trends , without noise

3/n

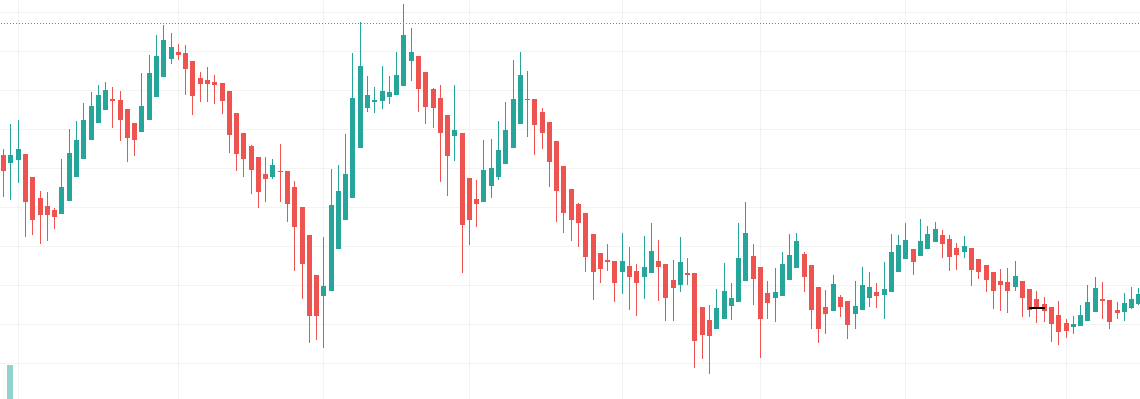

Heikin Ashi vs Candlestick

1. The Heikin Ashi has a few differences with the traditional candlestick chart.

The candles on traditional candlesticks usually change from green to red (up or

down), making it difficult for some traders to interpret.

Candlestick vs Heikin Ashi chart

1. The Heikin Ashi has a few differences with the traditional candlestick chart.

The candles on traditional candlesticks usually change from green to red (up or

down), making it difficult for some traders to interpret.

Candlestick vs Heikin Ashi chart

2.However, the candles on a Heikin Ashi chart display more consecutive colored

candles, making it easy for traders to identify past price movements and current

trends.

3. With Heikin Ashi, charts usually stay green in an uptrend and red in a downtrend.

Calcluation Shared

5/n

candles, making it easy for traders to identify past price movements and current

trends.

3. With Heikin Ashi, charts usually stay green in an uptrend and red in a downtrend.

Calcluation Shared

5/n

How to Use Heikin Ashi to Identify Trends and Trend Strength

1. Because Heikin Ashi candlesticks are calculated using averages, the candlesticks

have smaller shadows or wicks compared to the regular candlesticks.

6/n

1. Because Heikin Ashi candlesticks are calculated using averages, the candlesticks

have smaller shadows or wicks compared to the regular candlesticks.

6/n

2.However, similar to the regular candlesticks, the smaller or shorter the shadow or wick in

Heikin Ashi, the stronger the trend.

7/n

Heikin Ashi, the stronger the trend.

7/n

3. Heiken Ashi is designed to show you the direction of a trend with the help of its

color-coded candles. A green candle indicates that the trend is up, while a red

candle is a sign that the trend is down.

8/n

color-coded candles. A green candle indicates that the trend is up, while a red

candle is a sign that the trend is down.

8/n

4. Green candles without upper shadows show a strong uptrend, while red candles

without lower shadows indicate a strong downtrend.

9/n

without lower shadows indicate a strong downtrend.

9/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh