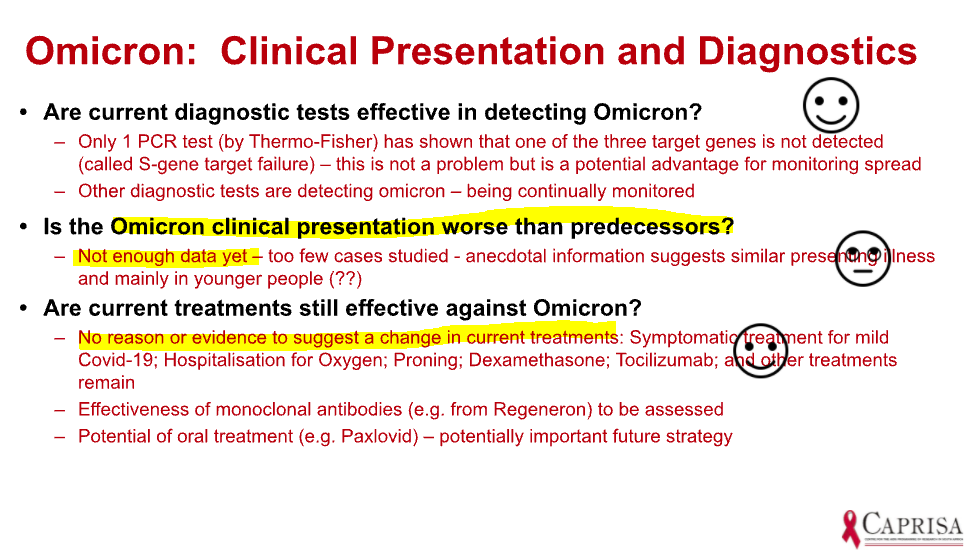

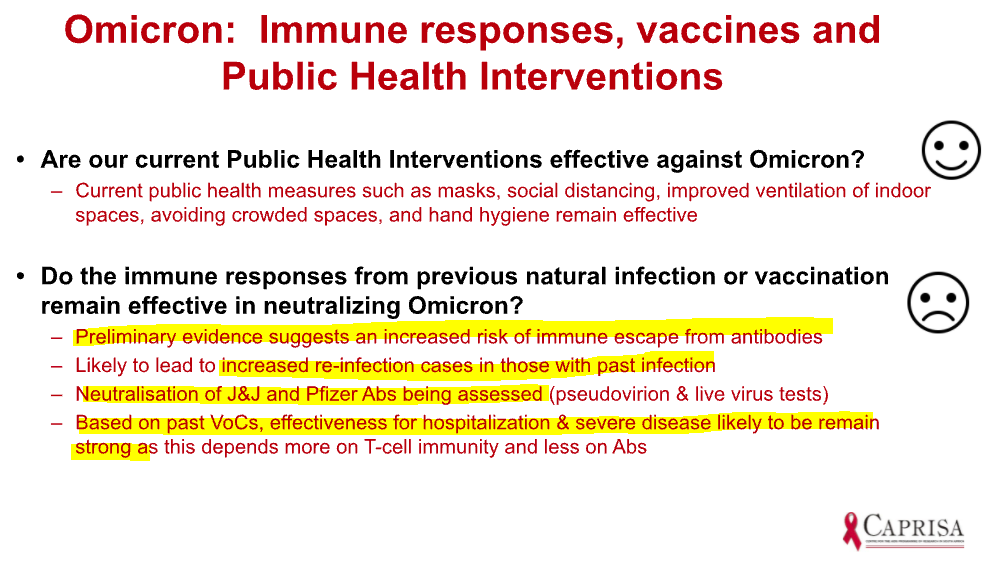

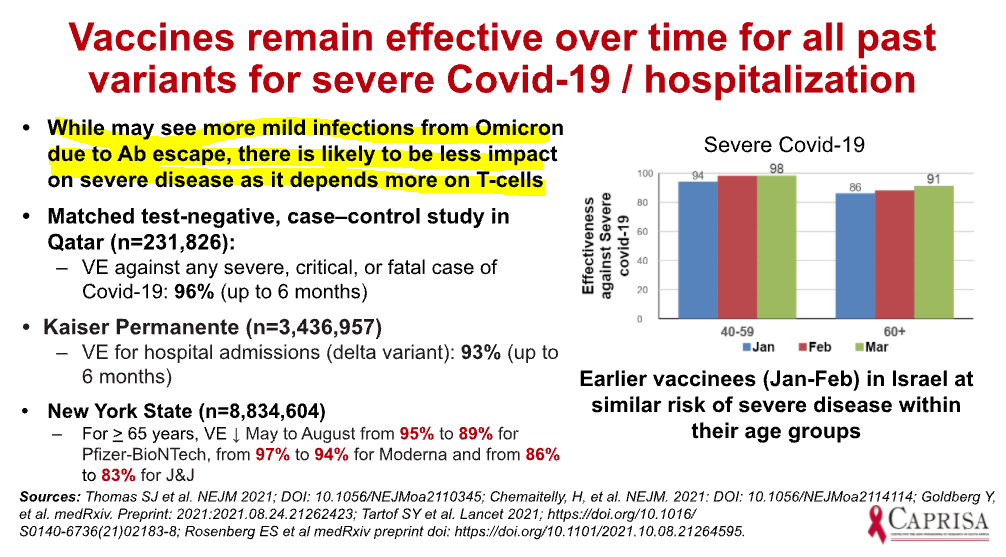

You're all going bananas about Omicron, so I think what you all should do is take a deep breath & read this balanced, informed, presentation from people on the ground (dated today). Highlights below.

