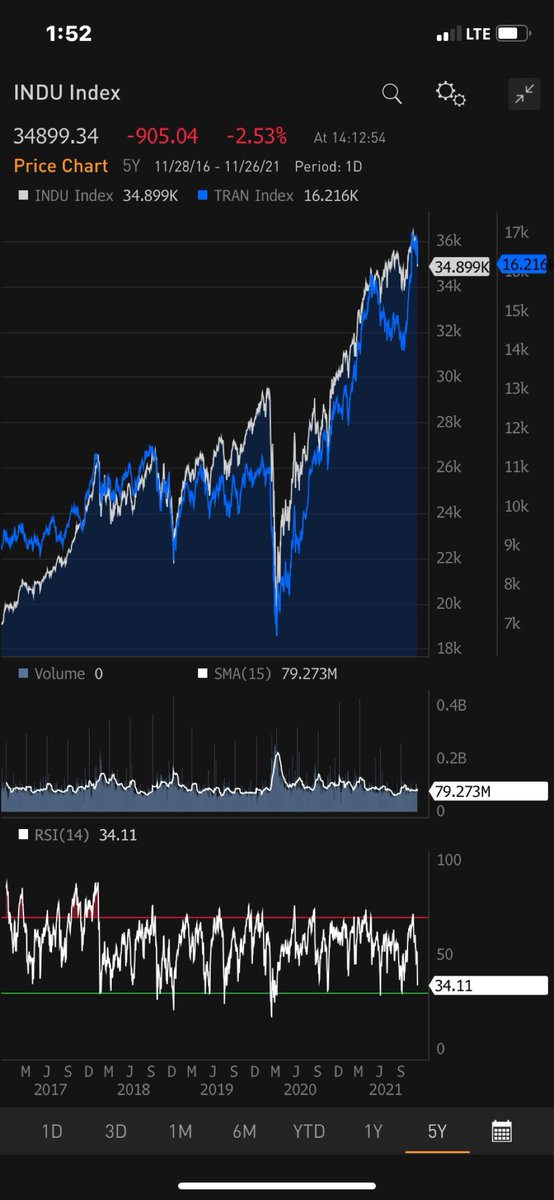

It’s Friday afternoon, first meal of turkey leftovers (turkey cream of cauliflower soup) in the belly… and pondering Dow Theory. Most technicians are aware of the idea to watch divergences between INDU and TRAN as we saw in the lead up to March 2020… or March 2000

3/n there’s a bit of a collision of worlds at play… it turns out that the reason the TRAN hit new highs is due to a single meme stock: $CAR (Avis). In fact, ex Avis the TRAN has turned down from a lower high and broadly the index constituents are lagging badly

4/4 While I don’t have the data in front of me, I’d hypothesize a similar dynamic for the now failed R2000 breakout as $AMC is the largest stock in the index now. So the unresolved question becomes “Did the TRAN make a new high or not?” And if not, Dow Theory suggests caution.

https://twitter.com/profplum99/status/1464302593052610564

• • •

Missing some Tweet in this thread? You can try to

force a refresh