$BCTX 1

In anticipation of $BCTX releasing interim trial data at the San Antonio Breast Cancer

Symposium on December 8. I am releasing a series of tweets showcasing why $BCTX (BriaCell)

is one of the best R/R across all biotech stocks and is primed to EXPLODE.

In anticipation of $BCTX releasing interim trial data at the San Antonio Breast Cancer

Symposium on December 8. I am releasing a series of tweets showcasing why $BCTX (BriaCell)

is one of the best R/R across all biotech stocks and is primed to EXPLODE.

$BCTX 2

$BCTX is a CLINICAL stage company developing cancer

immunotherapies (Bria-IMT) for third-line advanced breast cancer and its associated US patient

population of ~70,000. The market for breast cancer treatments is expected to reach $19.49B in

2025.

$BCTX is a CLINICAL stage company developing cancer

immunotherapies (Bria-IMT) for third-line advanced breast cancer and its associated US patient

population of ~70,000. The market for breast cancer treatments is expected to reach $19.49B in

2025.

$BCTX 3

at $10.20/share at a market cap of $156.3M. is CLINICAL stage company (Phase I/IIA) its valuation is below any reasonable base case. As of July 31, $BCTX had $55M in cash. Therefore, the value of the company’s IP and progress is ~$100M. Let’s put

this in perspective

at $10.20/share at a market cap of $156.3M. is CLINICAL stage company (Phase I/IIA) its valuation is below any reasonable base case. As of July 31, $BCTX had $55M in cash. Therefore, the value of the company’s IP and progress is ~$100M. Let’s put

this in perspective

$BCTX 4

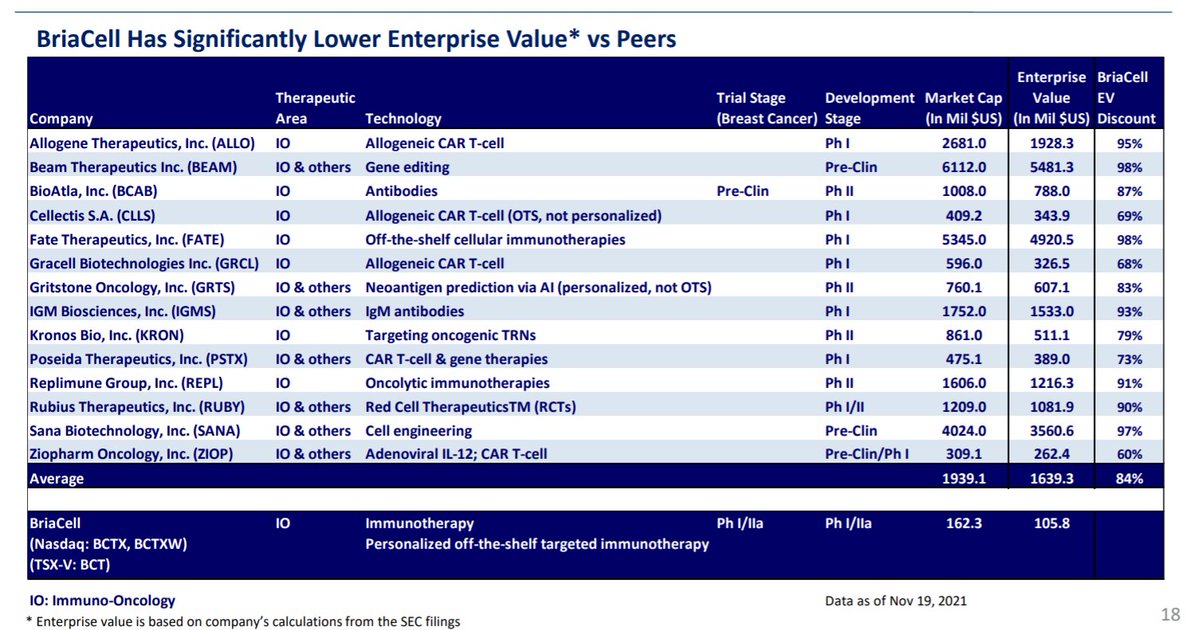

Below is a list of companies at various stages of clinical development (pre-clinical through Phase

II). $BCTX trades at roughly a ~94% discount to similar companies. Even if we use the lowest

market cap comparable, $BCTX is at a ~62% discount should be trading at $27/sh

Below is a list of companies at various stages of clinical development (pre-clinical through Phase

II). $BCTX trades at roughly a ~94% discount to similar companies. Even if we use the lowest

market cap comparable, $BCTX is at a ~62% discount should be trading at $27/sh

$BCTX 5- This is justified because (1) Bria-IMT [the lead drug] has only had

positive results so far and is in Phase I/IIa; (2) The technology Bria-IMT is based on can be used

for prostate, lung, and skin cancers [INDs expected in 2022 and 2023];

positive results so far and is in Phase I/IIa; (2) The technology Bria-IMT is based on can be used

for prostate, lung, and skin cancers [INDs expected in 2022 and 2023];

$BCTX 6 (3) BCTX is developing an

off-the-shelf immunotherapy [Bria-OTS]. An IND is expected for Bria-OTS by Q1 2022. .contd...

off-the-shelf immunotherapy [Bria-OTS]. An IND is expected for Bria-OTS by Q1 2022. .contd...

