Kudos to the @RollingStone for uncovering a monster that the media has worked to normalize, including his attack on women & morality. The thing about art is that while it may be an expression of beauty, it can also be macabre or promotion of evil by normalizing and ELEVATING it.

https://twitter.com/NoahShachtman/status/1460050309330477060

The fact that this guy dresses like the devil, writes music that is immoral & acts immoral for decades have normalized the sexualization of women.

Btw, George Orwell wrote a great essay on this topic regarding the monster called SALVADOR DALI.

orwellfoundation.com/the-orwell-fou…

Btw, George Orwell wrote a great essay on this topic regarding the monster called SALVADOR DALI.

orwellfoundation.com/the-orwell-fou…

Why do I say this? Salvador Dali is hailed for his surrealism but if u pay attention to his art and his life, the guy was a monster and his art celebrated and promoted it.

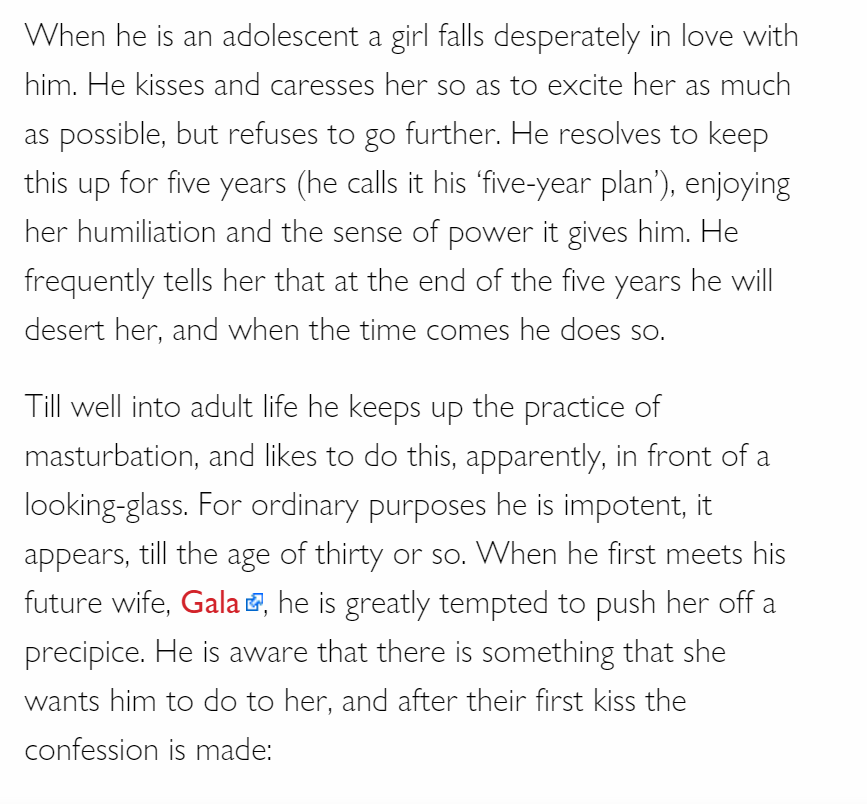

This is George Orwell review of Salvador Dali's autobiography & how he treated women since he was a child.

This is George Orwell review of Salvador Dali's autobiography & how he treated women since he was a child.

Dali's paintings were of the perverse & he admitted to those deeds in his real life. By celebrating his art, we do something as well - WE NORMALIZE our treatment of people, especially women. In the same vein, we do this w/ Marilyn Mansion - the guy told us who he was all along.

The guy's art, in George Orwell's words, reading his biography & seeing his art, is:

A DIRECT, UNMISTAKEABLE ASSAULT ON SANITY AND DECENTY; AND EVEN - SINCE SOME OF DALI'S PICTURES WOULD TEND TO POISON THE IMAGINATION LIKE A PORNOGRAPHIC POSTCARD - ON LIFE ITSELF.

So?

A DIRECT, UNMISTAKEABLE ASSAULT ON SANITY AND DECENTY; AND EVEN - SINCE SOME OF DALI'S PICTURES WOULD TEND TO POISON THE IMAGINATION LIKE A PORNOGRAPHIC POSTCARD - ON LIFE ITSELF.

So?

And here George Orwell ends with what is wrong with people like Dali and Marilyn Mansion is that they distort a sense of what is good & evil.

They attack life itself. People who like those things ATTACK people who don't like sexual abuse/rotting corps as if we're the savages.

They attack life itself. People who like those things ATTACK people who don't like sexual abuse/rotting corps as if we're the savages.

George said, we must not treat artists, musicians, celebrities w/ a double standard b/c they are humans & should not be ABOVE HUMAN DECENCY.

In doing so, as a society, we elevate and REWARD wickedness. Well done @RollingStone 👏🏻

orwellfoundation.com/the-orwell-fou…

In doing so, as a society, we elevate and REWARD wickedness. Well done @RollingStone 👏🏻

orwellfoundation.com/the-orwell-fou…

• • •

Missing some Tweet in this thread? You can try to

force a refresh