Technicals tell me WHEN to slam the bid. Fundamentals tell me how hard. DMs are open. #BearTipOfTheDay for FAQs. NOT a licensed professional.Tweets are opinions

103 subscribers

How to get URL link on X (Twitter) App

We got the afternoon trendbreak / late day offering !!! LFGGGG

We got the afternoon trendbreak / late day offering !!! LFGGGG

🏈 Late day fade kicking in ?? 👀 twitter.com/i/web/status/1…

🏈 Late day fade kicking in ?? 👀 twitter.com/i/web/status/1…

https://twitter.com/Hollow_Trades/status/1580991348244566016High overall IQ can actually buttfuck u in trading b/c:

https://twitter.com/adam83521/status/1567317984707846144You think the smartest people in the market see a piece of shit stock literally one foot away from getting delisted gap up 100% on crap news and think "yeah this is a great buy. Dear broker, fill me in at the very top please" ?

Im in the middle of a 3 month $TWTR break that's supposed to end in september (football season). We were at the half year mark (june) and I already hit 50% completion of 2022 trading goals, but was way, WAY behind on 2022 family (vacations & travels), fitness, and business goals.

Im in the middle of a 3 month $TWTR break that's supposed to end in september (football season). We were at the half year mark (june) and I already hit 50% completion of 2022 trading goals, but was way, WAY behind on 2022 family (vacations & travels), fitness, and business goals.

https://twitter.com/team3dstocks/status/1496976601036337152why do you think bad news seems to ALWAYS happen when the market is already in a heavy downtrend? or why good news seems to always happen when stocks are already uptrending? when they're short MASSIVE positions, they need u fuckers to panic sell so they can cover.

https://twitter.com/IHaveBorrows/status/1496960240272687104That's why a lot of times, when a move goes directly in my favor without a pullback or bounce, you see me tweet/complain "fuck, I was only on starter size" or "fuck, I didn't get to add the rest" etc. I ALWAYS break up my orders & drop Mjolnir only when EVERYTHING lines up

https://twitter.com/Kieran7731/status/1496958014598881290For every 1 "pReDiCtiOn" that comes true there is another 5 that failed. So we can sit here & talk advanced fundamentals and stats all day long, trust me, I can go full nerd mode when it comes to that, and i have spreadsheets GALORE. But NONE of that matters when u trade momentum

It gets worse 😂. It’s official, im having her bet with real money next year

It gets worse 😂. It’s official, im having her bet with real money next year

https://twitter.com/renszszs/status/1466107321323503621Also dont think "FiNe iLL jUst uSe a MeNtAl StoP tHeN".

https://twitter.com/legend2_o/status/14611651742750187544) was my size calculated BEFORE the trade, in accordance with my risk management system? or did I randomly estimate what size to use?

https://twitter.com/brighterside11/status/14564392374279495692) depends. if u're talking lowfloats then of course, i NEVER ever short a lowfloat stock without digging into its filings & fundamentals first. Too much edge there not to, plus it saves me from getting trapped on "agenda plays" like freedom price setups or planned offerings etc

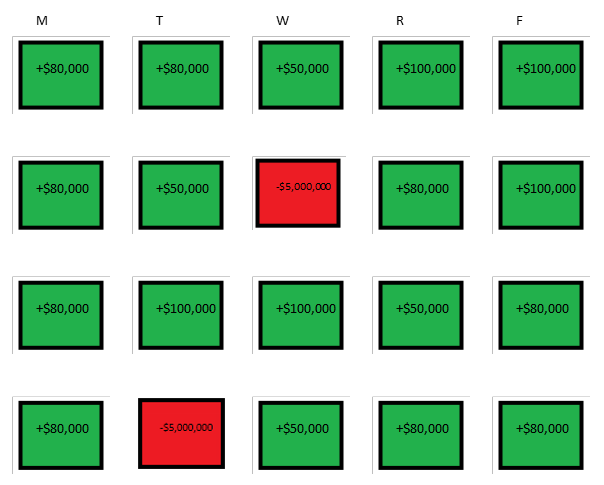

Meanwhile the reality is THIS.

Meanwhile the reality is THIS.

@_spikeet My spreadsheets had 10-30+ columns per ticker (row) depending on what I was tracking.

@_spikeet My spreadsheets had 10-30+ columns per ticker (row) depending on what I was tracking.https://twitter.com/Looktrades/status/1447991633287524357and where to most ppl place their stops? around basic ass support/resistance levels & round numbers. That's why basic S/R levels actually fail WAY more than they hold. Ppl just have confirmation bias & only focus on the few times that they work, then say "sEe? iT rEjEcTeD hErE"