$BCTX 7

$BCTX - To grasp how significant OTS immunotherapies are. Look at $FATE. Their drug is in

PHASE I trials for an OTS immunotherapy and the company is valued at $5 BILLION. THAT’S JUST

FOR A SINGLE OTS IMMUNOTHERAPY

$BCTX - To grasp how significant OTS immunotherapies are. Look at $FATE. Their drug is in

PHASE I trials for an OTS immunotherapy and the company is valued at $5 BILLION. THAT’S JUST

FOR A SINGLE OTS IMMUNOTHERAPY

$BCTX 8

On Sept 9, $BCTX issued a stock buyback. Since then, BCTX has purchased 200K shares A clinical stage biotech doing a buyback is NOT NORMAL. Ask yourself, why is this a good, business decision? Why not use that money to speed up research? Buyout/Partnership🤔?...why so?

On Sept 9, $BCTX issued a stock buyback. Since then, BCTX has purchased 200K shares A clinical stage biotech doing a buyback is NOT NORMAL. Ask yourself, why is this a good, business decision? Why not use that money to speed up research? Buyout/Partnership🤔?...why so?

$BCTX 9

Immunotherapies are the holy grail for big pharma right now. On 11/13/20,$GILD bought Immunomedics for $21B. On 03/04/21, Amgen bought Five Prime for $1.9B.

On 08/23/21, Pfizer bought Trillium for $2.3B.If $BCTX continues to show outstanding data it will be top of list

Immunotherapies are the holy grail for big pharma right now. On 11/13/20,$GILD bought Immunomedics for $21B. On 03/04/21, Amgen bought Five Prime for $1.9B.

On 08/23/21, Pfizer bought Trillium for $2.3B.If $BCTX continues to show outstanding data it will be top of list

$BCTX 10 Last week, CEO Dr. Williams was banging the table on his company’s valuation. Now,

Dr. Wililam’s is just a scientist. This man is an ex-big pharma exec who has overseen drug

development from the lab to FDA approval. He has hands on experience.

Dr. Wililam’s is just a scientist. This man is an ex-big pharma exec who has overseen drug

development from the lab to FDA approval. He has hands on experience.

$BCTX 11 His plan is to get BriaIMT into an FDA approved Ph II Pivotal Study which WILL have big pharma FROTHING at the mouth. A pivotal trial is a clinical trial or study that intends to provide the ultimate evidence data that the FDA uses to decide whether to approve a drug.

$BCTX 12 In exceptional cases, a

phase II study can be used as a pivotal trial. Yes – Dr. Williams has that much conviction about

Bria-IMT. He knows the FDA will sign off on a fast track to approval. (My speculation)

phase II study can be used as a pivotal trial. Yes – Dr. Williams has that much conviction about

Bria-IMT. He knows the FDA will sign off on a fast track to approval. (My speculation)

$BCTX 13

Lets see why $BCTX can explode, for that understand the Share structure

60% of outstanding 15Mil shares or 11 Mil Float are held by institutions. Over 2 Mil are Short, Over 1.2 Mil still in buyback, Few million with us retail, how much is left?

Lets talk shorts......

Lets see why $BCTX can explode, for that understand the Share structure

60% of outstanding 15Mil shares or 11 Mil Float are held by institutions. Over 2 Mil are Short, Over 1.2 Mil still in buyback, Few million with us retail, how much is left?

Lets talk shorts......

$BCTX 14

Trading at 10.20, 52 Week High at 10.73

1.8 Mil short with borrow rate 26.1%, utilization 99.4% means shorts have gone pedal to the metal with their positions. This is on uptrend since July 23,every single short is IN RED, stock is consolidating with 7% from ATHs

Trading at 10.20, 52 Week High at 10.73

1.8 Mil short with borrow rate 26.1%, utilization 99.4% means shorts have gone pedal to the metal with their positions. This is on uptrend since July 23,every single short is IN RED, stock is consolidating with 7% from ATHs

$BCTX 15

Cost of borrow for all shorts is adding up. Since top ticks, there have been numerous attempts by shorts to kill the momentum using market sells but stocks bounces EVERY SINGLE TIME , "shorts are trapped"

Now lets talk "Naked Shorts"

Cost of borrow for all shorts is adding up. Since top ticks, there have been numerous attempts by shorts to kill the momentum using market sells but stocks bounces EVERY SINGLE TIME , "shorts are trapped"

Now lets talk "Naked Shorts"

$BCTX 16

BCTX has been on NASDAQ SHO List repeatedly, this means that some shorts do not even have shares to cover, they will need to buy in open market, they are NAKED SHORTS

Adding insult to injury, BCTX can buy another 1.2 mil in buyback and who knows maybe another buyback!!!

