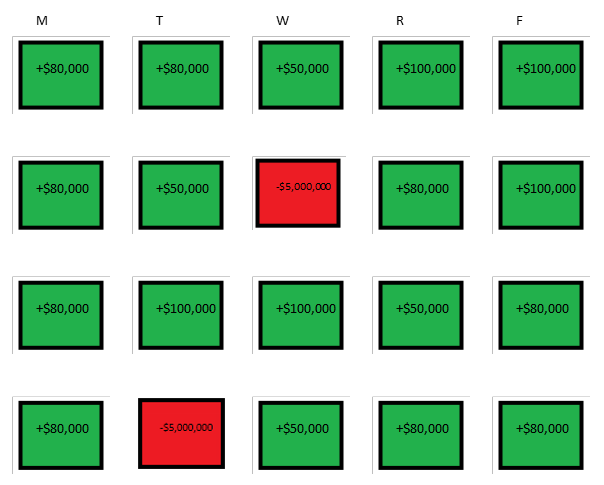

The more I answer questions the more I realize how full of shit this industry is. the amount of scammers & "gurus" out there who lure beginners in w/ unstainable strategies that offer short term satisfaction but long term failure is astounding. They lure u in with shit like this

and u guys are EATING this shit up like it's fucking cheesecake.

STOP falling for this BS.

Most of my time spent on DMs is literally me helping ppl UNLEARN the shitty habits they built up listening to fuck ass scammy gurus that blow up themselves but then refund with YOUR money

STOP falling for this BS.

Most of my time spent on DMs is literally me helping ppl UNLEARN the shitty habits they built up listening to fuck ass scammy gurus that blow up themselves but then refund with YOUR money

EVERYBODY can have a high winrate if they dont fucking stopout. that's common sense. stop thinking it's magic or requires some superior skill. if u martingale enough (keep adding to losers w/ more & more size) & dont stop out, u'll have a 90%+ winrate. it's not rocket science.

and sure enough, u'll feel like a fucking legend for a short while. but sooner or later 1 or 2 back to back black swan events will occur and U WILL GET YOUR CHEEKS CLAPPED!! What scamming gurus have figured out is that as long as they lure u in during the green streak,

they'll build up enough financial cushion w/ YOUR money so that when they DO blowup, they can always refund their account. and if no black swan events happen, they keep banking. win/win scenario. ultimate cheat code! Meanwhile when YOU blow up using THEIR strat, u have NO cushion

the entire fake guru industry including pumpers etc is LITERALLY built off this. most of these motherfuckers cant trade for shit, but who needs to when u can pump or manipulate what to post (hide most big losses, hide size, show carefully selected charts only etc).

and those fuckers actually give the GOOD chatrooms a bad rep. Newbies get scammed & burned so much that they end up thinking "all rooms must be bad". So stop falling for this BS. there's nothing wrong with joining a room AS LONG AS the leader SHOVES risk down ur throat daily

The room leader should actually SCARE u out of trading. im not talkin about the basic "bEwArE, tRadiNg iNvOlvEs riSk" BS disclosure that they're forced to say anyway. no, they should tell u straight up that there's a HIGH chance ur stubborn, undisciplined ass is gonna blow up

So that u actually go into every trade TERRIFIED & 100% ready to take a loss the moment the trade thesis fails. ANYONE who tells u that u should be comfortable taking HUGE losses or u should have "cOnViCtiOn" & "HoLd" etc is full of shit b/c even if ur winrate is high,

all it takes is a few black swan events to WIPE u out (there's a reason they're called black swans, they're NOT supposed to happen). even a 90% winrate strategy (18/20 when backtested) can give u 4 losses in a row in real life due to random market fuckboy shit or catalysts.

Not to mention that new traders with no financial cushion cannot mentally recover from large losses EVEN if the strat allows them to make it back in the longrun. a huge L can mentally fuck u over in ALL aspects of ur life & start a downward spiral that ll just push u down deeper

anyway this thread is too long but u can tell how much this shit pisses me off. I see it year after year & it never seems to end. STOP falling for the flashy BS. the ONLY thing u should focus on as a trader is MINIMIZING damage 1st, maximizing profit 2nd. PERIOD

#BearTipOfTheDay

#BearTipOfTheDay

• • •

Missing some Tweet in this thread? You can try to

force a refresh