When doing a Trading Performance review at the end of the day, ask yourself:

1) Was my stock selection systematic, or did I impulsively select the stock?

2) did I have a realistic stop loss BEFORE taking the trade?

3) did I have a realistic target area BEFORE taking the trade?

1) Was my stock selection systematic, or did I impulsively select the stock?

2) did I have a realistic stop loss BEFORE taking the trade?

3) did I have a realistic target area BEFORE taking the trade?

https://twitter.com/legend2_o/status/1461165174275018754

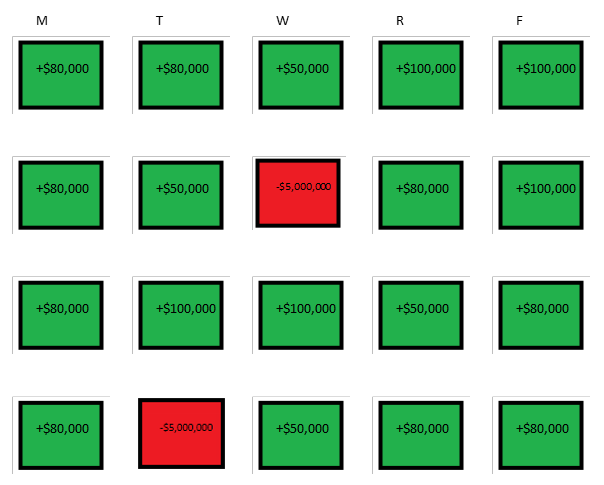

4) was my size calculated BEFORE the trade, in accordance with my risk management system? or did I randomly estimate what size to use?

5) did I have a systematic ENTRY or did I get in at some random ass area due to FOMO?

Do this for EVERY trade u took that day. Then overtime,

5) did I have a systematic ENTRY or did I get in at some random ass area due to FOMO?

Do this for EVERY trade u took that day. Then overtime,

you'll see where most of your losses or stubborn trades come from. Is it #1? #3 ? #5? which of those 5 points leads to 80% of your losses (Pareto Principle) ? is it entries? exits? size? trade selection? it's different for everyone since we're all stubborn in different ways.

For most traders, for every 10 mistakes we make, it's usually the same top 1-2 that make up the vast majority of our losses. So identify what those top 2 bad habits are, and purge them. Read my tweets on the pareto principle (80/20 rule) for more details.

#BearTipOfTheDay

#BearTipOfTheDay

• • •

Missing some Tweet in this thread? You can try to

force a refresh