BCTX has been on NASDAQ SHO List repeatedly, this means that some shorts do not even have shares to cover, they will need to buy in open market, they are NAKED SHORTS

Adding insult to injury, BCTX can buy another 1.2 mil in buyback and who knows maybe another buyback!!!

$BCTX 17 So where is the detonator to get these shorts to cover?

Although many PR Catalysts are coming but immediate is SABCS on December 8/9 when BCTX publishes interim Phase I/IIA data for Bria-IMT

SABCS is Mecca of Breast Cancer Conventions, Remember $GLSI last year SABCS?👀

Although many PR Catalysts are coming but immediate is SABCS on December 8/9 when BCTX publishes interim Phase I/IIA data for Bria-IMT

SABCS is Mecca of Breast Cancer Conventions, Remember $GLSI last year SABCS?👀

$BCTX 18 SABCS is where $GLSI and $SLS showcased results. Remember $GLSI? I bet you do. The stock

that 15x’d in a day?$Trigger for this squeeze

was excellent data presented at SABCS in 2020. BCTX has

potential to be a “mini-GLSI” courtesy of the shorts. Let’s look at this closer

that 15x’d in a day?$Trigger for this squeeze

was excellent data presented at SABCS in 2020. BCTX has

potential to be a “mini-GLSI” courtesy of the shorts. Let’s look at this closer

$BCTX 19 is also being valued as a pre-clinical company when its lead product is in Phase I/IIA. 2:

Not only that, Bria-IMT is in arm’s length of obtaining FDA clearance for a Phase II Pivotal Study.

(aka a fast track to approval and primed for a big pharma buyout.)

Not only that, Bria-IMT is in arm’s length of obtaining FDA clearance for a Phase II Pivotal Study.

(aka a fast track to approval and primed for a big pharma buyout.)

$BCTX 20

Where things are different from $GLSI $BCTX has a lot more shorts and options leverage. 2:

$BCTX will not be presenting final phase IIB data. It will present interim data. $GLSI had a

great hook – 0% recurrence. For $BCTX, the hook will be the fact that Bria-IMTresults

Where things are different from $GLSI $BCTX has a lot more shorts and options leverage. 2:

$BCTX will not be presenting final phase IIB data. It will present interim data. $GLSI had a

great hook – 0% recurrence. For $BCTX, the hook will be the fact that Bria-IMTresults

$BCTX 21 On December 8, at SABCS, $BCTX will almost certainly present positive interim Phase I/IIA data

for Bria-IMT. There will likely be prolonged survival for the patients enrolled in the study and A

COMPLETE REGRESSION OF METASTASIS in some patients.

for Bria-IMT. There will likely be prolonged survival for the patients enrolled in the study and A

COMPLETE REGRESSION OF METASTASIS in some patients.

$BCTX 22

This will kick off a value correction for the stock. The shorts will be blood red and will have to

decide whether they want to cover. If they do, there is no telling how high this stock will fly.

This will kick off a value correction for the stock. The shorts will be blood red and will have to

decide whether they want to cover. If they do, there is no telling how high this stock will fly.

$BCTX 23

What happens today or tmro does not matter, 2022 will be huge #LT

-Bria IMT - Breast Cancer Data with $INCY

-Bria IMT - Pivotal Ph2 approval

-Fast Track FDA

-Bria OTS-Ind Filing, Pre-Reg Study

-Bria PROS-Prostate Cancer Pre-RegStudy

-Bria-Mel- Melanoma Pre-Reg Study

What happens today or tmro does not matter, 2022 will be huge #LT

-Bria IMT - Breast Cancer Data with $INCY

-Bria IMT - Pivotal Ph2 approval

-Fast Track FDA

-Bria OTS-Ind Filing, Pre-Reg Study

-Bria PROS-Prostate Cancer Pre-RegStudy

-Bria-Mel- Melanoma Pre-Reg Study

$BCTX 24

Dr. Williams was an executive at $INCY. There is a reason why BCTX and INCY are partnered for Bria IMT. This weeks data will show that IMT is on track for a Ph2 Pivotal and primed for a buyout/partner. More whales will want in while retail wud like to Sell for pennies

Dr. Williams was an executive at $INCY. There is a reason why BCTX and INCY are partnered for Bria IMT. This weeks data will show that IMT is on track for a Ph2 Pivotal and primed for a buyout/partner. More whales will want in while retail wud like to Sell for pennies

$BCTX 25

There is no comparable combination of Huge Market, Catalysts, Small Float, Short Squeeze candidate, Buyout/Partner potential. Not here for tmro or day after, here for life changing move which will come sooner or later. If $BCTX is buying its own shares , so will I.

There is no comparable combination of Huge Market, Catalysts, Small Float, Short Squeeze candidate, Buyout/Partner potential. Not here for tmro or day after, here for life changing move which will come sooner or later. If $BCTX is buying its own shares , so will I.

• • •

Missing some Tweet in this thread? You can try to

force a refresh