The Heikin Ashi Trading Strategy !

A thread for Swing and Positional Traders who love Reversals !

Retweet And Share 🔄

@kuttrapali26 @AmitabhJha3

A thread for Swing and Positional Traders who love Reversals !

Retweet And Share 🔄

@kuttrapali26 @AmitabhJha3

What is Heikin Ashi ?

Go through this Tweet for complete understanding

1/n

Go through this Tweet for complete understanding

https://twitter.com/JayneshKasliwal/status/1463811861053259778?s=20

1/n

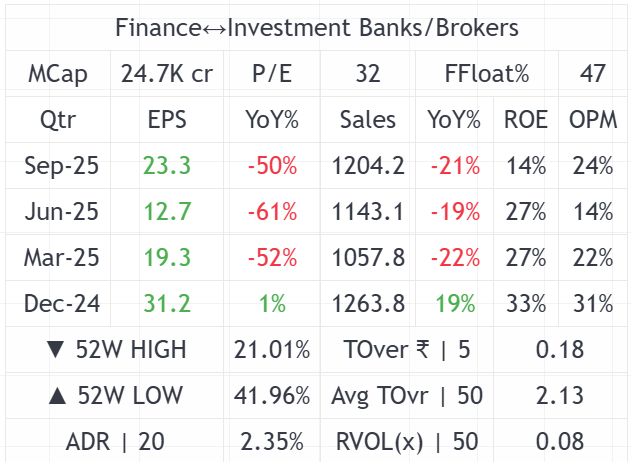

Tools used

1. HeikinAshi charts

2. 200 ema (black)for Dynamic support and reversal point

3. 21 ema(red) for trailing stop loss

4. Volumes

5. Your own confirmations and modification

2/n

1. HeikinAshi charts

2. 200 ema (black)for Dynamic support and reversal point

3. 21 ema(red) for trailing stop loss

4. Volumes

5. Your own confirmations and modification

2/n

Strategy:

200 ema is very important line of support on daily time frame .

Most reversals occur on this area of junction and stock further decides its trend from this point

Mostly stock consolidates near this area beore further move

Example : Breakdown Vs Reversal

3/n

200 ema is very important line of support on daily time frame .

Most reversals occur on this area of junction and stock further decides its trend from this point

Mostly stock consolidates near this area beore further move

Example : Breakdown Vs Reversal

3/n

1. Heikin Ashi candle shows the trend of a stock

2. Once we get confirmation of 2 Strong Green candles with full body a long trade can be created upon the closing above 200 ema

3. For further confirmation you can use Volume Spikes ,Macd or Relative Strength for filteration

4/n

2. Once we get confirmation of 2 Strong Green candles with full body a long trade can be created upon the closing above 200 ema

3. For further confirmation you can use Volume Spikes ,Macd or Relative Strength for filteration

4/n

1.200 ema is very important line for support and a stock should be closely watched at that junction .

2 In #bhel we can see how the price bounced back after 2 confirmation green candles.

3. The stock bounced 40% till top before dropping off.

4. Now again approaching 200 ema

5/n

2 In #bhel we can see how the price bounced back after 2 confirmation green candles.

3. The stock bounced 40% till top before dropping off.

4. Now again approaching 200 ema

5/n

Similar Chart : #coalindia

Fresh Reversals

1. 21 ema can be used as trailing Stop loss in such cases to ride the trend

2. One can use Risk Reward of minimum 1:2 for targets.

3. The Rewards will be very high compared to risk .

4. One can maximum have stop at 8%.

6/n

Fresh Reversals

1. 21 ema can be used as trailing Stop loss in such cases to ride the trend

2. One can use Risk Reward of minimum 1:2 for targets.

3. The Rewards will be very high compared to risk .

4. One can maximum have stop at 8%.

6/n

Fresh Buying and confirmation of reversal:

#piind closed above 200 ema and above support area.

This is a high probabilty setup for buying as we see volume also picking up and Rs is increasing.

You have to modify this with your own strategy and check what suits you.

7/n

#piind closed above 200 ema and above support area.

This is a high probabilty setup for buying as we see volume also picking up and Rs is increasing.

You have to modify this with your own strategy and check what suits you.

7/n

21 ema resistance :

Sometimes if the 21 ema is close to 200 ema and stock is bouncing you need to get confirmation closeabove 21 ema for safety .

Many times stocks will take resistance at this are and fall again.

Best confirmation is volume spikes above 200 ema

Examples :

8/n

Sometimes if the 21 ema is close to 200 ema and stock is bouncing you need to get confirmation closeabove 21 ema for safety .

Many times stocks will take resistance at this are and fall again.

Best confirmation is volume spikes above 200 ema

Examples :

8/n

Potential Buy #LAURUS #NILKAMAL #THYROCARE Obviously after confirmation .

#Laurus and #nilkmal looks good for fresh upsde as they both held well in falling market

9/n

#Laurus and #nilkmal looks good for fresh upsde as they both held well in falling market

9/n

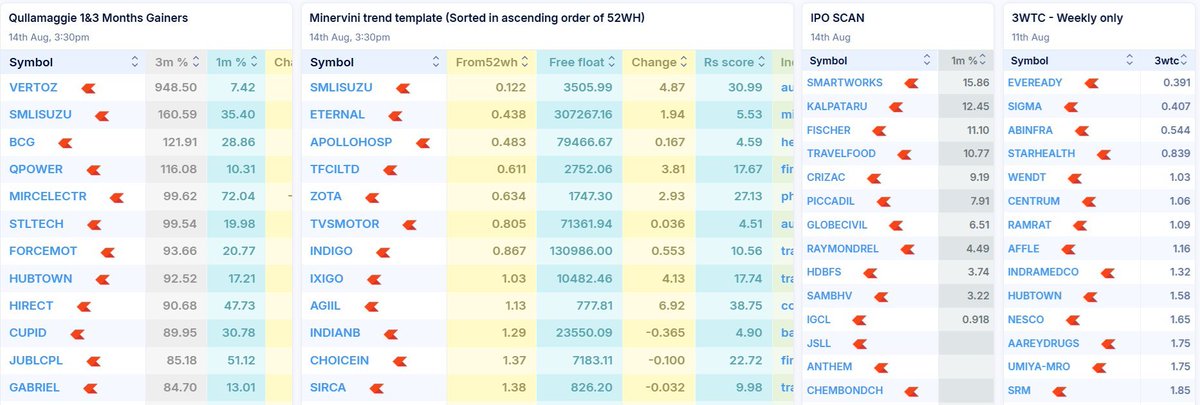

Screener To find such stocks that have given heikinashi close above 200 ema. chartink.com/screener/200-e…

Modify this by putting more filters according to your own rules !

#stocks

@caniravkaria @Stockstudy8

Modify this by putting more filters according to your own rules !

#stocks

@caniravkaria @Stockstudy8

To join our private group for free

app.cosmofeed.com/view_group/618…

To join free telegram group

t.me/Techno_charts

app.cosmofeed.com/view_group/618…

To join free telegram group

t.me/Techno_charts

• • •

Missing some Tweet in this thread? You can try to

force a refresh