sacoronavirus.co.za/2021/11/29/pre…

sacoronavirus.co.za/2021/11/29/pre…

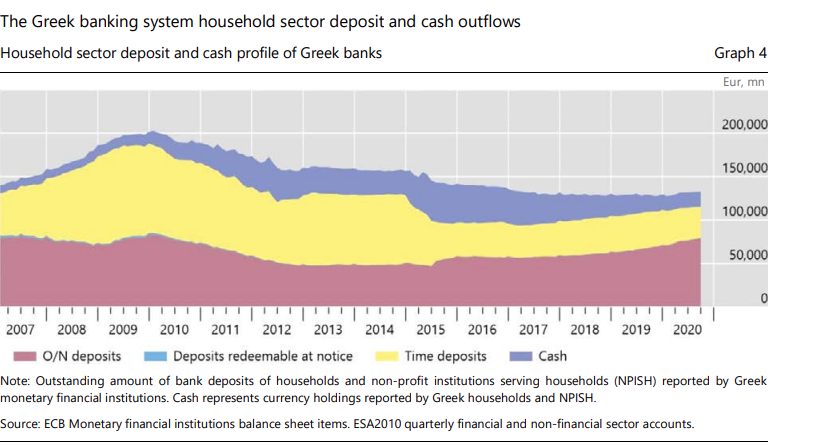

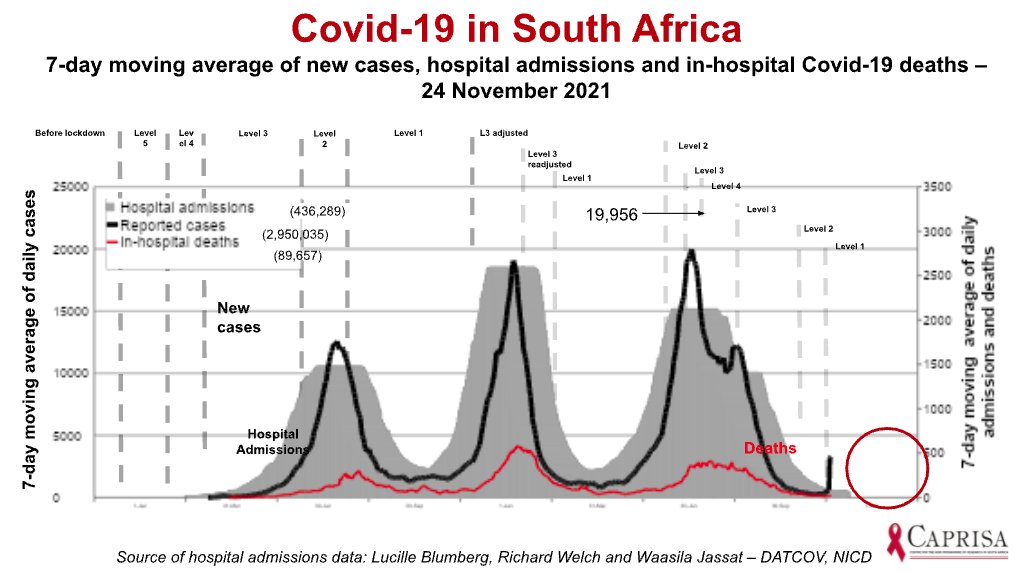

Hospitalization rates has been around 10%-ish in South-Af. What we should look at is this: over the next few days (because there is a lag) is that % significantly different. It's too early to tell.

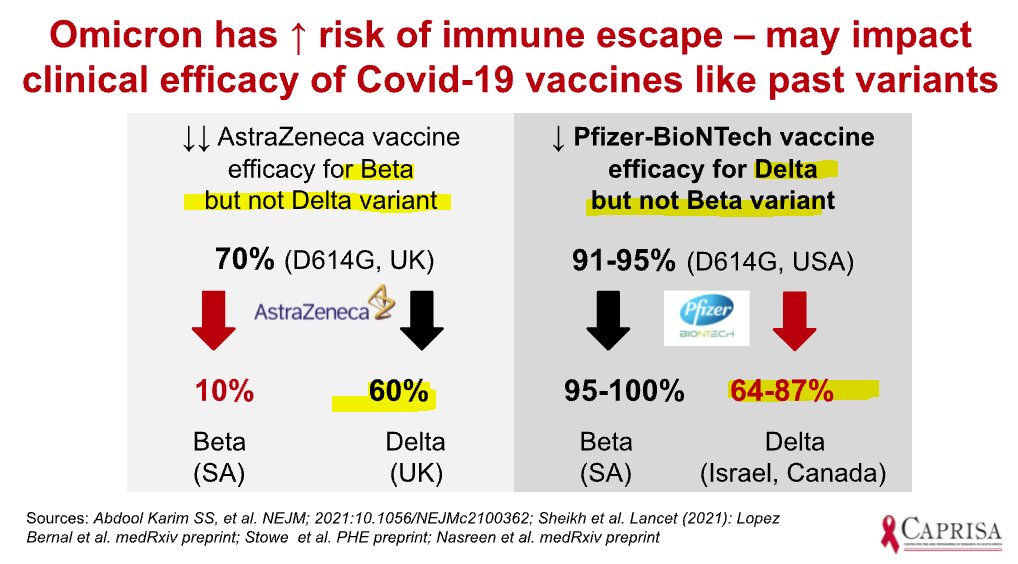

But reduced efficiency of vaccines has been seen before & it wasn't the end of civilization as we know it

• • •

Missing some Tweet in this thread? You can try to

force a refresh